Kenya Hunts Foreign-Owned Tech Startups With 30% Local Ownership Law

Kenya’s new National Information Communication and Technology (ICT) Policy was published in the Kenya Gazette earlier this month, effectively becoming the new policy. And one of the biggest talking points in the new policy is the provision that redefines ICT company ownership requirements in Kenya.

It is no secret that Kenya has a strong presence of foreigners or expat founders when it comes to company ownership in the country. According to a report on Forbes, there are even more expat founders in Kenya than female founders.

As a matter of fact, that report was a survey of 1,079 co-founders across 788 startups, focused on Ghana, Kenya, and Nigeria. It put a number on the extent of penetration of foreign business owners in the Kenyan technology space.

The survey found that Kenya “had the strongest presence of expat (foreign) co-founders of any single country,” and that, “In Kenya, 37 percent of the co-founders surveyed were expats compared to 10 percent in Ghana and 5 percent in Nigeria.”

But Kenya’s new national ICT policy might shift the dynamic as the law directs that foreign companies doing business in the country’s ICT sector must cede no less than 30 percent shareholding to Kenyans.

In other words, Kenyan individuals or corporations must own at least 30 percent of any tech venture rooted in the country, lest such companies will not be licensed to operate in the country.

“The government strongly encourages Kenyans to participate in the ICT and science and technology sector through equity participation,” states the regulatory policy published by the ICT Ministry.

“It is the policy that only companies with at least 30 percent substantive Kenyan ownership, either corporate or individual, will be licensed to provide ICT services.

“For purposes of this rule, companies without majority Kenyan ownership will not be considered Kenyan, and may thus not be calculated as part of the 30 percent Kenyan ownership calculus,” the document reads in part.

The new policy further states that licensees will have 3 years to meet the local equity ownership threshold and they may apply to the Cabinet Secretary for a one-year extension with appropriately acceptable justifications. For listed companies, the equity participation rules will conform to the extant rules of the Capital Markets Authority (CMA).

The motive behind the new rules is touted as an effort to ‘encourage local participation in the ICT sector through equity ownership and ease the barriers to entry.’ But the current set up of Kenya’s tech startup ecosystem especially might result in a situation where the opposite effect is achieved in reality.

In Kenya, expat founders raise much more money than local founders, as expat-founded startups are many times more likely to close investment deals.

As per data compiled by WeeTracker, Kenya-based startups raised a total of USD 428.9 Mn in total disclosed funding deals recorded in 2019. Expat-founded startups were the recipients of 87.8 percent of that sum, raking in a staggering USD 376.7 Mn.

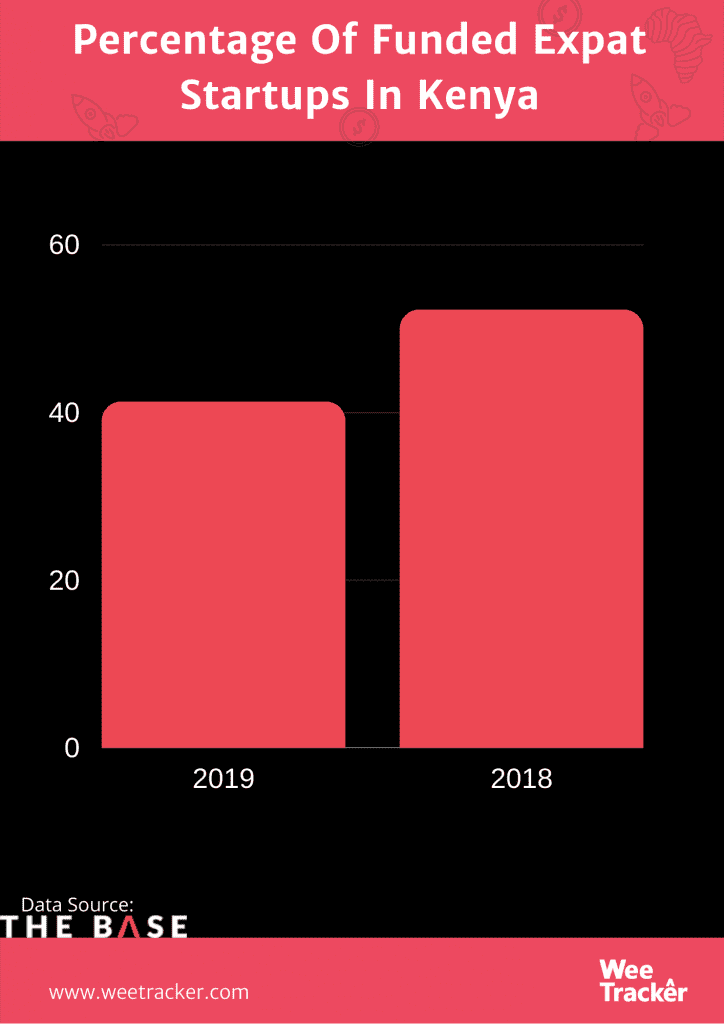

That year, some 63 Kenyan startups disclosed funding deals, and 41.2 percent of those startups were founded by expatriates. A year prior, startups founded by foreigners accounted for 52.2 percent of the total number of startup funding deals disclosed in Kenya.

