A Young African Startup Is Daring To Show Its Financials Publicly

For the second consecutive year, Carbon, the fintech startup cum aspiring neobank with operations in both Nigeria, Ghana, South Africa, and Kenya, has volunteered its financial results. Is this a big deal? Well, it’s not a common occurrence in these parts, so it probably is.

While it’s not uncommon for startups in advanced tech ecosystems to publicize their financial results even though they are still private firms, it’s a rarity for startups in Africa’s big tech hubs — such as Nigeria, Kenya, and South Africa — to go down that road.

Apparently, this is because most startups in these parts fear such disclosure could expose losses, attract the wrong kind of attention from regulators, give partners something to strong-arm them with during negotiations, and distribute intrusive market intel that competitors can feast on.

Carbon (formerly Paylater), thus, pulled off a move no one saw coming when it released its 2018 financial results audited by KPMG last July. Technically, it was a first and it came with the promise of making it a yearly affair, even if it reflects losses. And true to that, Carbon has made it two-for-two with the release of its financial results for 2019.

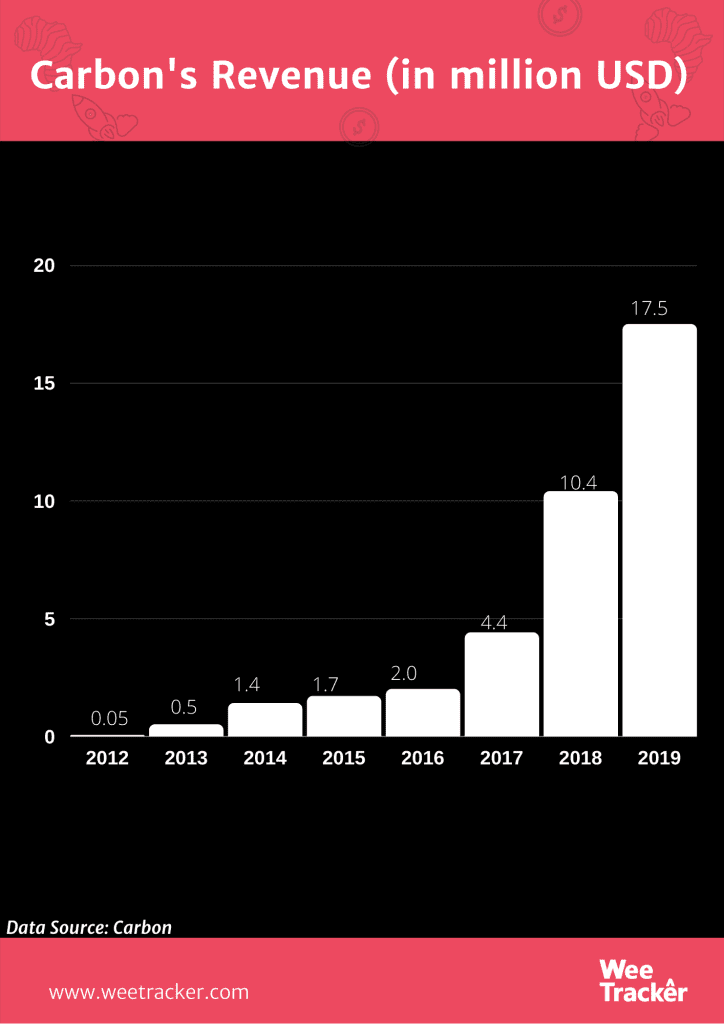

The startup’s latest report revealed some interesting numbers too. As seen in its report, the company which offers a suite of financial services — from digital wallets and quick loans to savings/investments and payments — saw its revenue rise by nearly 70 percent to USD 17.5 Mn in 2019 from USD 10.4 Mn in 2019.

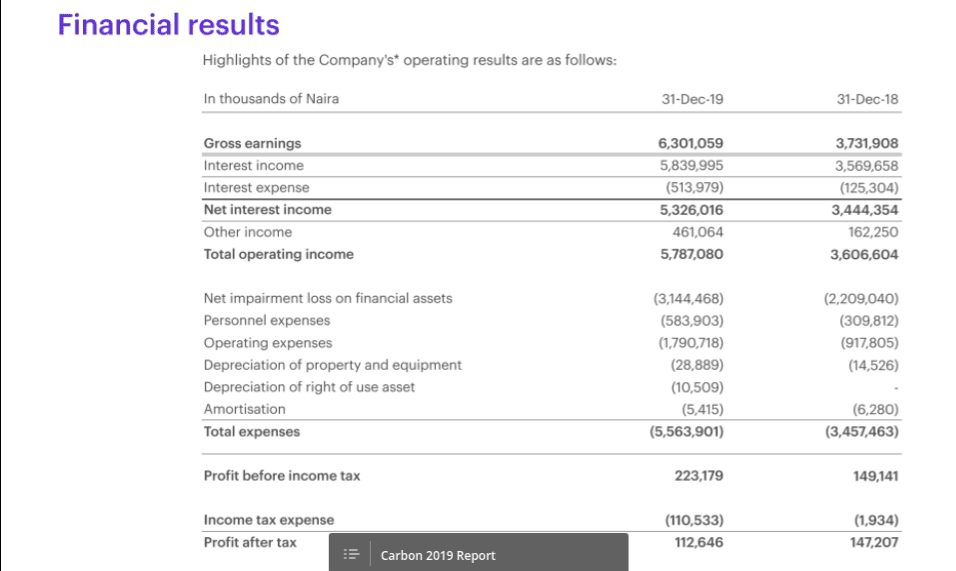

The Series-A stage company, which has raised up to USD 15.8 Mn since launching in 2012 and announced a USD 100 K startup fund earlier this year, also turned a “small” profit of NGN 112.6 Mn (USD 290.2 K) in 2019; less than the NGN 147.2 K (USD 379.3 K) it made in 2018.

It may not sound like a lot of money but that takes nothing away from the fact that Carbon is laying down the marker as a young fintech company with a Profit-After-Tax (PAT). Pretty atypical for fintechs at this stage, and this might suggest sustainable growth.

This was four months before One Finance and Investments Limited Nigeria (OneFi) acquired Nigerian payment solutions company, Amplify, for an undisclosed amount; about the same time the company obtained a credit rating as a pre-IPO venture. (Carbon is the operating brand of OneFi).

In its latest financial report, Carbon also claimed that its loan disbursement volumes have grown from NGN 3 Bn (USD 7.7 Mn) in 2017 to NGN 13 Bn (USD 33.5 Mn) in 2018 to NGN 23 Bn (USD 59.2 Mn) in 2019.

Additionally, Carbon’s bill payments value hit NGN 51 Bn (USD 131.4 Mn) in 2019 and the volume was 5.5 million. Investments on the platform reached NGN 2.8 Bn (USD 7.2 Mn). The startup claims 2019 was its best year yet, it was the same year it launched in the fintech fiefdom that is Kenya.

Although the economic impact of the pandemic has necessitated certain adjustments and it is likely to affect its business, the startup says it is moving forward with plans to launch virtual and physical debit cards this year, as well as a reward programme and a package for SMEs.

With Carbon, as an African startup, taking the unusual route of making its financial results public for the second year running, it is hoped that many more of the continent’s top tech ventures would eventually follow suit.

Such a move would breed more openness and build trust in a tech ecosystem that is generally reluctant to divulge meaningful in-house metrics.

Update: Carbon’s profit for 2019 was NGN 112.6 Mn and not NGN 112.6 K as earlier reported. Also, it’s profit for 2018 was NGN 147.2 Mn and not NGN 147.2 K.

Featured Image Courtesy: EndeavorNigeria