These ‘Soonicorns’ Could Be The Next Billion-Dollar Companies in Africa

The African venture capital ecosystem has been very active since the beginning of 2019. Seven months in the year, the African ventures have already surpassed last year’s funding numbers.

Though the ecosystem can still be described as nascent; few ventures have grown very fast and are racing towards the Unicorn status. While Africa does have a few unicorns in the technology and food processing sectors, the rate at which new ones are added needs impetus. In 2018, the US added 35 Unicorns, while China added 25.

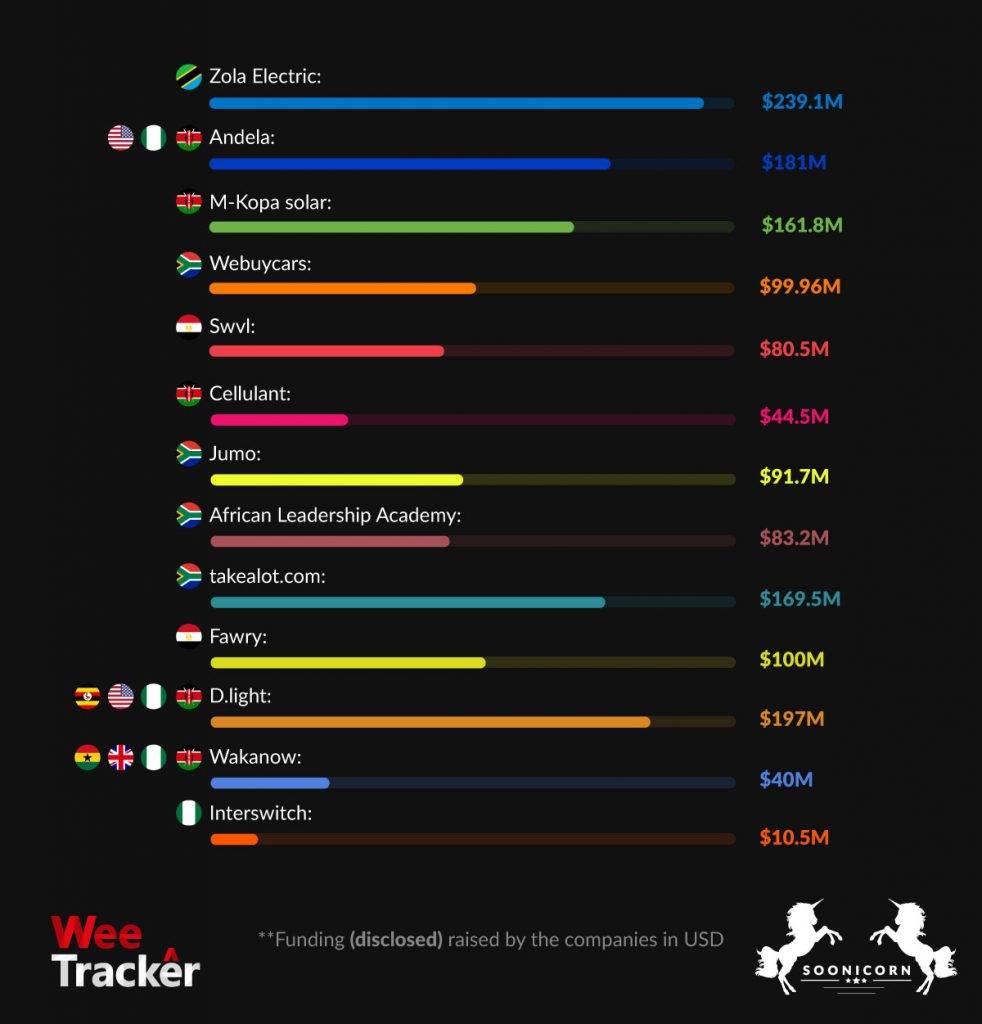

We tracked and analysed many startups and ventures across the continent and shortlisted a few who have the potential to become unicorns soon. “Soonicorns” is the term we have used to refer to companies that have the capacity to reach the one-billion-dollar market valuation. The combined value of funding raised by these companies has crossed USD 1.5 Bn till date.

