Ethiopia Inching Closer to End The Telecom Market Monopoly

Stakes are high in the Ethiopian telecoms after 12 operators expressed their interests to buy into the once-closed market. The competition will eventually see two bidders bagging the lucrative business.

The Ethiopian Communication Authority (ECA) is looking to privatize the telecom sector which has been operating under a monopoly for decades. Of the 12 bidders, 9 are telecom operators. 2 non-telecom operators are also looking to enter the market. ECA said that just 1 of the bids is incomplete.

Etisalat, Axian, MTN, Orange, Saudi Telecom Company, Telkom SA, Liquid Telecom, Snail Mobile and Global Partnership for Ethiopia—a consortium of telecom operators comprising Vodafone, Vodacom, and Safaricom—are among the bidders. The two non-telecom operators are Kandu Global Telecommunications and Electromecha International Projects.

During the bidding process, interest operators are expected to provide detail about their organization to the ECA. Though the timeliness for the bidding remains unknown, a spokesperson for the regulator said only that the second stage would kick off “soon”.

The idea was first mooted in mid-2019 when the sector announced a major shakeup, one that would open up one of the world’s last major closed telecom markets. The industry’s push is to liberalize the economy of the East African nation, which has a population of around 100 million.

The government looks to sell of a 40 percent stake in Ethio Telecom—the one and only telecom operators in the country, but under the full control of the state. A further 5 percent stake will be made available for public purchase, and the remaining 55 percent would be retained by the Ethiopia government.

In 2018, Prime Minister Abiy Ahmed announced a raft of measures to revive the economy. This was aligned to earlier research which put the nation as a capable and a potential resource with an untapped market.

This is the last greenfield site and there is a high possibility of Vodafone, South Africa’s MTN, France’s Orange, and Etisalat of the United Arab Emirates leading the contenders’ pack. Some stakeholders have raised concerns about risks, citing low-income levels of the citizens and the over-valued nature of the Ethiopian Birr.

When the tender was opened in May 2020, ECA sent shockwaves to most of the operators when it slapped them with high entry costs. Safaricom Plc was on record that this could breach the KES 100 Bn (USD 1 Bn) mark, thus forcing it to look out for partnerships. However, the regulator justified that it raised the bar to avert national security threats and to protect the consumers.

The competition is anticipated to improve the quality of services offered and to be a game-changer in the sector. Global accounting firm, Klynveld Peat Marwick Goerdeler (KPMG), presented the evaluation criteria that will enable the government to award the licenses.

The winners will build, own and operate a nationwide telecommunications networks including an international gateway. This will automatically terminate the Chinese companies, Huawei and ZTE, and Sweden’s Ericsson which developed the infrastructure for Ethio Telecom over the past years.

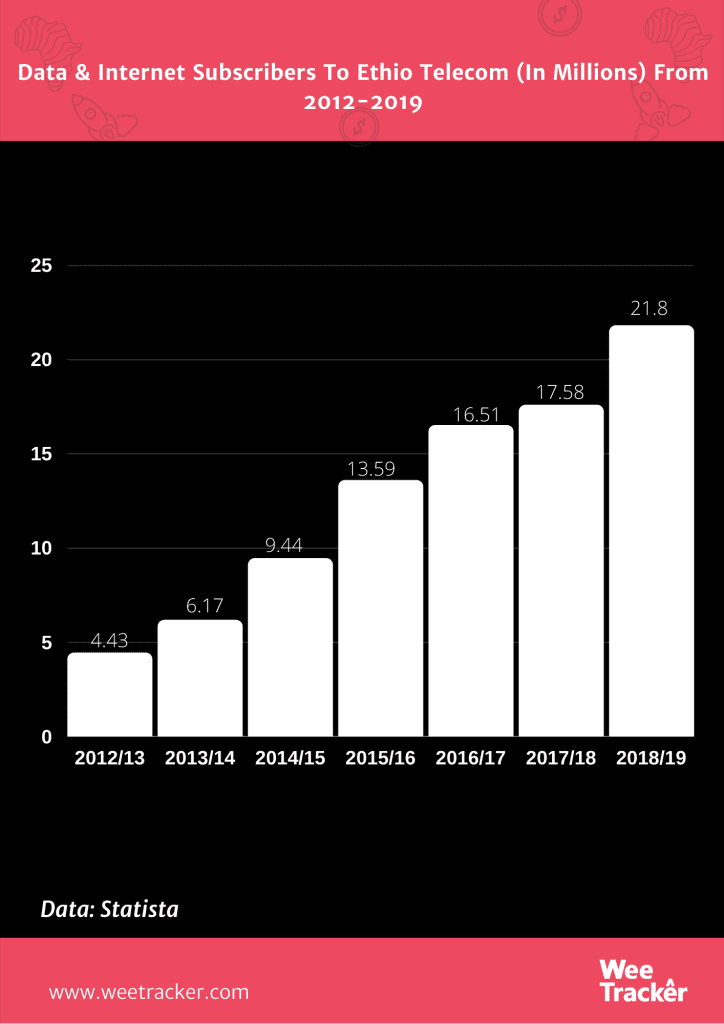

Over 44 million subscribers and 22 million internet users are eagerly waiting for the modernization. Helios Towers, a cell tower service provider, is kicking off its multimillion-dollar African expansion in Ethiopia, as the current activity in the country’s telecoms market shows a pressing need for tower assets.

Featured Image Courtesy: REUTERS/Tiksa Negeri