Kenya’s Glowing Fintech Scene Is Dulled By A Lukewarm Wealthtech Segment

Across the African continent, it is undeniable that fintech startups are the toast of the burgeoning tech ecosystem. And in Kenya, this is especially true.

Kenya’s fintech revolution has helped the country achieve near-total financial inclusion, currently at 82.9 percent; the highest on the continent.

At any one time, one can count up to 150 fintech companies in Kenya, but the bulk of the players in the sector have largely pitched their tent on mobile payments and digital lending. And perhaps digital payments processing and online banking, to a lesser extent.

But fintech can be much more than that. There’s a relatively new crop of fintech startups that are now prioritising savings and investments over spending and consumption.

This evolving segment of fintech distinguishes itself with the term, “wealthtech” or “wealth management.” And Kenya’s otherwise bubbly fintech sector appears to be lukewarm on this front, though there are a few promising players.

How wealthtech compares to other fintech segments in Kenya

Mobile money and lending platforms dominate Kenya’s fintech industry both in terms of subscription numbers and financial performance. On the other hand, the wealthtech segment is “very disjointed,” as WeeTracker gathered from Robert Ochieng, Founder and CEO of Abojani, a financial literacy and wealth management startup in Kenya.

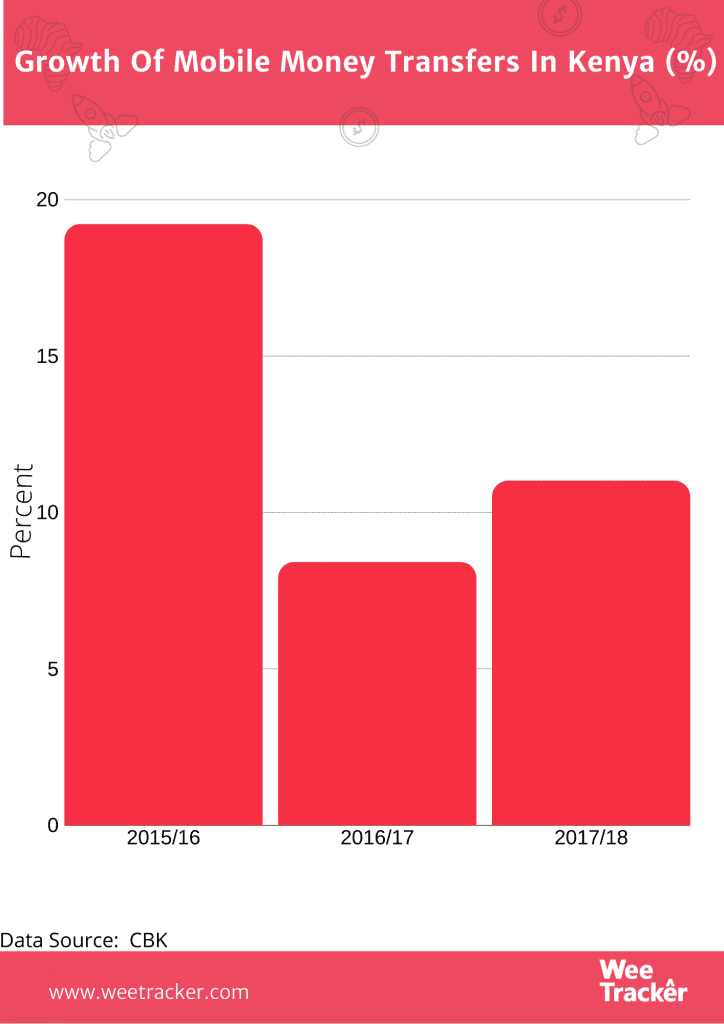

Looking at data from the Central Bank of Kenya (CBK), mobile money transactions are the most common form of payment in the country. Total mobile money transfers have recorded strong growth in recent years, at 19.2 percent, 8.4 percent and 11 percent in 2015/16, 2016/17 and 2017/18, respectively.

Peer-to-peer (P2P) transfers exhibited even sharper rates of expansion at 35.8 percent, 21 percent, and 10.57 percent over the same periods. Strong growth is visible in mobile deposits through agents, which increased by 13 percent in 2017/2018 after rising by 42.8 percent the year before.

