Kenya Approves First-Ever Green Bond, What It Means For The Country

Market regulator, Capital Markets Authority has approved the first-ever green bond months after it launched the Policy Guidance Note on Green Bonds.

Green bonds are fixed-income securities that are used as a source of funding for projects in renewable energy, energy efficiency, green transport and waste-water treatment among other activities that fight climate change.

Kenya becomes among the few African countries which have embraced the green bond which will allow international and local institutions to raise funds for environmentally friendly projects through Kenya’s capital markets.

The first green bond will be issued by Acorn Project (Two) Limited Liability Partnership to raise Sh5 billion for the construction of sustainable and climate-resilient student hostels.

This green bond is structured as a restricted public offer for sophisticated investors, hence it will be marketed to a select number of investors only and its tenor and coupon remain undisclosed.

“The green bond seeks to raise Sh5 billion to finance sustainable and climate-resilient student accommodation and is structured as a restricted public offer for sophisticated investors.

“The issuance is a critical step in advancing the development of an effective ecosystem to support the establishment of green capital markets in Kenya,” said CMA in the notice.

Continuance approval of green bonds in Kenya will attract international and local investors keen on averting climate change and will provide an opportunity to market Kenya as a leading investment destination.

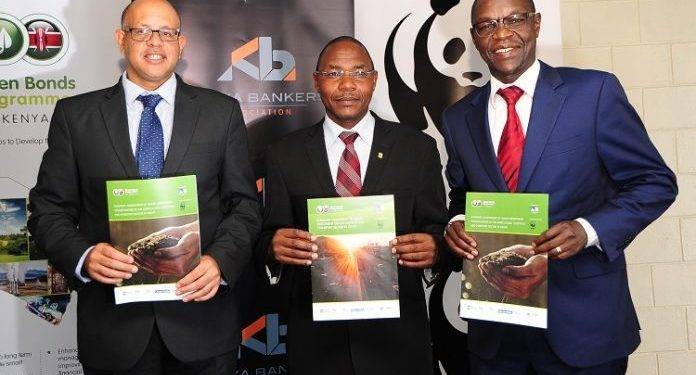

“The approval of the amendments to our listing rules to facilitate issuance of green bonds will enable the NSE offer local and international issuers additional source of green financing, improve investor diversification as well as enhance issuer reputation thus leading to growth in our market,” Chief Executive Officer at the NSE, Geoffrey Odundo, said.

Acorn and Helios are planning to build 3,800 university hostel units in Nairobi worth Sh7.4billion.

Besides, the bond investors will get a 50 percent guarantee from Guarantco which will them recover half of their principal and interest in case of a default.