With an increasing number of promising innovative startups securing significant funding over the past few years, Africa is well on its way to having its Unicorns.

Here are some of our top picks (in alphabetical order):

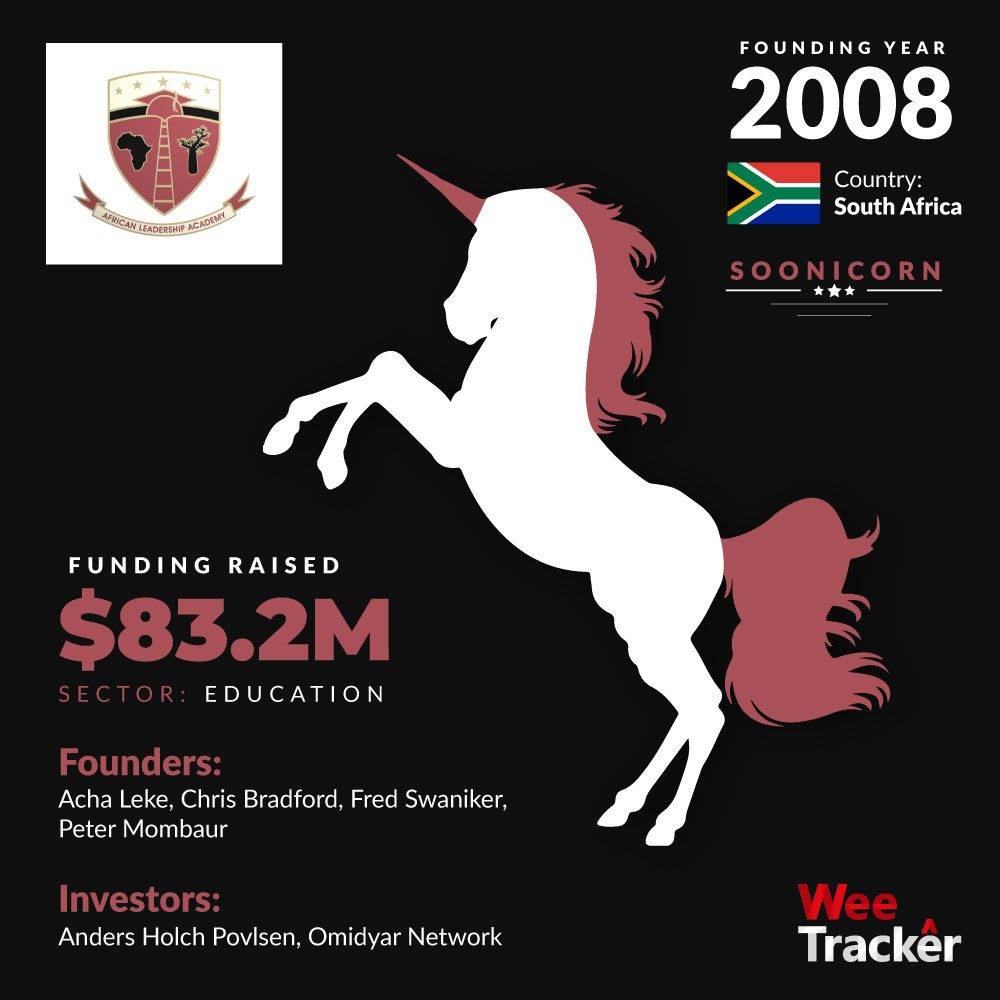

African Leadership Academy

This is a secondary institution that was founded by Acha Leke, Chris Bradford, Fred Swaniker and Peter Mombaur in 2008 which seeks to develop the next generation of African leaders. They identify and train high-potential youth between the ages of 16 to 19, equipping them with high impact and entrepreneurial skills.

The academy has spiked interest from various education-focused investors such as the MasterCard Foundation and even raised USD 28Mn from Omidyar Network late last year.

