The Pay-TV/VOD Convergence Is Blocked By Odd Regulation That ‘Kills’ Exclusive Content

The Pay-TV/VOD brouhaha

At this point, it is hardly news that Africa’s largest Pay-TV firm, Multichoice Group Ltd., has opted to make allies out of its perceived rivals. The company is understood to have signed deals with U.S. companies, Netflix Inc. and Amazon.com Inc., to offer their streaming services through its new decoder.

No problems there. If anything, it’s a clever move by the South African company; one that would help it retain subscribers — given that, in recent times, both Netflix and Amazon have been breathing down Multichoice’s neck by taking advantage of faster and cheaper internet to grab a foothold in Africa.

Where the problem lies is approximately 6,527 kilometres away, nearly northside to South Africa. That’s the Federal Republic of Nigeria, which is coincidentally Multichoice’s second-largest and fastest-growing market.

The problem? The announcement of the deals between the Johannesburg-based company and the well-known U.S.-based video-on-demand (VOD) streaming giants sort of coincided with the emergence of a regulation that, if enforced, could effectively make investing in exclusive content pointless.

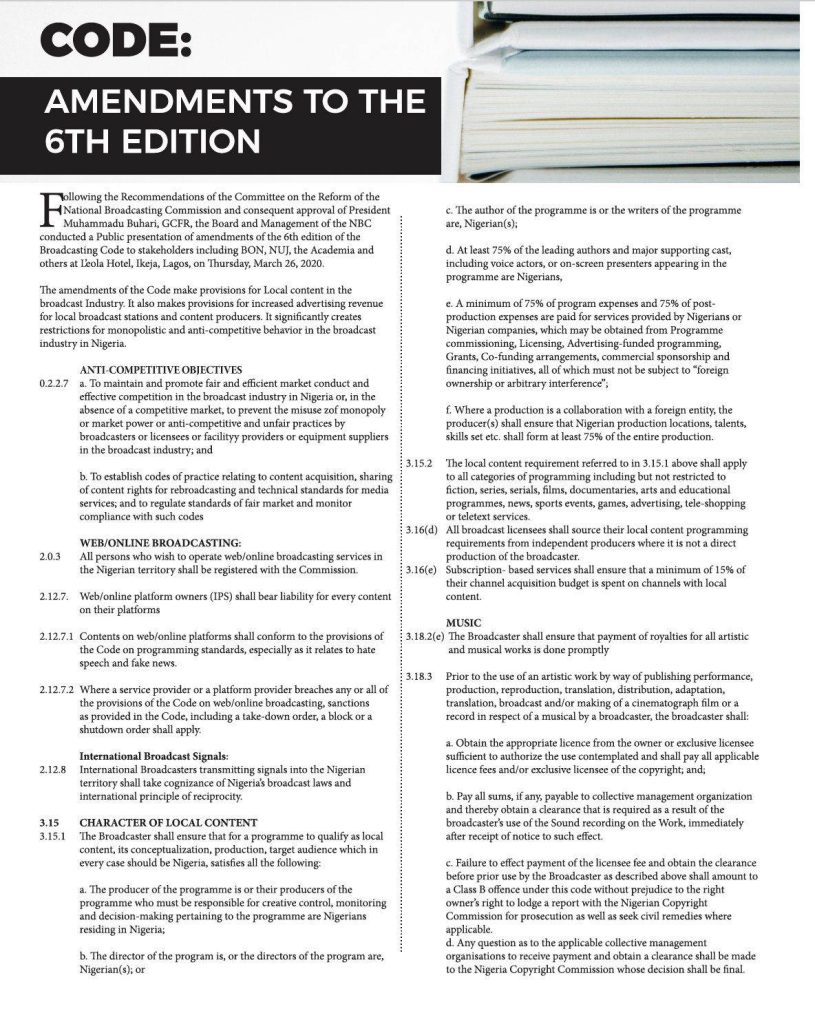

In the amended version of the 6th edition of a broadcast code — released about the same period Multichoice unveiled the deal with Netflix and Amazon in its latest results presentation — Nigeria’s National Broadcasting Commission (NBC) issued a number of provisions that summarily outlaws exclusivity and makes investing in original content a waste of resources, fundamentally.

What the new regulation says and means

The new code, which requires that all online broadcasters are registered with the Commission, will prevent PayTV and streaming platforms from making content exclusive and compel them to sub-license content at prices it will regulate.

