A New Twist In The Terrorism Case Against MTN Brews Fresh Trouble

MTN still has that Afghan problem

The ongoing anti-terrorism case against Africa’s largest telecommunications provider, MTN Group, and seven other companies got a new twist on Friday, June 5, when an amended complaint was filed in the United States District Court for the District of Columbia.

As contained in the legal documents obtained by WeeTracker, additional plaintiffs and new allegations have been included in the amended complaint. There are now 702 plaintiffs, including veterans and members of more than 200 Gold Star Families. In the U.S., a Gold Star family is a family whose loved one died in service to the country.

The amended complaint which was filed Washington-based lawyers alleges the following:

- MTN paid protection payments to the Taliban to intentionally assist the Taliban’s effort to drive Americans out of Afghanistan.

- MTN’s business model focuses on dangerous or unstable markets without a major U.S. presence, and therefore MTN benefited from attacks on American forces insofar as those attacks encouraged U.S. policymakers to withdraw from Afghanistan.

- MTN relied on American contacts for financing and insurance.

- MTN’s support for Taliban attacks against U.S. citizens advanced the foreign-policy interests of MTN’s most important business partner – the Iranian Revolutionary Guards Corps (“IRGC”).

Last December, a lawsuit was first filed against a number of firms including MTN Group, in a United States court. The plaintiffs in the original lawsuit were 385 Americans, including dozens of veterans and members of Gold Star Families. They seek damages for the losses suffered; losses which they claim were aided by MTN and others.

That initial lawsuit alleged that MTN Group, along with DAI Global, Louis Berger Group, G4S Risk Management, Centerra Group, and Black & Veatch Special Projects Corp., violated the Anti-Terrorism Act by paying off terrorists in Afghanistan and by extension, enabling acts that harmed many U.S. nationals.

New twist in the tale?

On its part, MTN Group is being accused of not only making payments to Taliban guards between 2009 and 2017 to ensure the protection of some of its facilities and installations in the conflict-ridden country but also allegedly deactivating its cellular network at night at the Taliban’s request.

After initially stating that it was reviewing the allegations while maintaining that it had done no wrong, the telco went on to file a motion to dismiss in April this year on the grounds that “the court lacks jurisdiction over MTN (since MTN does not operate in the U.S.), and because the claimants do not allege conduct by MTN that would have violated the U.S. Anti-Terrorism Act.”

In the amended complaint filed just 3 days ago, the plaintiffs allege that MTN Group did tie the matter to the U.S. in a number of ways, one of which is through some of its financial dealings.

“MTN Group also connected MTN’s support of the Taliban to the United States by obtaining financing in reliance on U.S. contacts,” reads a part of the amended complaint.

“MTN Group supplied financing for MTN’s Afghanistan operations through several capital investments in MTN Afghanistan.”

It further reads, “In doing so, MTN Group tied MTN’s unlawful conduct to the United States in two ways: First, by obtaining U.S.-supplied debt financing that it used to fund MTN Afghanistan’s cash payments to the Taliban; and second, by obtaining political-risk insurance from a U.S.-based entity – which was material to MTN’s Afghan operations – expressly conditioned on a promise to refrain from engaging in terrorist finance. Both U.S. contacts were closely related to MTN’s support for the Taliban.”

The plaintiffs also claim that MTN Group’s decision to solicit funding from U.S.-based entities – and then to conceal its conduct through communications to the United States – was important to its scheme.

“During the time period at issue, no non-U.S.-based financing source could replicate those benefits for MTN,” the claimants allege.

More new claims in the amended complaint

MTN Afghanistan came to life in mid-2007 after South Africa’s MTN Group acquired Areeba which had 200,000 subscribers as of 2006.

The acquisition was part of a USD 5.53 Bn global merger between the two companies. MTN is the majority shareholder, owning as much as 90 percent of the company, while the International Finance Corporation (IFC), with its 9 percent stake, is also a debt and equity shareholder in MTN Afghanistan which now has more than 6.2 million subscribers and generates over USD 8.3 Mn in annual revenue.