Andela

Andela, a tech startup founded in 2014, trains and outsources programmers and software developers, with offices in Nigeria, Kenya, Uganda, Rwanda and the US. With an increase in demand for highly-skilled developers globally, Andela has demonstrated ability to satisfy this demand and has been able to onboard many investors (including the Chan-Zuckerberg initiative).

The company has also caught the eye of Serena Williams, who invested via her venture fund, Serena Ventures. Having raised funding to the tune of USD 181Mn, Andela is keen to train 100,000 software developers by 2024, with more than 20,000 aspiring programmers having used the company’s free and paid tools already.

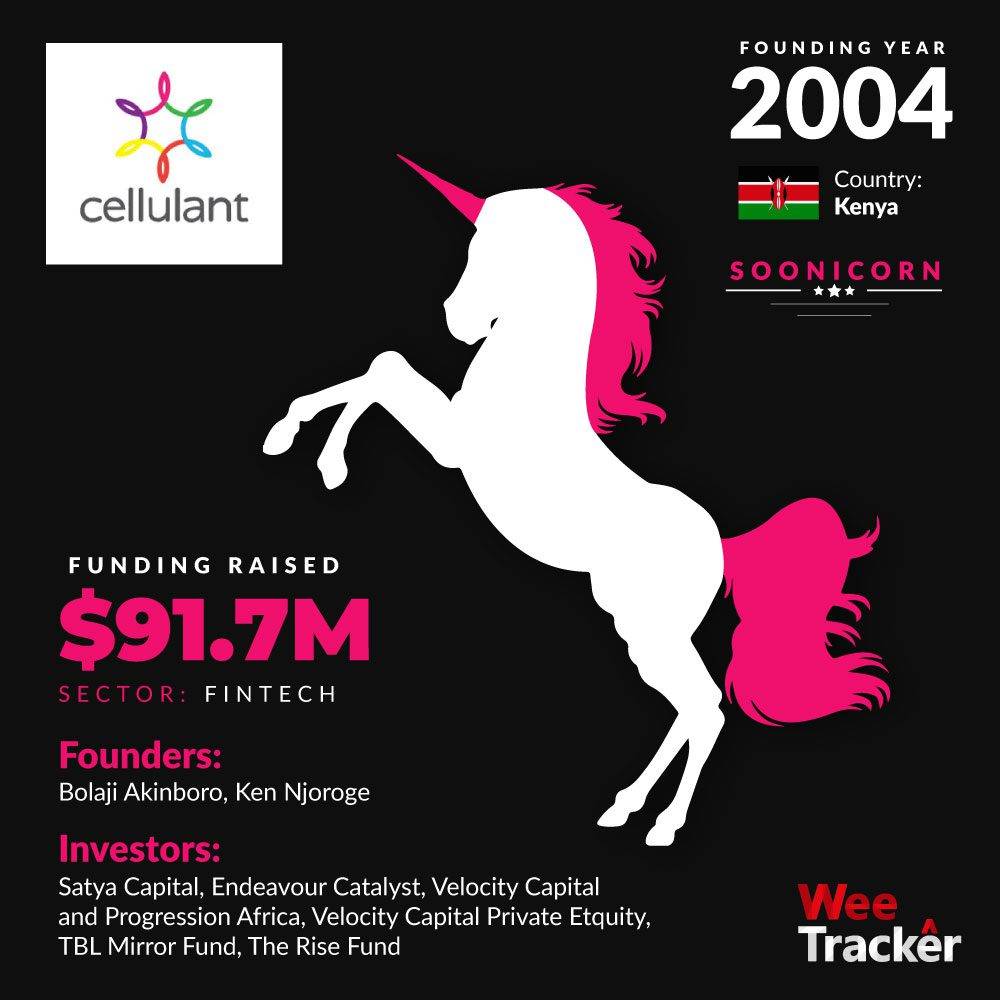

Cellulant

This is a multinational online payments company serving 34 countries in Africa, claiming to process 12 percent of Africa’s digital payments. Founded by Bolaji Akinboro and Ken Njoroge in 2004, the company has gained notable traction in its space and has received a number of accolades over the years.