A Village Capital report even asserted that as of 2017, 90 percent of fintech investment in East Africa was poured into startups with American and European founders.

In fact, some of the most-funded startups in Kenya almost always have a foreign (usually white) co-founder. Cellulant, JamboPay, Seven Seas and Wananchi are perhaps the only genuine exceptions.

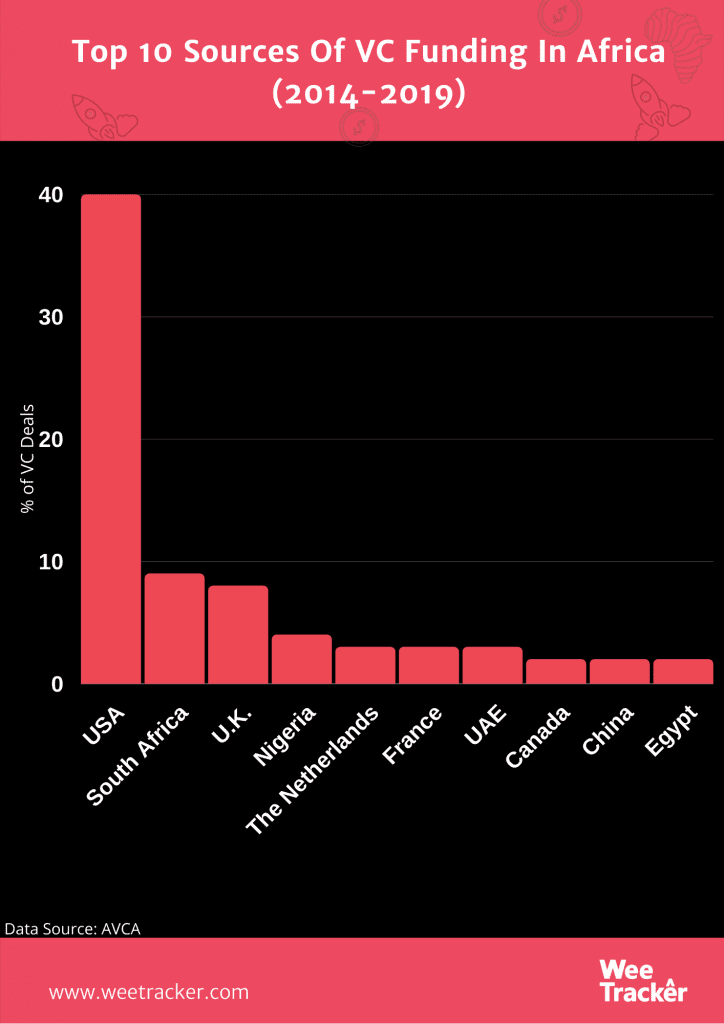

One of the factors often blamed for this obvious funding disparity is the near absence of local funders within the ecosystem.

A huge chunk of startup investments comes from foreign backers who seem more open to funding foreign-owned ventures. Per this data, around 80 percent of VC deals that took place in Africa between 2014 and 2019 were sponsored by foreign networks.

Kenya’s new rules of ICT company ownership does come with some perks but it also presents a problem tied to funding.

Since foreign investors and foreign founders are essentially held back on how much of a company they can own in Kenya, it makes it harder for existing startups to raise funding.

That’s because the equity threshold creates friction, tightens the noose, and restricts the flow of funds as investors and founders now have to negotiate a tightrope. Foreign investors would surely be concerned about entering a market where about 30 percent is already untouchable.

Although the country’s new ICT policy proposes a government venture capital fund that will invest in startups in exchange for equity, Kenya’s tech startup ecosystem still pretty much runs on foreign capital.

And there are concerns that the new regulation is a measure that hardly addresses the real challenges stifling local-owned startups but instead ties the hands of foreign players, possibly based on a misconception that clipping the wings of foreign actors is one way to make local firms flourish.

Featured Image Courtesy: Viktoria Ventures