Strategy TearDown: Decoding SA SME Fund and its Investments in the Southern Africa VC/PE Space

Traditionally, Africa’s Investment space has been dominated by institutional investors such as pension funds, insurance firms, and other asset managers. With the growth of technology solutions that address priority sectors in Africa, and the rising recognition of the importance of Private-Public Partnerships, unique investment vehicles are being set up to address the funding gap, to support the growth of businesses and incubation of ideas. Such vehicles include fund of funds, with the latest into the space being SA SME, a South African founded fund of funds

Summary of Formation

Founded in 2016, SA SME is an initiative between 50 JSE Listed firms, and the South African government, through the Public Investment Corporation (PIC). With a fund size of R 1.4 Billion (USD 88 Million), the fund’s mandate is to invest in innovation and technology, through Venture Capital and Private Equity funds, to support SME growth in Southern Africa. To date, the fund has announced capital deployment of more than R 900 Million, approximately (USD 70 Million) to fund managers. The remaining amount is expected to meet the Fund’s operating expenses over the next 10 years.

Management and Limited Partners

Out of its 55 shareholding companies, inclusive of corporates and government agencies, 45% are players in the financial services sector, 9% in food & agriculture, 7% in mining, real estate & infrastructure, with the remaining participants being players in the hospitality, manufacturing, and apparel industries. Government entities form 6% of the LPs and include the Compensation and the Unemployment Insurance Funds both of which stem from the department of labor. To fulfill its mandate, the fund has two teams reporting to the Board of Directors. These are the Investment Committee, overseen by Micheal Jordaan, and the Executive Management team, overseen by CEO, Ketso Gordhan. The management forms a 16 member team.

Strategy Teardown

SA SME Fund commits capital in three priority areas; VC/ Incubation, Growth Investments, and impact & support initiatives. With black-owned businesses still highly marginalized, the fund’s deployment strategy requires that fund managers invest 50% of capital received to black African SA owned businesses, 25% into other businesses owned by SA Indians and other people of color, and the remaining 25% into other businesses. Failure to adhere to this strategy may result in a 20% penalization of profits as a percentage of invested capital. This carried interest mechanism establishes best practices in structuring the LP/GP partnership as it improves transparency and governance, which help to align the interests of all parties involved.

Operationally, SA SME presents itself as an unfettered fund of funds. While 86% of its investable capital has been allocated to growth equity fund managers, SA SME has invested in debt capital. Its debt fund portfolios include A2Pay and Spartan SME Finance which provide short-term debt capital to SMEs. A2Pay is a trade financing company focussing on spaza shops and stokvels at the grass-root level. The firm, which also manufactures Point-of-Sale (PoS) hardware, provides up to USD 3300 in debt capital to these shops, in a bid to enhance their capacity. This initiative is in line with SA SME fund’s mandate to spur innovation in activities that directly contribute to sustainable job creation and growth of SMEs. Through this partnership, the fund hopes to finance 10,000 spaza shops over the next 10 years.

In its industry building efforts, SA SME has partnered with a number of industry players whose activities it supports through funding and advisory services. These include SAVCA and Akro networks. In partnership with SAVCA and the First National Bank (FNB), the fund has developed a training program dubbed the Fund Managers Development Program (FMDP). The 12-month curriculum aims to support and increase the number of female and black-owned fund managers in investment management. In its partnership with Akro, the fund has developed a 20 -week accelerator program that utilizes a hands-on venture building approach. The cohorts constitute up to 8 startups to maximize face time and to get the scalable businesses, investment-ready and funded within 5 months.

Known Plans

With most of the funds having been formed in the year 2019, SA SME fund’s main play centers around monitoring the investment funds. One of the funds to keep an eye out for is the newly formed University Technology Fund (UTF), the first of its kind in Africa, which aims to commercialize technologies and business ideas that arise from universities.