It was selected as one of the top ten medium-sized company finalists out 453 at the Legatum Pioneers of Prosperity Africa Awards in Kigali Rwanda in 2007. Cellulant has been recognized as the top medium-sized company in Kenya in the KPMG Top 100 medium-sized company contest in 2008 and also listed in the Best Payments and Transfer Fintech in Africa by Fintech 100 in 2016, among others.

The company’s CEO, Kennedy Njoroge, has received EY’s Entrepreneur of the Year award. Cellulant has received a total of USD 54.5Mn in funding to date and is predictably set to earn more, judging from the many awards it has received.

d.Light design

d.light was founded in 2007 by Sam Goldman and Ned Tozun with the aim of providing off-grid solutions, ranging from pico to solar home systems, to people without access to electricity in developing countries. The solar-powered solutions provider has sold over 20 million solar light and power products in 65 countries through its hubs in Africa, China, South Asia and the US.

It has also received significant funding over the years from various investors, cumulatively close to USD 197 Mn. Additionally, the company has received some global recognition for innovation, design and leadership in its space, the most recent being its win at the Toyota Vehicles of Change Contest.

Fawry

Fawry, founded in 2008, is the biggest e-payment network in Egypt, offering convenient ways of paying bills and other services via multiple channels such as online, using ATMs, mobile wallets and retail points. The company was acquired by a consortium of investors in 2015 for USD 100 Mn and now offers more than 200 services.

It claims to process half a million transactions daily on its network, including payments, collections, reconciliations, settlements, new contracts and subscriptions. The company was recognised by Mashable, one of the world’s largest technology websites, as one of 20 important African startups to watch.

