MTN Has Reduced Data Prices In South Africa While Ignoring Its Largest Market

MTN has cut its data prices in South Africa, significantly.

After initially opposing the “slash data prices” directive put forward by the Competition Commission, MTN Group appears to have finally bowed to pressure in South Africa.

The telco has now finalised its agreement with the Competition Commission on the wide array of price adjustments announced last month and implemented on 15 April.

Last December, right after the release of the now-famous Bonakale report, the Competition Commission instructed two of South Africa’s biggest telcos, Vodacom and MTN, to cut their prices by 30-50 percent or face prosecution.

Initially, Africa’s largest telecom network operator, MTN, which is headquartered in South Africa, disagreed with the analysis and recommendations contained in the summary report. The telco had stated that it would “continue to engage constructively and vigorously defend against over-broad and intrusive recommendations.”

However, fast-forward a few months into the rollercoaster ride that 2020 has been so far and both MTN and Vodacom have budged, with the latter moving first to implement a 30 percent data price cut in March

MTN, the second-biggest telco in South Africa by number of subscribers, made the second move, revealing much-reduced data prices in a press release dated May 4.

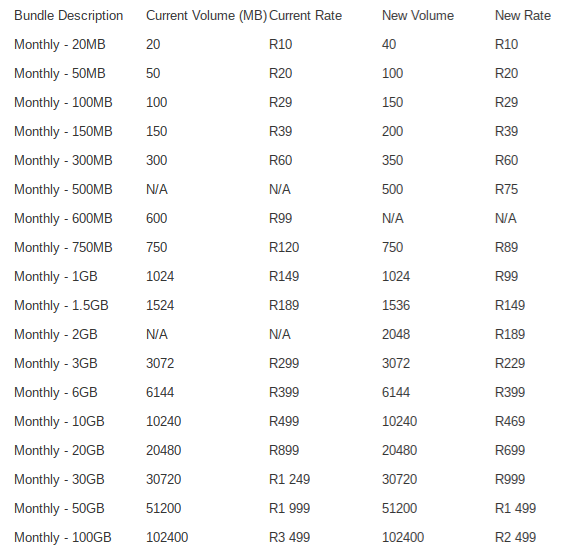

Source: MTN Group

As seen in the revised data pricing, all of MTN’s sub-1GB 30-day data bundles (from ZAR 10.00 [USD 0.54] – ZAR 149.00 [USD 8.09]) will be reduced by up to 50 percent.

Furthermore, the very popular monthly sub-1 Gigabyte category saw significant price reductions implemented on 15 April. The monthly 20MB and 50MB bundles double in volume – from 20MB to 40MB and from 50MB to 100MB – without any change in price. That is to say, prices stay at ZAR 10.00 [USD 0.54] and ZAR 20.00 [USD 1.08] respectively, but for double the data.

This development is a win for the South African public which has long called for a reduction, arguing that data prices in the country are too expensive compared to prices in similar economies.

So, what’s the catch? MTN is facing similar pressure in its largest market, Nigeria, especially since the COVID-19 pandemic forced a lockdown that increased online traffic.

Although there hasn’t been much by way of organised, meaningful effort to get telcos in Nigeria to review their data prices downwards, a precedent seems to have now been set in MTN’s home country, South Africa.

And if MTN’s checkered history in Nigeria — where it has had several squabbles — is anything to go by, the telco may soon find itself in-between a rock and a hard place.

Will MTN also be forced to cut data prices in its biggest market?

With over 68 million MTN subscribers in Nigeria as of December 2019, Africa’s most populous country is easily the telco’s largest market. As a matter of fact, it has twice as many subscribers in Nigeria as its home country. (MTN has 30.2 million subscribers in South Africa.)

