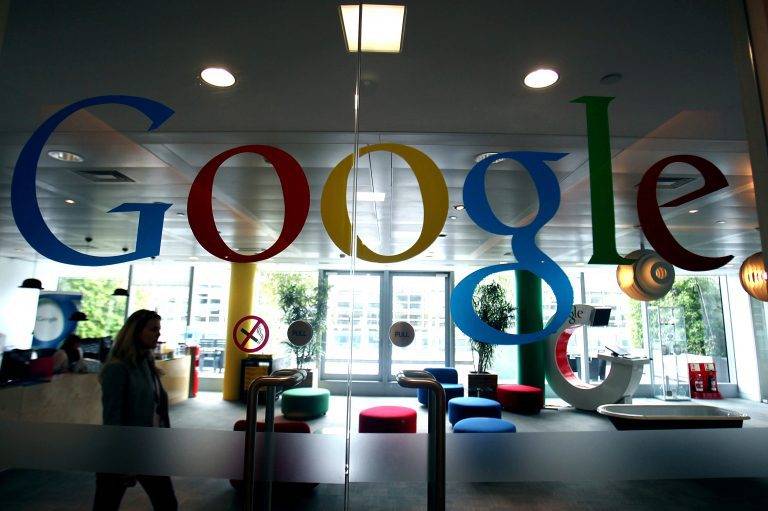

Kenya Risks Trade Wars If It Imposes Taxes On Digital Transactions – Google Warns

American Multinational technological firm, Google has warned that Kenya risks getting into a trade war with other countries if it imposes taxes on digital transactions.

Under the proposed amendment to the Finance Bill 2019, Kenya wants to impose an income tax which will require online businesses to charge Value Added Tax (VAT).

Under the Value Added Tax (VAT) Act 2013, provision of online platforms for use by third-parties falls under the taxable supply and it attracts a 16 percent levy.

In the proposed amendment, the National Treasury wants to introduce a new paragraph under the charging section, which emphasizes that income accruing through a digital marketplace be chargeable to tax.

Google’s East Africa Policy and Government Relations Manager, said that the proposed amendments contradict the international tax system that requires companies to pay their corporate tax in countries where their products and services are created and not where they are consumed.

He cited France which faces trade war with the US after it defied President Donald Trump and stuck to its plan to tax big multinational US tech companies and now its wide-ranging list of goods, including aircraft, cheese, and wine could be targeted by the White House.

“The risk with this is as we see happening in France after its decision to impose a unilateral tax on international firms on digital platforms.

“France is now in the midst of a trade dispute with the US Treasury because of that tax which was seen as targeting Google and other multinational firms based in the US,” he told the House Finance committee during public hearings on the Finance Bill.

Similarly, KRA has said that it will soon seek income tax from income-generating digital applications, those that sell goods and services and those that require users to pay before downloading.

The taxman said that it will liaise with Communications Authority of Kenya (CA) to obtain transactions data by resident and foreign-based app developers doing business in Kenya.

Featured Image Courtesy: Africanstylesand culture