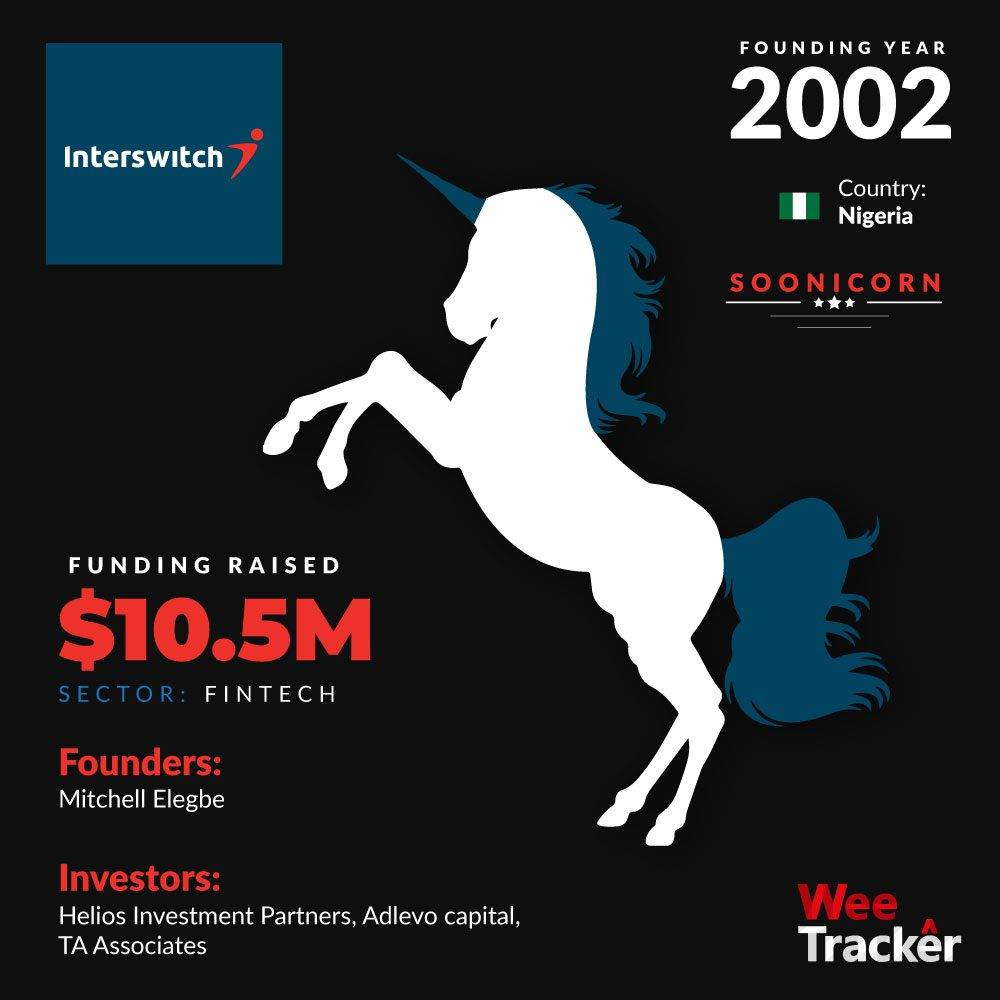

Interswitch

Nigeria based fintech startup Interswitch was founded in 2002 as a transaction switching and electronic payments processing company, evolving to become an integrated digital payments & commerce company. It facilitates mobile money circulation between individuals and organisations.

In its journey, two-thirds of the company was sold off to a consortium of investors led by Helios Investment Partners in 2010. The fintech has also acquired a number of companies along the way including Paynet, where it acquired a majority shareholding in 2014 and VANSO for USD 50M in 2016.

Additionally, the company has signed massive deals with other fintech aligned companies, the most recent being a USD 73 Mn deal with UK’s Becoz in May 2019, in a bid to provide a cashless transport system. What’s more, the company launched a USD 10 Mn fund for African startups in 2015 as well as a STEM competition in Nigeria dubbed SPAK National Science Competition in 2018.

Another factor that positions the company as a soonicorn is the fact that it was set for a dual listing on the Lagos and London stock exchanges at a USD 1Bn valuation back in 2016. But didn’t go through due to the instability of the Naira and the macroeconomic situation in Nigeria. However, the company is timing an LSE listing for 2019 which if successful, would make it the first significant African tech IPO and another unicorn on the continent, second only to Jumia.

