The Million-Dollar African Expansion Of Helios Towers Is Kicking Off In Ethiopia

Helios Towers, one of Africa’s largest telecom tower leasing companies, has made known its plans to expand in Africa. The United Kingdom-headquartered towerco is, thus, reviving expansion plans that were put on hold as a result of the coronavirus pandemic, with an initial focus on Ethiopia.

Into Abyssinia

Towards the end of May 2020, Ethiopia was in many a headline across the world for finally unlocking its telecom sector to private companies. The Ethiopian Communications Authority (ECA) invited companies to register their interests in two licenses, opening up one of the world’s last major closed telecoms markets around 110 million.

The monopoly of Ethiopia’s telecom sector is under the belt of Ethio Telecom, a state-owned company. It has significant control over anything from a fixed line to a mobile telephone to broadband. Nevertheless, Prime Minister Aby Ahmed’s liberalization and reform administration led the ECA to hold a consortium in November 2019 to open up the sector for privatization.

As it is, Ethiopia is on the lookout for highly capable and qualified telcos to become the new license holders in a to-be competitive market. Any company that can bid a win for the permit would be able to build, own and operate a nationwide telecommunications network, including an international gateway.

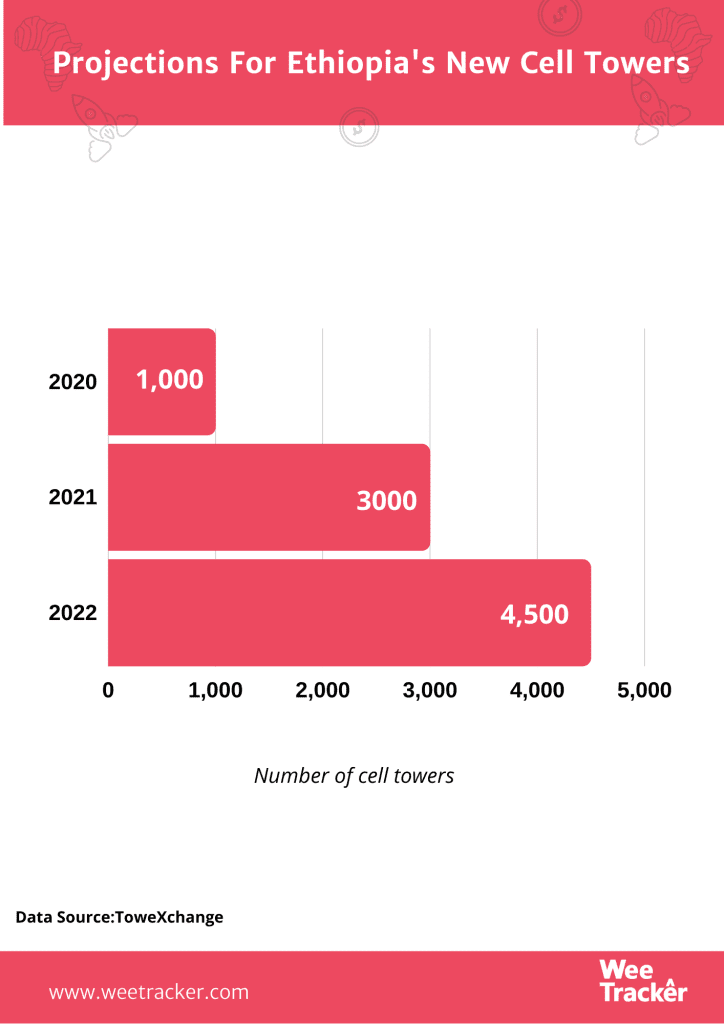

The privatization of the Horn of Africa nation’s telecom industry will be needing as much as 10,000 towers, says Helio Chief Financial Officer, Tom Greenwood. That is where Helios—a company that started investing exclusively in Africa in 2014—comes in. It currently has a portfolio of 7,000 towers located in South Africa, Congo, Ghana, the Democratic Republic of the Congo, and Tanzania.

According to TowerXchange, the opportunity for passive telecom infrastructure investment in Ethiopia in 2020 will be a quarter of a billion dollars, with ongoing investment at a similar level for several years. The telcos looking to win the bid for the country’s telecoms license have no intention of owning their towers, which suggests that there will be significant towercos-funded programs for new builds.

Revved Up Telecoms

Helios is one of the handful of tower infrastructure providers whose feet are hurrying into Africa. American Tower Corp and IHS Holdings are also seeking to take advantage of cheaper and faster internet speeds as well as smartphone uptake to give their African presence a firm leg up. At the same time, wireless carriers worldwide have been ditching their tower assets to free up capital for other ventures.

Africa’s telecoms sector has gone through a significant series of changes since the coronavirus pandemic. Google’s Project Loon was launched in Kenya, after which some rural areas in Mozambique also got the hovering balloon internet beam project. Airtel Africa, on the other hand, made significant revenue that almost landed it a billion-dollar status.

