Why A Seasoned VC Investor ‘Angel-Funded’ This 6-Month-Old Female-Led Nigerian Startup

It was the year 2009 when Tomilola “Tomi” Adejana earned a bachelor’s degree in Physiology from the prestigious University of Lagos (UNILAG).

As a very bright prospect with a freshly-minted degree in a particularly attractive field, she may have been tempted to join the incredibly long line of helpless Nigerian graduates who appear to have found a job in job-hunting.

But Tomi was cut from a different cloth. Being the go-getter that she is, she was always going to carve her own path and she was never going to grow complacent because of a fancy piece of paper that had her name on it.

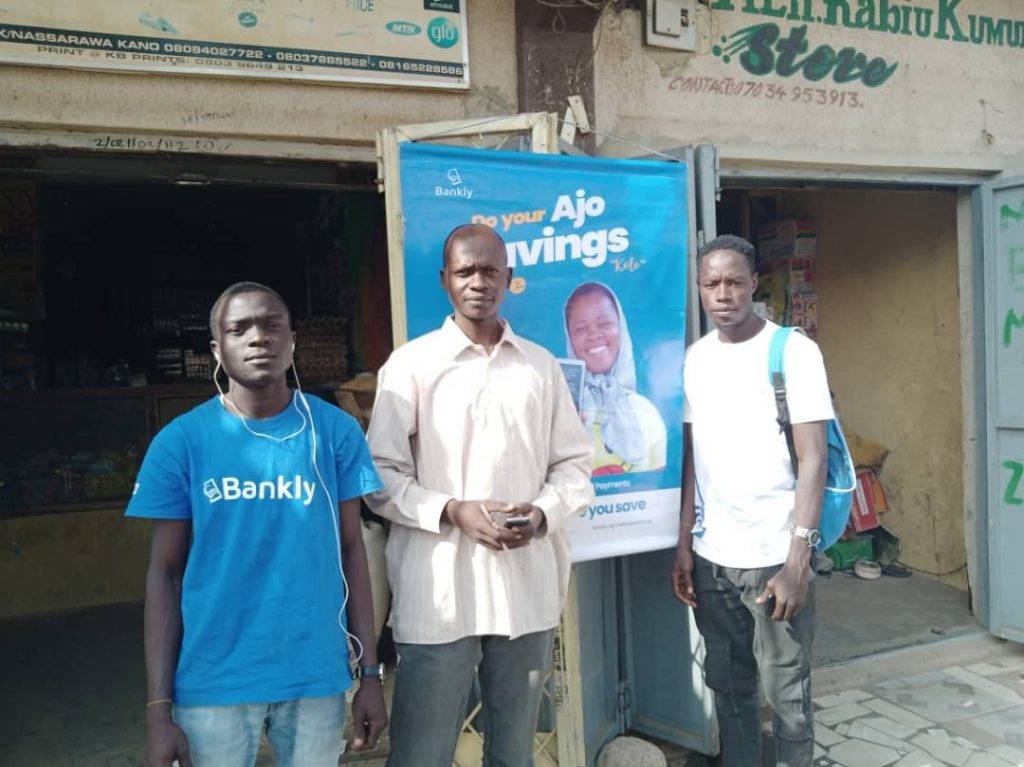

Tomi currently runs Bankly; a Nigerian fintech startup that is unlike any other. Although the company only officially launched in July this year having successfully completed a pilot phase in December 2018, Bankly is holding its own quite well.

Despite going live barely 6 months ago, the startup has already got backing from a seasoned investor who has completed over USD 2 Bn in acquisitions, divestitures, and joint ventures for private equity companies and this investor also happens to be the co-founder of a fintech company that is making a killing in remittances.

What Bankly Is About

Bankly is a cash digitization payments and savings platform targeted at individuals in the informal sector who would rather keep their money or save with the traditional thrift collectors (popularly known as Ajo, Esusu or Adashe in various parts of Nigeria).

During the pilot phase, Bankly majorly operated a voucher system which made it possible for people to pay/save using Bankly vouchers in a “Recharge to save” model.

Bankly’s voucher system operated similarly — allowing users to save by buying and loading Bankly vouchers that are equivalent to the amount the user intends to save.

But even as the voucher system helped with significant adoption during the pilot phase, Bankly now prioritizes a 1,500-strong growing network of agents spread across 7 states in Nigeria built in 6 months.