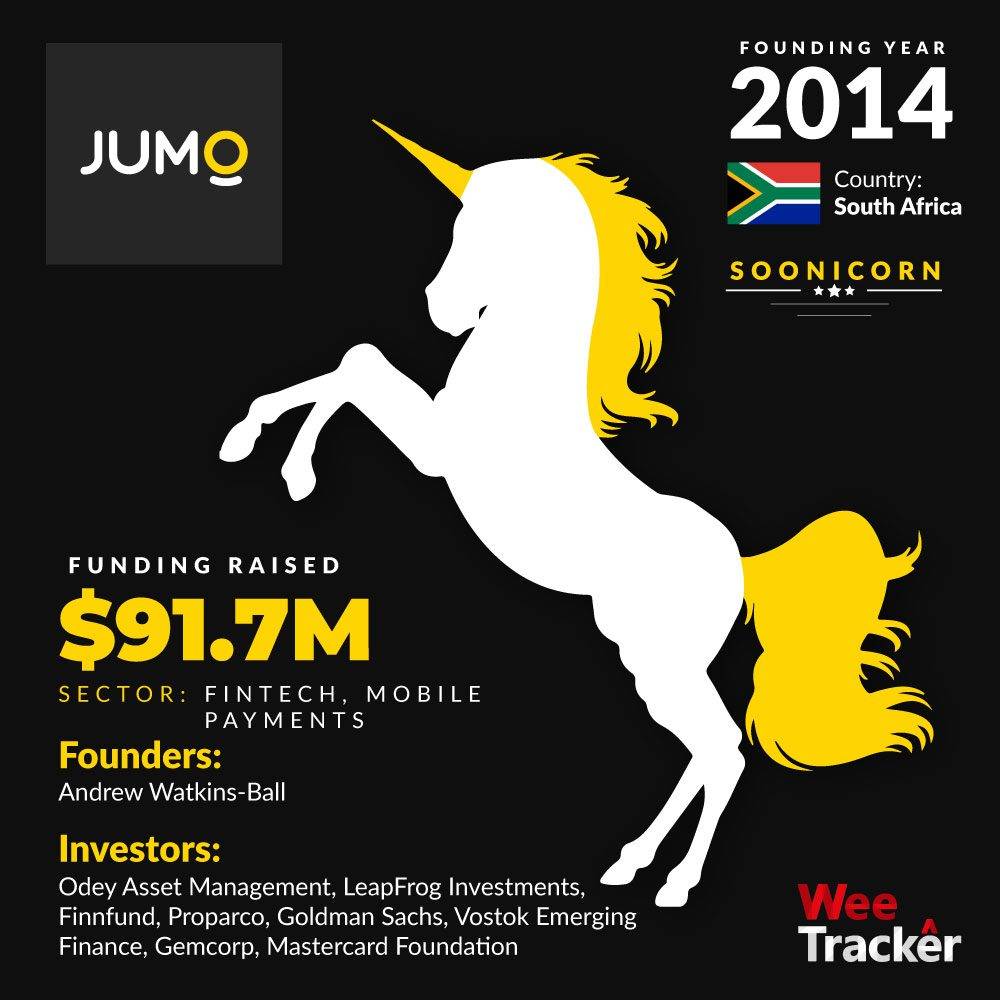

Jumo

This is a fintech startup founded in 2014 that facilitates digital financial services such as credit and savings in emerging markets and the unbanked in Africa. It has been working with various banks in developing new generations of financial products and tries to be unique by working with existing systems instead of trying to unseat banks.

This has helped the South African company land massive investments amounting to USD 91.7 Mn . The funds have been used to facilitate expansion in Africa and Asia, as well as to the company towards its goal of serving 79 million clients by 2021.

M-Kopa Solar

M-Kopa has become a prominent name in the renewable energy sector since its inception in 2011. Much of its success is in the supply of pico and solar home systems in Kenya using the ‘Pay As You Go” financing model. Its success can also be attributed to the high penetration of mobile payments in the East African country where it has served more than 30,000 users and generally in East Africa, where clients are able to make periodic payments to the startup. This has gone a long way in helping it raise significant funding to amounting to USD 161.8 Mn to date.

Swvl

This ride-hailing app allows customers to book fixed-rate bus and van rides on their network. Founded in 2017 and headquartered in Egypt, the startup has since ventured into the Kenyan market, quickly gaining significant traction with backing from Kenya’s largest mobile network platform, Safaricom.

Most recently, the startup raised USD 42 Mn in a round co-led by Vostok Ventures and Beco Capital, making it one of the best-funded startups in the MENA region. And it may (or may not) be gearing up for Nigeria next.