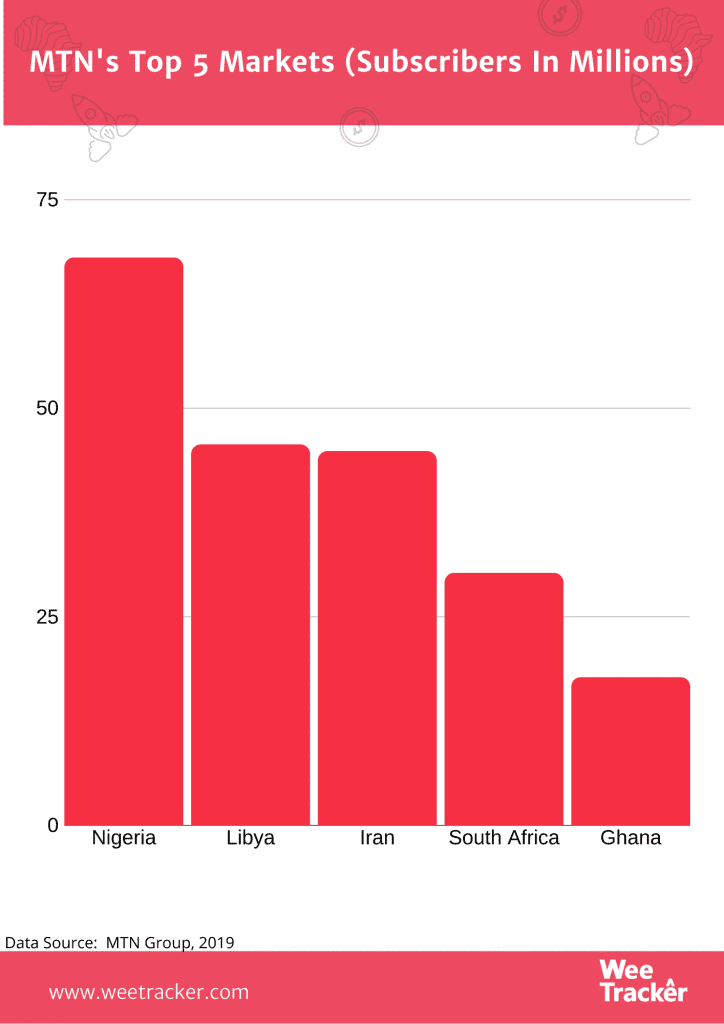

Currently, MTN is active in 20+ countries, though one-third of the company’s revenue comes from Nigeria, where it commands about 38 percent market share.

Parts of the freshly-filed complaint also claim that MTN negotiated its protection payments in direct discussions between MTN Afghanistan’s security department and Taliban commanders.

“MTN’s security department consisted of roughly 600 total staff in Afghanistan, which included both local Afghan employees of MTN Afghanistan and a South African security component from MTN Group,” reads a portion of the court document.

“The senior MTN Afghanistan security official who oversaw many of MTN Afghanistan’s protection payments to the Taliban reported directly to the head of MTN Group’s head of business risk management, in Johannesburg, South Africa,” it claims.

“MTN Group was specifically aware of, and approved, MTN Afghanistan’s practice of paying the Taliban for security. In fact, MTN Group compensated MTN Afghanistan’s security team with cash bonuses reflecting its success at resolving “security issues” involving the Taliban.”

The bold claims allege that those bonuses typically had three levels: Level 1 (USD 1.5 K, for local operatives); Level 2 (USD 5 K, for regional operatives); and Level 3 (USD 10 K, for national operatives).

The complaint also says the head of MTN Afghanistan’s security group received roughly USD 66 K in such bonuses during the relevant timeframe, which specifically compensated him for negotiating with the Taliban successfully. It alleges that MTN Group even gave this individual an award for best “display[ing] the Group’s values in MTN Afghanistan.”

The representatives of the plaintiffs went on to state that according to evidence from the U.S. interagency Afghan Threat Finance Cell (ATFC), “MTN Afghanistan was the worst offender of all [the Afghan telecommunications firms.”

There are also claims that MTN sources told the ATFC that it was “cheaper to pay the Taliban than it would have been to rebuild the towers in the face of Taliban threats.”

How MTN is responding to the fresh allegations

WeeTracker got in touch with MTN Group for comments on the latest development around the anti-terrorism suit against the company. The telco offered that the only comments it would be dropping on the matter have been issued in the company’s official statement.

“We are reviewing the new material in consultation with our legal advisers but remain of the view that we conduct our business in a responsible and compliant manner in all our territories,” said MTN Group’s President and CEO, Rob Shuter. “As a result, we intend to continue to defend our position.”

As seen in the official statement declaring the company’s position on the matter, MTN says its position is unchanged and it might resort to the same course of action as before.

“Now that the complaint has been amended with additional allegations, MTN anticipates filing another ‘motion to dismiss’ to take these new allegations into account. While MTN is reviewing the new material, it does not change the fundamental defects in the case explained in the April motion,” a part of the company’s statement reads.

For now, though, fingers remain crossed as the ongoing legal battle continues to unravel.

Featured Image Courtesy: CAJ News Africa