The Idea Behind Bankly

According to Tomi, Bankly has set out to eliminate the many risks faced by the ordinary Okada Rider or Pomo Seller who can’t access formal financial services and thus save money by setting aside a specific amount in payments to Ajo, Esusu, or Adashe.

In Nigeria, thrift collection is a common method of saving especially for people in the informal economy. For reasons ranging from the economic to the downright sentimental, low-income individuals find traditional thrift collectors more suitable than banks when it comes to saving.

But unlike banks, these traditional thrift collectors are neither known for their accountability nor their trustworthiness. There are many reported cases of people losing lots of money to roguish thrift collectors who abscond with funds, never to be seen or heard from.

Also, something as natural as the death of a thrift collector could well mean the loss of all the money being saved up as there is usually no succession plan.

With the traditional thrift system, there is no insurance; unforeseen yet not uncommon occurrences like theft or accident can cause people to lose their hard-earned money forever.

More so, the traditional thrift collection outfits operate a rigid, centralised system such that people cannot access their savings — regardless of the emergency — until after a specific period of time and users can only retrieve cash from a particular individual.

There is also a lack of transparency and some “unspoken” terms and conditions regarding the retrieval of savings which makes pulling out funds a rat race sometimes.

These, amongst many other issues, are some of the problems Tomi is addressing with Bankly.

“We are trying to serve people who otherwise keep their money in cash and save with thrift collectors,” Tomi told WeeTracker.

“One of the things market women and other people in the informal sector do is to discipline themselves and put some money away so that they don’t eat into their capital. The second thing they do is to aggregate funds. The third thing is to have an outlet through which they can access credit. These are the main reasons they use thrift collectors.

“The biggest issue with this informal savings and loan system is that many unsuspecting people often become victims of fraud and theft. That’s one of the problems Bankly is addressing,” she said.

But beyond that, Tomi also sees benefits in capturing the data of people in the informal economy who save using the thrift system.

“If a local woman is saving in cash with a thrift collector, she has no data. So, even when there is a social welfare package from the government and impact organisations, even when formal insurance or credit system wants to serve people like her, there is no data on her financial capacity or her average monthly income, nothing to guide these institutions to serve people like her better” said Tomi.

Bankly has thus set out to first protect such individuals from the theft and fraud that happens in thrift systems. Then, decentralise the system and make it flexible such that users can retrieve their cash from anywhere at any time.

“With the informal thrift system, you can only get your cash after a specific period from a particular person in a certain place. But with Bankly, if you’re saving with an agent in Ajah and then travel to Enugu to meet a family emergency, you can get your money in Enugu, unlike the usual thrift system,” Tomi remarked.

“You can save anywhere, you can get your money anywhere. Also, there’s no need for keeping track of savings with paperwork. Users get an SMS alert for every transaction. We’re digitising cash.”

What Makes Bankly Tickly

Tomi also highlighted what she described as the 3 pillars of Bankly. According to her, the first thing Bankly has set out to do is to digitise cash.

Secondly, Bankly aims to afford its users other financial services that are tailored to their needs using the data derived from digitising cash. These services include lending, healthcare/education financing, and insurance.

The third and final pillar of Bankly, according to Tomi, is to “include” people in the informal sector in financial systems rather than just creating “access”.

“There is a difference between creating access and inclusion,” she says. “Inclusion makes such individuals members of the formal community. It encompasses education on financial literacy and all those things can lift them out of poverty.”

How Bankly Operates Today

Tomi spent the better parts of 2018 building the Minimum Viable Product (MVP) and she funded the entire thing from her own pocket.

Prior to developing the agent app, the startup used USSD for onboarding users and a few agents in parts of south-western Nigeria. This was, more or less, a way of testing the waters during the initial phase.

Since officially launching earlier this year, Bankly has grown its network of agents having toned down on the usage of the USSD channel.

Currently, there are some 1,500 agents serving up to 10,000 users on the platform, and counting. These agents are responsible for onboarding users, collecting the savings, enlightening/encouraging users on basic saving habits, and facilitating cash retrieval.

Customers can easily sign up on Bankly by registering with agents who are present in strategic locations. Bankly and its agents currently earn commissions on the individual accounts held and regular mobile money offerings like funds transfer and bill payments, as well as interests on credit extended to customers.

Tomi, who is committed to hauling financial services to the last mile, believes that financial services should be treated like fast-moving consumer goods (FMCGs) and that’s how financial services can best reach everyone.