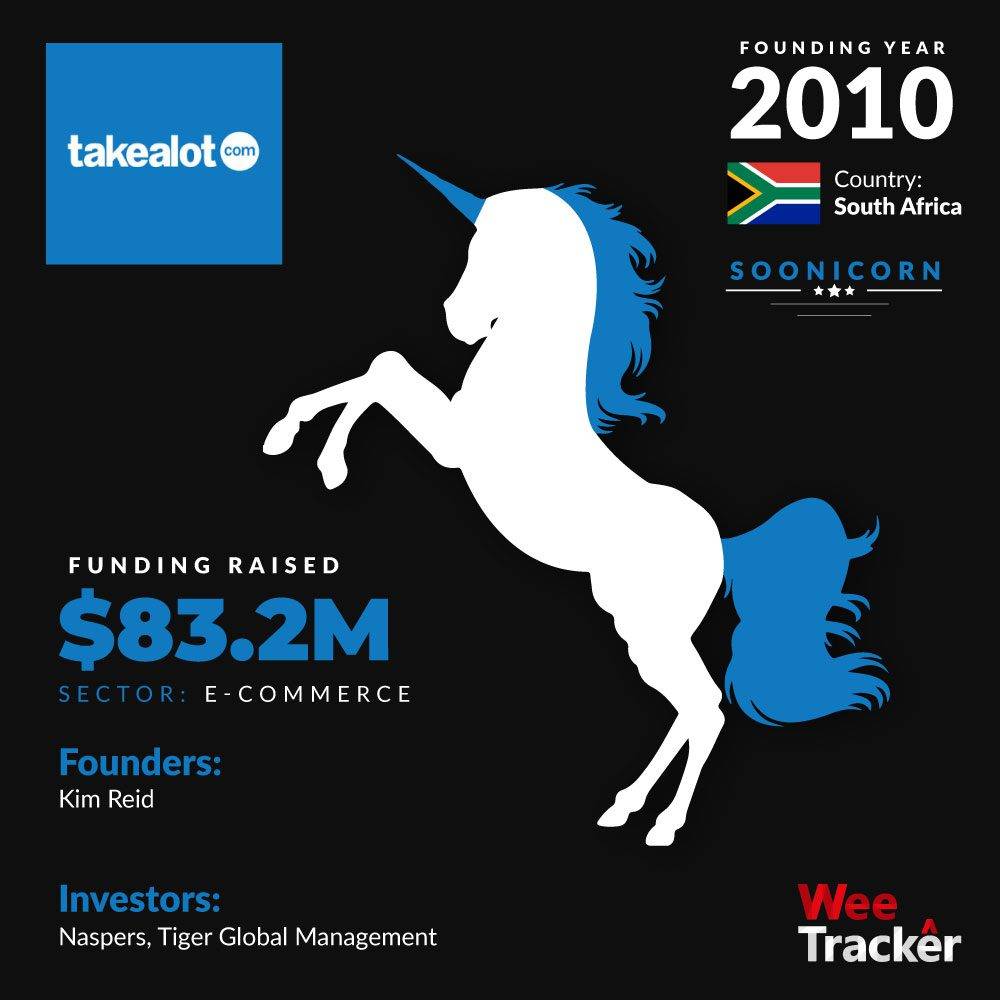

Takealot

Founded by Kim Reid in 2010, Takealot is a simple customer-centric online shopping platform in Africa that has been operational for over a decade. The company has so far grown to be one of the biggest e-commerce platforms in Africa with over 1 million customers in South Africa alone.

It has received massive investments — raising rounds of USD 69 Mn and USD 100 Mn from investors such as Naspers and Tiger Global Management respectively in the past. Takealot has also acquired a couple of companies in the same line such as Mr.Delivery and Superbalist.com