Kenyan fintech tends towards payments & credit

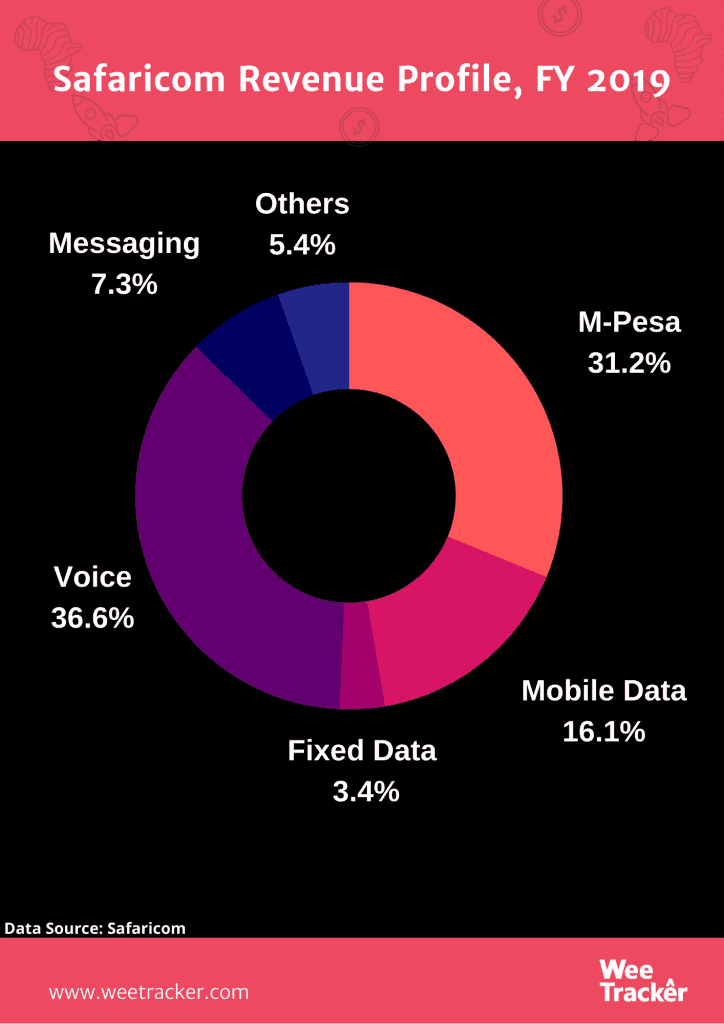

The tendency of Kenyan fintech to lean heavily on payments can be attributed to the pioneering payment platform, M-Pesa, which has become something of a runaway success since launching in 2007.

Now fully-owned by Safaricom and Vodacom (after last month’s Vodafone stake buyout), the success of M-PESA has driven financial inclusion in Kenya and turned Safaricom into East Africa’s largest and most profitable telecommunications firm, contributing around 5 percent to Kenya’s GDP.

In its Full Year 2019/2020 Financial Results, M-Pesa accounted for 33.6 percent of Safaricom’s revenue. In this case, M-Pesa revenues grew by KES 11 Bn to KES 84.44 Bn which translates to year-on-year growth of 17.2 percent. A year prior, M-Pesa’s contribution was 31.2 percent.

On the whole, Kenyans moved KES 4.35 Tn (USD 40.8 Bn) through their mobile phones last year, according to the CBK.

This means that an average of KES 11.91 Bn (USD 111.7 Mn) was transacted on mobile phones daily between January 2019 to December 2019 – some KES 990 Mn (USD 9.2 Mn) higher than the KES 10.92 Bn (USD 102.4 Mn) daily average in 2018. The overall mobile payments in 2018 amounted to KES 3.98 Tn (USD 37.3 Bn).

It was M-Pesa that paved the way for other segments like digital lending, mobile banking, fundraising applications, mobile payment, digital payment, online trade, international money transfer, online procurement, and other fintech applications that are now hotting up in Kenya.

Digital lending, in particular, has been as much of a hotspot as payments, perhaps even overcrowded. There are up to 49 digital lenders in Kenya, no other African country has more. Digital lending has even come under fire recently in the country, owing to shylock practices and wanton blacklisting on credit-rating bureaus (CRBs).

But while Tala, Branch, Okash and many others fight on digital credit, and the likes of Pesapal, iPay Africa, Cellulant, Flutterwave, and Wapi Pay among others make strides in digital payment processing, the wealthtech scene in Kenya seems to be lagging behind with fewer players, fewer customers and weaker financial performance.

