Nigeria Has Gone From A Bulk Cement Importer To A Clinker Exporter

Before Dangote Cement was established in the early 1980s, Nigeria was a cement-importing country. From there, it went to not just a producer of the commodity but also an exporter. The country has now taken on a new level, becoming an exporter of cement clinker.

Cement & Clinker

For clarity, cement and clinker are different in their uses. While the former is a commonplace binding material used in construction projects, the latter is used to produce the cement itself. In cement products, clinker is used as a binding agent.

Dangote Cement—a major subsidiary of Dangote Group, a Nigeria-based multinational industrial conglomerate owned by Aliko Dangote, the world’s richest black man—exported 27,800 metric tonnes of clinker to Senegal in what was the company—and the country’s—first ever.

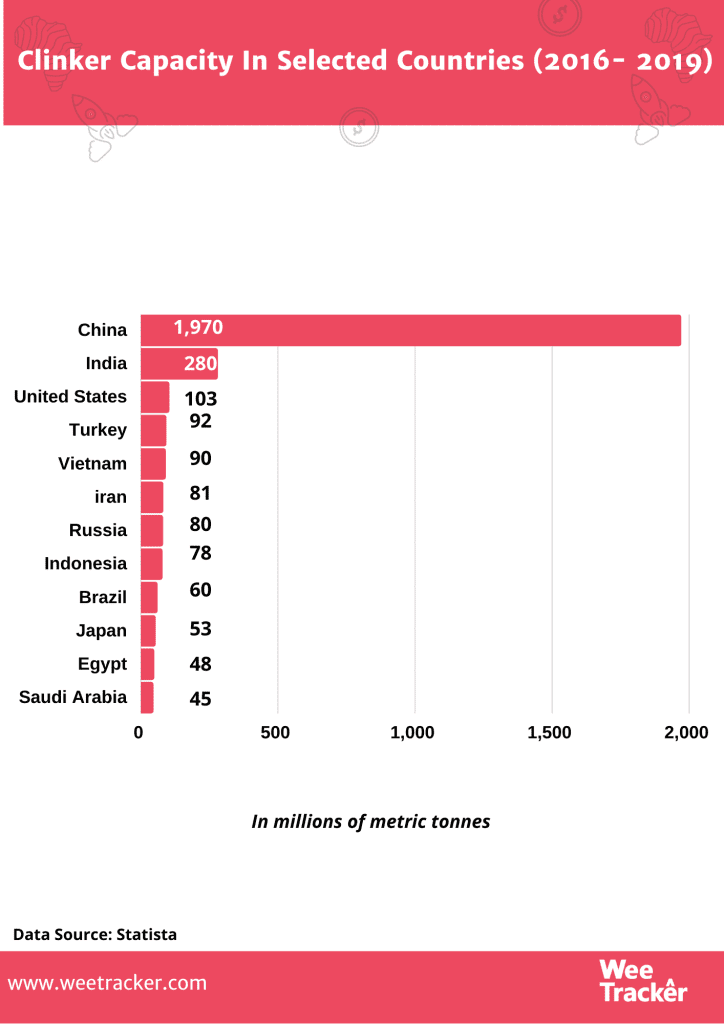

The company—which is currently the largest cement producer in Africa—reported the maiden export to have started from its export terminal in Apapa, Lagos, over the weekend which started from June 15th (2020). After making Nigeria a self-sufficient nation in terms of cement production, the Nigeria Stock Exchange-listed firm is set to make Nigeria one of the leading clinker exporters in the world.

Dangote Cement’s new clinker exportation development would enable it take advantage of the much-awaited African Continental Free Trade Agreement, which in terms of member countries is envisioned to be the largest trade bloc since the 1994 World Trade Organization. The Lagos-headquartered firm has presence in 10 African countries, an edge with which it will promote intra-regional trade.

According to the the firm’s executive director, Alhaji Sada Ladan-Baki, the increased export of clinker—as well as cement—to other countries in Africa will give Nigeria’s foreign exchange a leg up while dialling down its unemployment challenges. For every batch of clinker we export, the money comes back to Nigeria; the amount we are talking about is not small, he said.

2017 In Retrospect

It was back in 2017 that Dangote Cement became officially recognized as the company that turned round Nigeria’s cement buying habit. In the firm’s 2016 full-year audited results presented on the Nigerian Stock Exchange’s floor, it was reported that it had sold 8.6 million metric tons of cement outside Nigeria. That was a 54 percent jump from the volume the company sold the previous year.

The publicly traded manufacturer whose 2017 revenues were in an excess of USD 2.2 Bn was able to turbocharge its production capacity to just about enough to end the era of Nigeria’s reliance of cement importation. For context, the firm exported only 0.4 million tons of the product to other countries in 2012.

Well, Nigeria used to be a net importer of cement. As of 2011, the West African country was one of the world’s largest importers of the commodity, shipping in 5.1 million metric tonnes of it, doing so at the consequence of a shaky national balance of payments.

Large Africa—a leading Sub-Saharan Africa building materials company—was once upon a time Nigeria’s only major cement maker. At at then, the manufacturer was unable to satiate even one-thirds of the market.

The result is: countries like India, Brazil and China considering Nigeria as a key export market. There were 8 million metric tonnes of annual the commodity’s demand between 1999 and 2020, but only 1.7 million metric tonnes were produced.

Featured Image: Bloomberg Africa