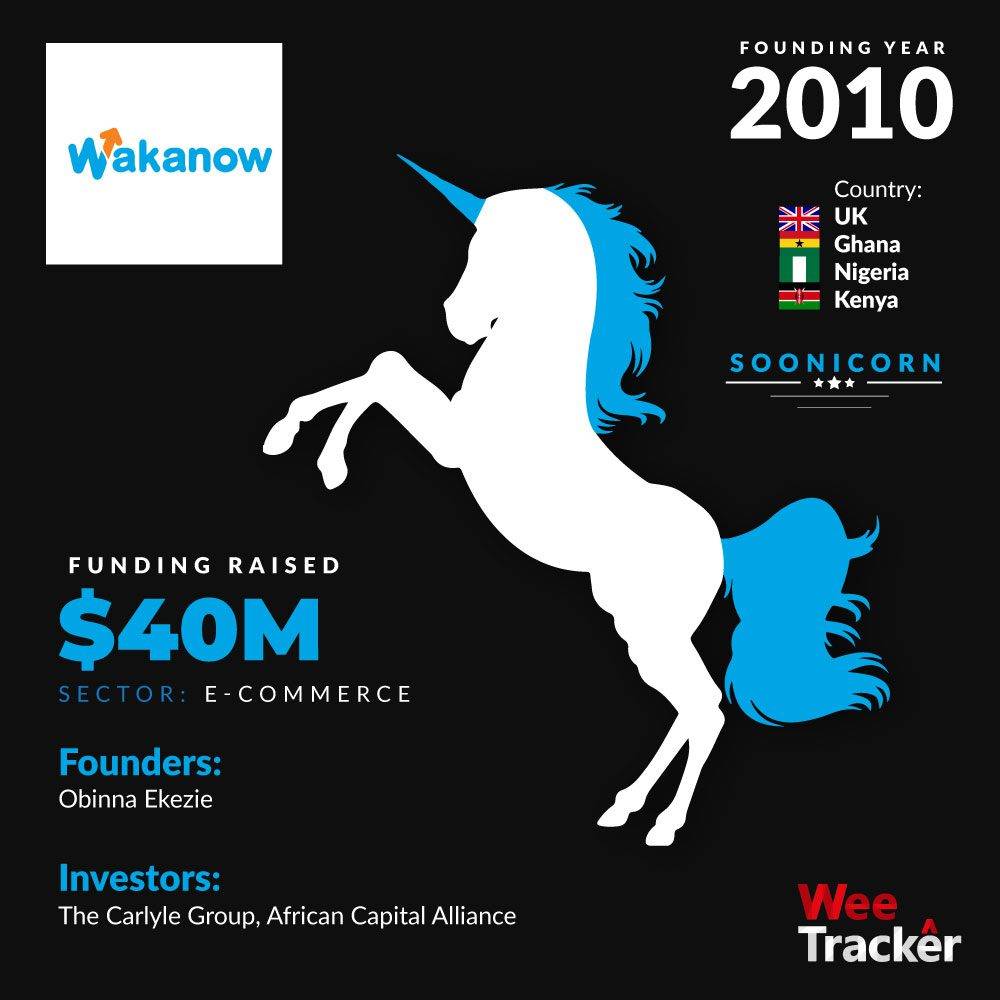

Wakanow

Wakanow is one of Africa’s largest travel booking portals with offices in Nigeria, UAE, Ghana, UK, US. It was founded in 2008 by Obinna Ralph Ekezie, a Nigerian former professional basketball player who played in the NBA and other leagues until he became an entrepreneur.

Wakanow offers a wide range of products and services including vacation packages, hotel and flight booking, specialised travel packages, corporate travel management, visa procurement, an international prepaid card and travel SIM card, as well as loyalty solutions.

It launched in Nigeria as the country’s first online travel agent after which it went to East Africa with a Kenyan subsidiary. It is also keen to open offices in other countries. Last year, the company secured a USD 40 Mn investment from The Carlyle Group, one of the highest single rounds by a non-online shopping business in Nigeria.

In 2013, the company was recognised as one of the fastest-growing online companies in Nigeria by the Tony Elumelu Foundation in collaboration with the UK’s All World Networks. Wakanow’s Founder Obinna Ekezie was recognised as the West African Entrepreneur of the Year for 2015 at the AABLA Awards.

Webuycars

Founded in 2001 by Faan van der Walt, this is a South Africa-based company specialized in buying, selling and auctioning of cars which also offers in-house finance and insurance solutions with most major banks in the country.

The company recently raised USD 94 Mn from OLX group, sold a minority share to Fledge Capital and even opened doors to The Car Supermarket in Midstream, home to 1,100 cars under one roof; Africa’s biggest car showroom!

Zola Electric

Founded by Erica Mackey, Joshua Pierce and Xavier Helgesen, this is a solar company that manufactures and retails solar-powered electricity solutions. It pioneered the ‘Pay As You Go’ model of finance to deliver off-grid electricity in Africa.

With products in the line of household lighting and mobile charging, the Tanzania-and-Rwanda-based startup has seen massive success in securing funding from a variety of investors and is notably one of the highly funded renewable energy companies in Africa, raising USD 239.1 Mn to date.

The company is also expected to rapidly expand with more uptake of renewable energy solutions in East Africa and Sub-Saharan Africa. This is bolstered by the increase in demand for these solutions, as well as a reduction in the cost of production of these solutions.