South Africa Retains Position As Africa’s Most Attractive Market For Investments

For the third year running, South Africa has topped as Africa’s most attractive market for investments.

In ABSA’s latest Africa Financial Markets Index, the Southern African country has ranked top in terms of financial market development.

“South Africa has claimed top position mainly because of its sizeable lead in market depth and deep market liquidity supported by strong domestic investors,” the report noted.

The Cyril Ramaphosa-led country was also ranked top in access to foreign exchange, market transparency, tax and regulatory environment and capacity of local investors.

In regards to legality and enforceability of standard financial markets master agreements however, South Africa came third after Mauritius and Kenya and in the macro-economic opportunity, it was ranked second after Egypt.

“Egypt’s strong performance in ‘macroeconomic opportunity’ is driven by steady economic and export growth, along with a decline in non-performing loans,” a part of the report read.

“South Africa’s high position on access to foreign exchange after having been overtaken by Kenya in the previous edition of this index was as a result of high interbank foreign exchange turnover, regular exchange rate reporting and a favorable reserve level relative to net portfolio flows. “

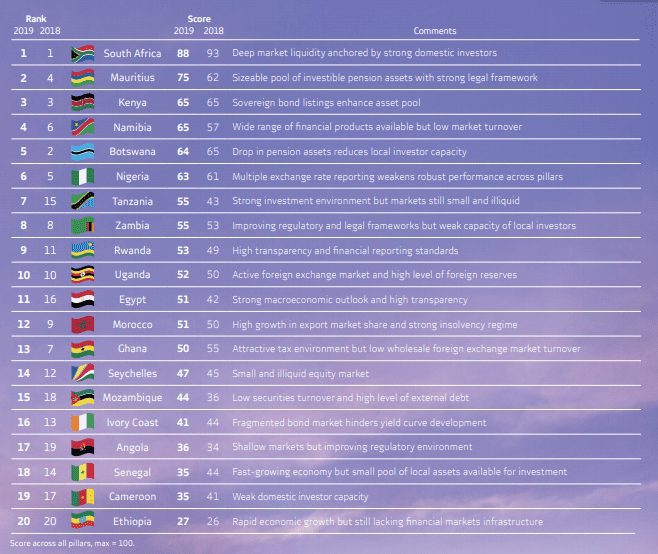

In the ranking, Mauritius came second while Kenya followed in the third position. Namibia, Botswana, and Nigeria followed in fourth, fifth and sixth positions respectively.

The report ranked 20 African countries based on six key pillars: market depth, access to foreign exchange, tax and regulatory environment and market transparency, the capacity of local investors, macroeconomic opportunity, and enforceability of financial contracts, collateral positions, and insolvency frameworks.

The Absa Africa Financial Markets Index presents the required set of tools for countries looking to strengthen their financial markets infrastructure.

“The index is becoming a powerful barometer for policymakers and playing a role in building an Africa which is able to fund itself,” George Asante, the head of global markets for Absa’s regional operations said.

Featured Image Courtesy: Adriaan Louw