Record High 2019 for The African Ventures – USD 1.340 Bn Venture Capital Secured in 427 Deals

What a year!

Our love for the African ecosystem is unending, and we put every ounce of effort to live up to it. In this year’s report, we have added even more data points with comparison to our 2018 report on African venture capital. We have analysed 20 industries, 54 countries and 20+ deal types with a comparison to 2018 numbers. The report also takes into consideration feedback and queries raised by several readers of our previous reports.

The African venture investments broke all the previous records to register USD 1.340 Bn in investments through 427 deals in equity and debt financing in 2019. The year was especially a great year for the Nigerian ventures that raked in USD 663.24 Mn, highest amount of venture capital money secured by a country in 2019. Kenya had a super growth year netting 283.64% growth over the previous year’s funding amount. South Africa took the third position in the top 3 countries as per funding amount.

Fintech, which is on a growth path for the fifth year in a row securing USD 678.73 Mn, witnessed a spectacular growth of 138.48% over the previous year. The ecosystem appears solid for the companies to set their footing as evident from the rise in seed and Series A rounds which were the most preferred form of deal closures for the investors.

It was also a year when the corporates led investments into industry shaping ventures that could be game-changers for African infrastructure. The continent did not shy away from the limelight and was in constant focus of the global investors and tech giants.

The enablers of the ecosystem continued to show their commitment towards hacking the growth opportunities on the continent, which are as diverse as its challenges.

Women entrepreneurs were a vital part of the growth in 2019, bagging a few of the big-ticket rounds of the year.

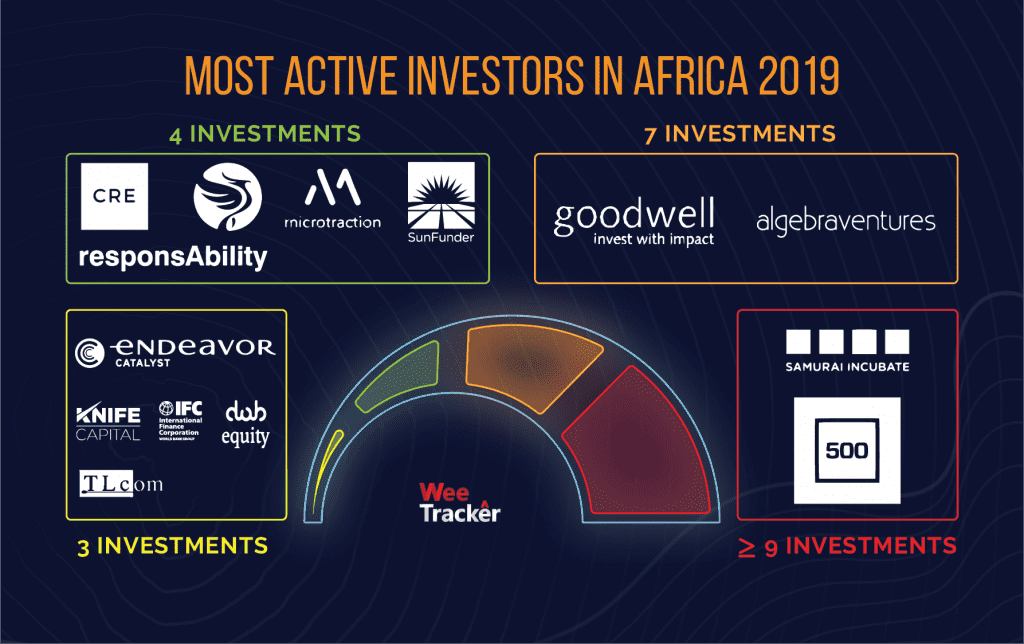

The local investors did not stay behind in loosening their purse string and did not fail to surprise the African startup ecosystem with bigger rounds. 24 M&A deals took place during 2019 which was a 50% growth over 2018 numbers.

With the current market climate, the VC market in 2020 is expected to remain robust, particularly in areas such as fintech, logistics, on-demand services and agritech.

The 2019 African VC ecosystem report will give you a detailed overview of the state of ventures & venture capital in Africa. It will also help you, deep-dive, into the data to uncover insights on the most upcoming and promising startup ecosystem in the world.