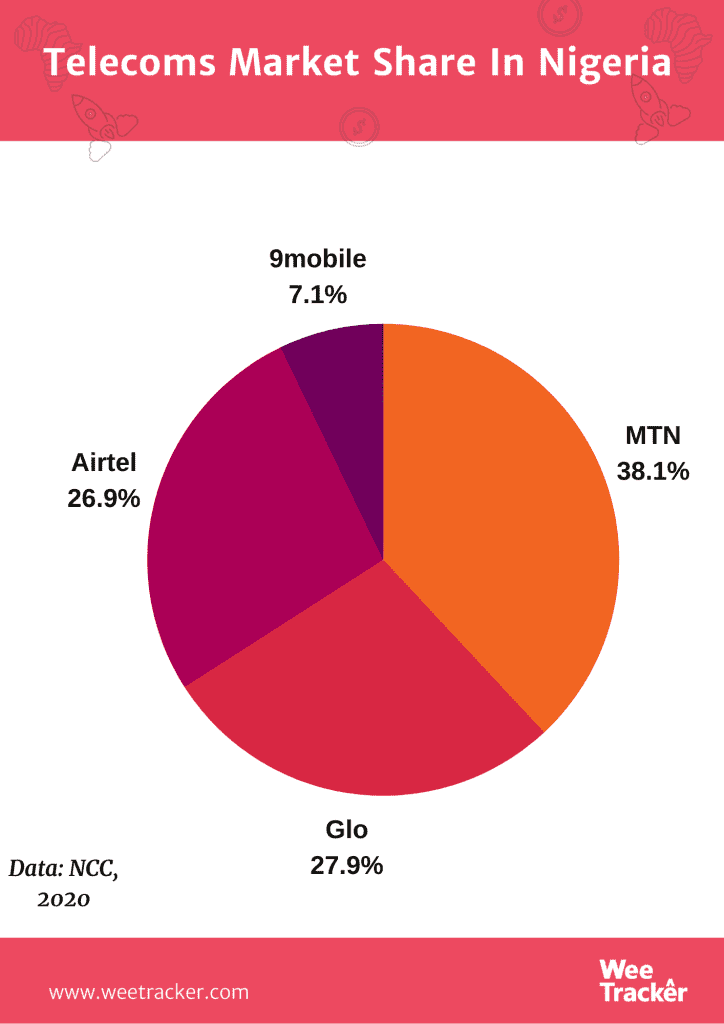

As of 30 June 2016, MTN recorded 232.6 million subscribers worldwide, making it the eighth largest mobile network operator in the world, and the largest in Africa. Active in over 20 countries, one-third of the company’s revenue comes from Nigeria, where it currently holds about 38 percent market share.

Evidently, the company dominates the huge Nigerian market having taken the initiative to facilitate the first GSM voice call in Nigeria on 16 May 2001. And the importance of the Nigerian market, which accounts for 30 percent of its revenue, is not lost on the telco.

During the first few weeks of the COVID-19-fuelled lockdown in Nigeria, the hashtag, #CutDataPrices, trended on social media for a few days as people clamored for a revision of data charges.

To their frustration, nothing happened. But now, there’s a precedent that may catch the eye of Nigerian authorities which has a history of back-and-forths with MTN.

The height of the squabble was in 2015 when the Nigerian Communications Commission (NCC) handed MTN Nigeria a massive USD 5.2 Bn fine for not complying, on time, with rules regarding unregistered SIM cards on its network. That fine was eventually reduced to USD 1.6 Bn, of which MTN has reportedly paid NGN 275 Bn (USD 705.3 Mn).

However, what would prove pivotal to reducing tensions was the clause accompanying the reduced fine that stated that MTN Nigeria would be required to list on the Nigerian Stock Exchange (NSE).

Last year, MTN finally listed on the NSE, 18 years after launching in Nigeria. Apparently, the telco had been strong-armed into listing in Nigeria, as it had done in South Africa three-and-a-half years before.

And it won’t be too far-fetched to imply that the “what-is-good-for-the-goose-is-good-for-the-gander” play might come to the fore once again as calls for Nigerian telcos to slash data prices grow louder.

How are telcos really faring on the internet front in Nigeria?

The NCC’s latest figures place total telecom network subscribers in Nigeria at 184 Million.

In its recently-released financial report for Q1 2020, the Nigerian subsidiary of MTN Group, MTN Nigeria, recorded impressive revenue growth, raking in NGN 329.2 Bn (USD 845.4 Mn) during the period under review.

That figure represented a 16.7 percent growth from the same period a year ago. Profits after tax increased by 5.3 percent to NGN 51.02 Bn (USD 131.1 Mn).

While voice revenue took a blow, data revenue is rising fast. MTN said traffic patterns changed following the lockdown of Lagos, Abuja, and Ogun States as part of initial responses to tackle the COVID-19 pandemic in Nigeria.

Between January and March, the company’s total number of active data subscribers jumped by 1.7 million to 26.8 million. Data revenue equally witnessed growth as it increased by 59.2 percent during the first quarter.

However, data revenue is still a relatively small part of MTN’s revenue. In Q1 2019, it accounted for just 16.6 percent of the company’s earnings. Even with its 59.2 percent growth in the first three months of 2020, it only accounts for only 22 percent of the NGN 329.2 Bn the telco has earned so far this year.