In other words, the NBC is looking to, among other things, compel platforms like iROKOtv, DStv, NetflixNaija, FilmHouse Cinemas, SilverbirdTV, SceneOneTV, and any other platform or independent production house that invests in the development of local content, to give up their “selling point” by sharing their content with other local broadcasters for a fee set by the NBC.

In plain terms, the NBC wants to “create competition in the industry” by effectively “killing the industry,” since the new guidelines, if enforced, would imply that there is zero incentive for platforms to commit hard-earned resources into projects that anyone can just buy into at a price which the originator of the project cannot determine.

Per the proposed guidelines, every broadcaster must license its broadcast and/or signal rights in any genre of programming to another broadcaster in Nigeria if:

- The genre of the programme(s) enjoy(s) compelling viewership by Nigerians;

- It relates to a product or service that is objectively necessary to be able to compete effectively on a downstream market;

- It is likely to lead to the elimination of effective competition on the downstream markets; and

- The refusal is likely to lead to consumer deprivation.

Any platform that contravenes this provision will be given the chance to comply or risk a fine of NGN 10 Mn (USD 25.7 K).

Apart from basically outlawing content exclusivity (the very essence of Pay-TV and VOD) and compelling platforms to sub-license content, the proposed guidelines also touch on sports broadcasting.

It proposes that a broadcaster cannot transmit sports content unless it has also acquired a minimum of 30 percent equivalent local licensing of the same category.

This would imply that a company like Multichoice which operates DStv — a known holder of broadcast rights to the global festival that is the English Premier League — would be running afoul of industry regulations if it fails to acquire a minimum of 30 percent equivalent licensing in the Nigerian Premier Football League (NPFL), for instance. This way, NBC aims to promote local content, however unmarketable.

Also, the regulation dictates that 20 percent of broadcast hours should be dedicated to emergencies and other public services programs like election campaigns and trending issues weekly. The code also adds that public programs must have at least 120 minutes of broadcast time daily.

How industry players are reacting

In the last 5 years, iROKOtv claims to have commissioned, acquired, and produced approximately USD 25 Mn in content. And an overwhelmingly large portion of that sum was invested in Nigeria.

However, The company’s founder and CEO, Jason Njoku says only 20 percent of iROKOtv’s revenues come from Nigeria.

For context, Njoku — who claims to have built the largest independent Nollywood companies — has revealed that only 20 percent of revenues come from Nigeria even though 90 percent of the approximately USD 25 Mn invested over the past five 5 years was spent in Nigeria.

Yet, it appears Nigerian authorities are looking to defeat the whole aim of spending all that money and putting in all that time and work. That’s because it makes no sense for anyone to go through all that trouble to get hands on unique content just to hand it out to every Tom, Dick, and Harry, at a price set by an external body.

According to Njoku, “NBC, in making exclusivity illegal, compelling sub-licensing of content and regulating price, are effectively turning private enterprises into state property.”

He also says that under the proposed terms, it makes or any platform or independent production house to invest in local content and that the body is about to tank Nigeria’s USD 400 Mn Pay-TV industry.

“I invest billions of Naira in content then I am compelled to share with everyone else as NBC sets the price. Why? Dark forces or incompetence is at play here. Ridiculous,” he revealed his displeasure in a series of tweets.

Like the cinemas where showcasing exclusive content is key to cracking the entertainment market, investments in exclusive content by streaming and Pay-TV platforms also have a multiplier effect. The exclusivity and unique provisions on those platforms are largely their selling points. But the proposed terms implicitly erode that selling point.

Netflix and DStv’s Africa Magic also seem to be worried that the new broadcast code is a huge threat to their investments as it seeks to end exclusivity and compel re-sale or sub-licensing to other broadcasters, including direct competitors.

Per reporting by Vanguard, it is understood that global streaming service providers, Netflix, Amazon, and popular channel Africa Magic, are all considering halting further investments in Nigerian content.

Nothing is set in stone as of yet

There are indications that a number of inconsistencies contained in the proposal might make it largely unenforceable, especially as the NBC appears to be contradicting Nigeria’s Copyright Act.

By all accounts, the Copyright Act allows content producers to grant partial or total exclusivity to any distributor, and NBC currently has no legal right to determine who should acquire rights to such content.

At present, the wording of the law dictates that it would be an infringement for NBC to declare that broadcasters cannot acquire exclusive content.

To get around this, standard procedure is for NBC to attempt to amend the Act through the National Assembly; hardly a straightforward process since it would require first, second and third readings, committee stages, and a public hearing where it would likely be shot down.

Featured Image Courtesy: 123RF.com