Funds

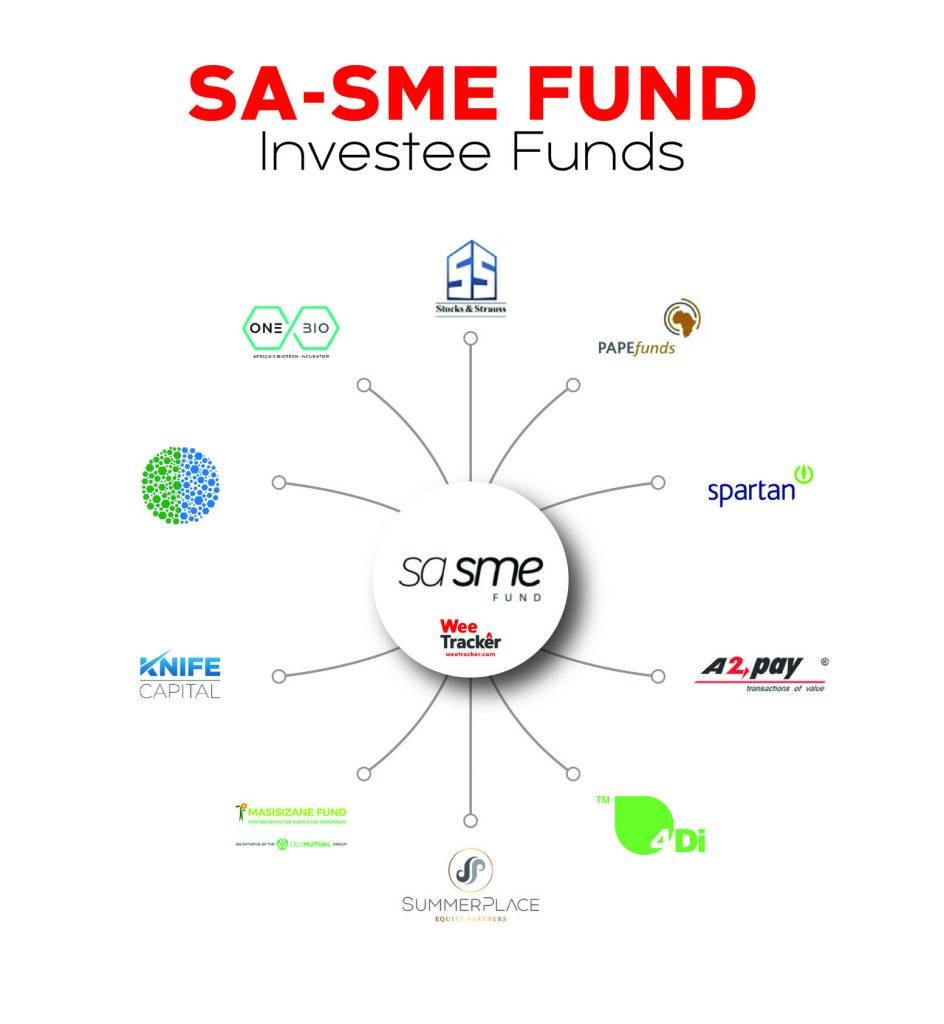

In our analysis, we identified 10 fund managers through which the SA SME has invested. However, in a recent interaction with a member of the Executive management, SA SME discloses that there are plans to deploy further capital into 3 new funds that have been approved by the Investment Committee but awaiting legal sign off. Below, we summarize these fund managers’ industry focus and disclosed funding.

SA SME is a Rand denominated fund. The USD amounts are backdated to reflect historical rates at the time of fund formation.

| Logo | Name | Fund Name | Industry Focus | Amount (USD) | Amount (ZAR) |

|---|---|---|---|---|---|

| Knife Capital | KNF Ventures Fund | Technology & Innovation commercialization | 1.4 Million | 40 Million | |

| 4Di Capital | 4Di Capital Fund III | FinTech, InsureTech, HealthTech, EduTech, AgriTech | 9 Million | 125 Million | |

| SummerPlace | Summer Place Equity Fund I | Priority sector revenue generating SMEs | 8.4 Million | 125 Million | |

| Pape Fund Managers | PAPE Fund III | Agnostic SME | 6.8 Million | 100 Million | |

| Savant | Savant Ventures Fund | Technology & Innovation commercialization | 8 Million | 110 Million | |

| One Bio | One Bio Seed Investment Fund | Biotech | 5.7 Million | 75 Million | |

| Stocks & Strauss | University Technology Fund | University technologies | 10.4 Million | 150 Million | |

| Spartan SME Finance | Spartan Debt Fund | Agnostic SME Debt financing | 7.2 Million | 100 Million | |

| Masisizane Fund | Masisizane Francise Fund | Agnostic SME fInancng | 3.4 Million | 50 Million | |

| A2Pay | Spaza Shops & Stokvels | Agnostic | 1.7 Million | 25 Million |

The data of this research piece comes from THEBASE, Africa’s leading market intelligence platform focussed on private companies, VC and PE space. Sign up for FREE today