Helios is making Ethiopian inroads right away, but it is also searching for opportunities in other African countries, like Morocco, Egypt, and Madagascar—three countries that happen to have some of the continent’s fastest internet speeds. The firm will add more to its portfolio by either building more towers or buying existing ones from wireless carriers looking do ditch the equipment to realize cash.

Helios, however, is not the only company with eyes for Ethiopia right now. Safaricom—a leading telco in Kenya—has opened talks to form a consortium that will bid for one of the country’s telecoms licenses. The Nairobi Securities Exchange-listed firm, which is also East Africa’s most profitable company, hopes to replicate its Kenyan success in Ethiopia. South Africa’s Vodacom and France’s Orange are also potential bidders.

Raise Ready, Market Ready

It seems Helios is financially prepared to take double down on the African market. This week, the tower firm secured about USD 1 Bn from debt markets, which builds on a successful USD 1.45 Bn-value public listing in London in 2019. Through the IPO, it raised USD 364 Mn, funds with which firm plans to acquire more towers and enter new markets.

The majority of Helios’ debt raise will go into refinancing existing borrowers. Meanwhile, its shares have slumped 10 percent to 184 pence in London, paring gains since the IPO to about 60 percent. Nevertheless, Helios will take USD 450 Mn from the funding it got from debt markets to finance its African expansion.

“Our view of the five-year horizon is we’re looking to have in order of 12,000 towers from 7,000. We’re very focused on expanding our geography from five markets. We want to go from five countries to eight countries [in five years]. We view our growth in terms of adding 5,000 towers; roughly 2,500 will come from organic growth in the five markets we’re in, and the other 2,500 will come from M&A,” Helios CEO, Kash Pandya, said in January 2020.

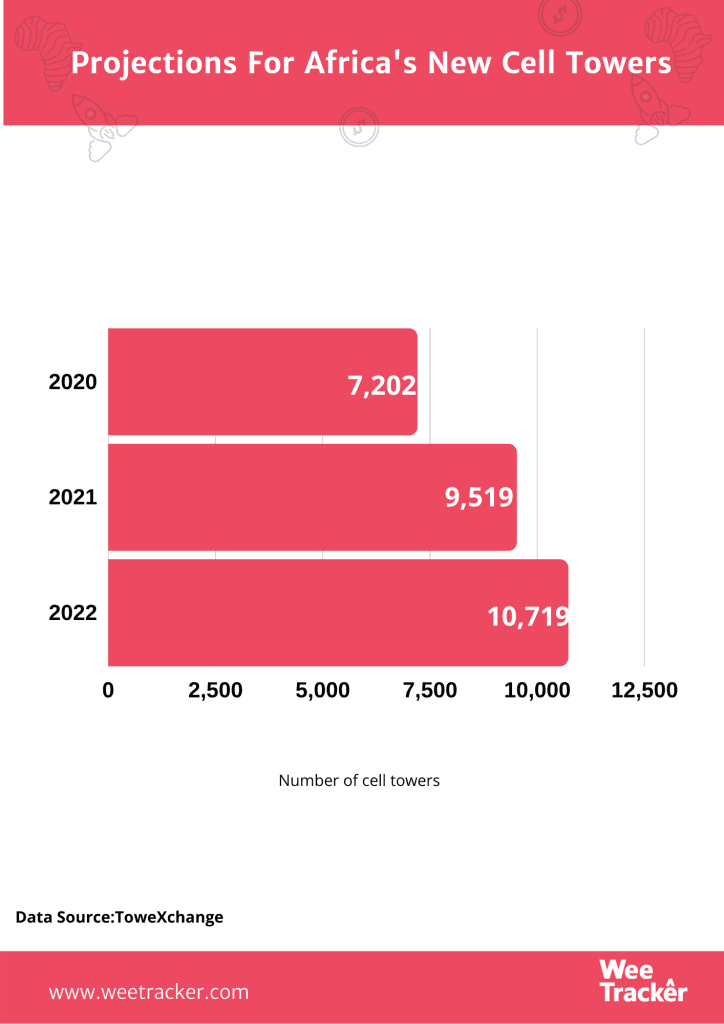

Telecommunications firms across Africa are enjoying steady growth, as the region’s subscriber base is projected to surpass 600 million by 2025. Amidst this towercos providing infrastructural support are set to gain sustainable momentum, as thousands of planned towers are already on the cards.

Phone companies continue to enjoy growth across Africa (the total mobile subscriber base in the region is projected to surpass 600 million by 2025), towercos who provide core infrastructure support by developing and leasing tower space are also set for sustained momentum.

In 3 of the 5 markets the Soros-backed firm operates—Tanzania, DRC, and Congo-Brazzaville—mobile penetration remains within the 50 percent threshold. In South Africa, however—where the company is just starting—penetration tops 68 percent. There are plenty of customers who do not yet have a mobile, which points to a growth potential, which would be, in part, beneficial to tower operators.

Featured Image: Tony Stoddard Via Unsplash