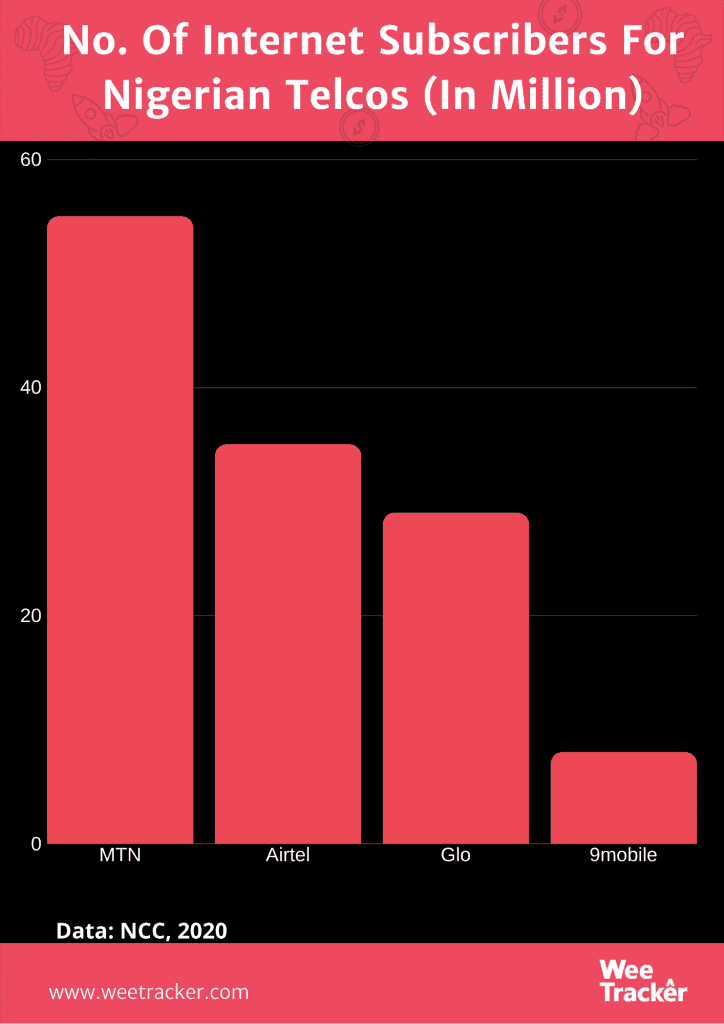

MTN Nigeria currently has over 55 million data subscribers, of which 26.8 million are active subscribers. For clarity, the telco defines inactive subscribers as users who bought less than 5MB of data or did not subscribe at all during a 90-day period.

For Airtel Nigeria, things are looking quite good. In addition to expanding LTE coverage, it has become Nigeria’s second-biggest telco in terms of data subscribers.

Between 2014 and 2020, it added 24.5 million new data subscribers, bettering even MTN which added 22 million new data users during the same period.

Airtel Nigeria currently has around 50 million subscribers, of which about 35 million are internet subscribers. In last year’s IPO prospectus, its parent company, Airtel Africa, said data brought in 22.2 percent of its revenue in Q1 2019.

The other members of Nigeria’s “Big Four Telcos”, Globacom and 9mobile, had 29 million and 8 million internet subscribers respectively, as of January 2020, out of a total of 51 million and 13 million mobile subscribers respectively.

Telcos typically peg their charges on the relatively-higher costs incurred in the operation of different broadband spectrums, licenses, and in the development of infrastructure (4G and 5G these days) for each country they operate in.

However, the word on the street is that internet subscribers should be paying a lot less in a market the size of Nigeria.

Does data really cost too much in Nigeria?

As people are forced to stay at home while waiting for the worst to pass, telcos in Nigeria and indeed the rest of Africa are being urged to trim down their internet rates. The telcos have been urged to do this as a way of offsetting the economic burden and also helping people stay connected at a critical time.

Well, the recent wave of calls for a reduction in mobile data prices hasn’t yielded much fruit as no changes have been recorded since, at least, in Nigeria.

In any case, we decided to dig into whether mobile data is really expensive in Nigeria compared to other markets. And here’s what we found.

A 30-day subscription for 1.5GB broadband mobile data typically costs around NGN 1 K in Nigeria (USD 2.76) at the moment.

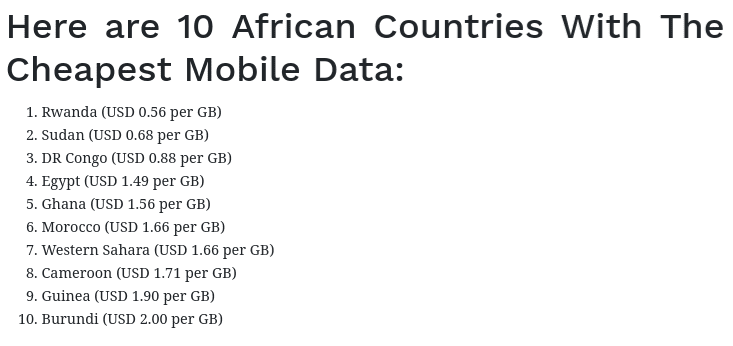

In early 2019, a study conducted by UK-based broadband research firm, Cable, measured forty-five (45) 1GB data plans in Nigeria and pegged the average price of 1GB of mobile data in Nigeria at USD 2.22.

The study also found that the cheapest 1GB mobile data cost USD 0.26 and the most expensive was USD 13.79. Nigeria ranked 44th in terms of Global Mobile Data Price.

That is to say, only 43 countries of the world have cheaper mobile data than Nigeria. That’s neither a ringing endorsement nor a scathing indictment, but it can’t be ignored that there were a total of 230 countries on that list put together by Cable. For context, South Africa ranked 143rd on that list with mobile data costing USD 7.17 per GB at the time.

The Alliance for Affordable Internet (A4AI) defines affordability as 1GB of mobile broadband data costing no more than 2 percent of average monthly income. For Nigeria, that figure currently stands at 1.7 percent. The average for Africa was found to be 7.12 percent.

All these factors suggest that data prices in Nigeria may actually be more affordable than they seem, though it can always be cheaper.

Photo courtesy of Freekpik