What wealthtech looks like in Kenya presently

Even though reliable data on the actual number of purely wealth management startups in Kenya is not readily available, the scene can be thought of as nascent at best owing to lukewarm interest from the mass market. Looking at data from The Base, however, one can identify up to 82 wealth management startups across Africa.

Currently, there are just a handful of wealth management platforms in Kenya, and most of them can hardly be described as pure wealthtech startups that serve the average person.

There are mobile banking apps that offer savings products such as M-Shwari, Timiza by Absa Kenya, KCB M-Pesa by KCB Bank, and HF Whizz by HFC Ltd. There are also apps by stockbrokers and investment banks that allow investors to buy only stocks of companies listed in Kenya. Such apps include AIB DigiTrader by AIB Capital, G-kuze by Genghis Capital, and few others.

For wealth management, Abacus is perhaps the most visible platform. The five-year-old NSE-licensed company offers users the ability to deposit, buy, sell, and trade unit trusts, bonds, and equities on their platform.

Another startup is the earlier-mentioned Abojani which is an agent of AIB Capital for the purchase of local stocks. Founded in 2018, Abojani claims to have up to KES 40 Mn (roughly USD 400 K) under management for 150 clients in both stocks and mutual funds, as its CEO revealed to WeeTracker.

Other platforms for wealth management in Kenya are Britam Asset Managers for mutual funds and Scope Markets for offshore stocks via Contract for Difference (CFD).

Then there’s Kwara which is more of a digital cooperative society that allows its members to save money and earn interest. Safaricom also recently rolled out a savings platform known as Mali which rewards users with interests on savings.

How Kenyan wealthtech compares with the leaders

By contrast, in Nigeria’s equally booming fintech scene (home to over 60 active fintechs), wealthtech is fast-becoming mainstream with 20+ wealthtech startups/investing apps giving individuals freedom and flexibility to make rewarding investments and savings. No other African country has more. And this doesn’t even include “crowd-investing” platforms.

Wealth management startups like PiggyVest and Cowrywise which launched between 2016 and 2017 are among the most popular wealthtech startups in Nigeria with over a million users combined.

One source even claims PiggyVest now has around one million users who put in up to USD 80 Mn (NGN 28 Bn) last year alone.

There is also a new breed of Nigerian wealthtech startups that are now helping the average joe to invest in U.S. stocks. This is where startups like Rise, Bamboo, Chaka, Trove, and others are starting to make waves.

In Kenya, no known “startup” currently offers that. The closest thing to that in Kenya is to buy CFDs using FxPesa owned by EGM Securities. Scope Market also offers a platform where investors can buy or sell CFDs for international markets stocks.

Both are non-dealing forex exchange brokers licensed by the Capital Markets Authority (CMA) and are not really startups. Going further, Kenya’s Standard Investment Bank has something called MansaX funds but they invest for investors.

What’s holding back Kenyan wealthtech?

Ochieng reckons that Kenyan wealthtech is yet to really take off due to a combination of factors including low financial literacy levels, low disposable income, lack of investment and technical support (of the kind enjoyed by fintechs in payment and lending), and stiff regulation for startups looking to go down the wealth management road.

He, however, acknowledges that things could improve soon as the CMA has since come up with a sandbox for startups to test their ideas.

Michael Kimani, Head of Business Development, East Africa at Zippie; a fintech firm, told WeeTracker that the savings/investment startup scene in Kenya is still “raw and untapped” though, according to him, the likes of M-Akiba, Cytonn, and PennySmart are making strides in that area.

“Kenyan companies still seem to be playing payments, lending, and insurance. Savings/investment is still raw and untapped and limited to the investment banks and large insurance companies,” said Kimani.

Kimani also put the tepid nature of the segment down to regulation, lack of adequate investment products/options, and the usual challenges associated with building startups in such climes.

“The capital markets industry is highly regulated. The products we have like bonds and money market funds are by licensed investment firms,” he said.

“There is not enough investment product options besides the regulated financial products by capital markets regulators. This means besides the usual bonds, unit trust, and shares, there is not much else.

“Yet, people looking to save and invest want a diversity of options of products that offer cash flow, or yield, or interest or capital gains. So what happens is people diversify into projects like housing/real estate, farming, Uber, etc. I see this as the reason why Kenya has a lot of scams promising returns.”

“Also, the usual problems that plague young startups trying to solve big problems in our market is another factor. It is a big problem, requires a great team and funding. So this limits the number of young companies that can take on this problem,” he added.

Featured Image Courtesy: US News