Thus, Bankly actively uses super-agent networks, as well as collaborations with organisations that have a wide reach like the Association of Mobile Money Agents of Nigeria, to expand its reach into neglected/underserved communities.

“We’ve built our agent network by first leveraging existing mobile money agents and reaching out to existing thrift agents while digitising their operations,” she said.

How The Idea For Bankly Came About

In the six years that followed Tomi’s graduation from the university, she had volunteered with the United Nations, completed a course in Strategic Innovation & Business Management from Lagos Business School (LBS), bagged an MBA in Finance, Investment Banking & Wealth Management from SP Jain School of Global Management (Singapore), and put in work in a number of firms including Meristem Wealth Management Limited and Frontline Strategy Limited.

According to Tomi, Bankly wasn’t something she consciously set out to build from the start but she was nudged in that direction by something she encountered while working on some projects in fintech.

Between January 2016 and January 2018, Tomi had worked as Head of Business at Aledin Nano Limited; a company she co-founded.

Still fully operational, Aledin Nano is a mobile financial services company borne out of the need to serve the unbanked and underbanked in the areas of microfinance and microinsurance, leveraging technology and alternative data sources to foster financial inclusion.

“In my previous role, we were offering a product called SmartCredit in partnership with Access Bank and Airtel,” she said. “We wanted to drive the usage of the mobile money wallet, Access Money, by giving nano loans.”

She added: “Uptake was pretty decent as I was leading that team. When studying defaults on loans, I and my team called customers to find out what the problem was. We wanted to know about the blockades or obstructions that prevented them from paying back.”

Tomi found out that the obstacle to repayment was not necessarily a shortage of funds as had been feared. The challenge was in digitising the cash.

“It’s easier to withdraw a huge sum of money from an ATM that to put in the bank,” she said, “just like it is easier to download a 1GB movie from the internet than to upload it.

“With SmartCredit, we had made it very easy for them to obtain cash from their mobile wallet. But it was hard for them to convert hard cash to e-money when the time for repayment came. We even had customers saying they had the money in their pockets and we could come to collect.”

Tomi, thus, saw a dire need to make digitisation of cash easy for everyone, especially for those people who are excluded from formal financial systems. She eventually participated in a programme on financial inclusion conducted by Accion Venture Lab. Before long, she was able to fully grasp the problem and a solution took shape in the form of Bankly after months of intensive research.

How Bankly Found Favour In The Eyes Of A VC Investor

While Nigeria’s and indeed, Africa’s emerging startup ecosystem is certainly starting to attract significant funding, shortage of finance is still a major reason many startups never quite get off the ground in these parts.

More so, the African startup ecosystem appears to be rigged against female entrepreneurs such that only 14 percent of the 51 startups that have raised USD 1 Mn and above in 2019 have women as founders/co-founders.

It is, thus, no mean feat that Bankly; a female-led Nigerian startup that is barely 6 months old, has managed to raise capital from an investor of repute.

Opeyemi “Yemi” Odeyale, invested in Bankly earlier this year. Yemi is the co-founder of Ping Express; a fintech company that he grew to a multi-million-dollar profile in less than 3 years and now operates in 31 countries.

Yemi — a seasoned finance professional with over 18 years’ experience — was an Assistant Vice President of Barclays Bank Plc until co-founded Ping Express. Before joining Barclays, he had worked with PricewaterhouseCoopers, JP Morgan, and BNP Paribas.

Yemi and Tomi first linked up during her time at Aledin Nano; a company he also interests in. Yemi, who describes himself as an “unrepentant apostle of the evolving fintech industry” is keenly interested in deepening financial inclusion in order to serve people at the bottom of the pyramid. And this is partly why he backed Bankly.

Speaking to WeeTracker on why he invested in the startup, Yemi revealed that he was encouraged by a combination of reasons.

“First of all, the idea is something I subscribe to. I try as much as possible to support financial inclusion and I see the Bankly project extending the whole agenda of financial inclusion,” he said.

“The second reason I invested was because of the person driving the project. I found someone that was hardworking and very resilient. As a startup in Nigeria, you are bound to face many issues and being able to find your way around those obstacles and not giving up is a priceless trait. I saw all these in Tomi while working with her on previous projects.

“I thought the combination of a good idea with a resilient entrepreneur behind it and above all, someone you can also trust creates a good chance of success.”