Will COVID-19 & The Pay-TV/VOD Marriage Blackout Cinema Screens In Africa?

In Africa’s bubbly video entertainment scene, there appears to be a coming together that many people would not have seen coming.

Despite having competing offerings in Showmax and DStv Now, Africa’s largest pay-TV company, Multichoice Group, has opted to link up with global video-on-demand (VOD) streaming platforms, Netflix and Amazon Prime Video.

Both were thought to be Multichoice’s rivals, but now they all appear to be allies. It’s kind of a win-win for everyone, except cinemas which have been shut since the pandemic struck.

Throw in the idea that streaming platforms, which are becoming increasingly popular and prominent in these parts, have all but linked up with the most popular and most-watched pay-TV in Africa. And there’s cause to worry that cinemas in Africa are in danger of seeing their screens go off.

These streaming platforms are investing heavily in originals and churning out premium exclusive content. Indeed, big-time filmmakers are even going ahead to premiere new releases on VOD platforms.

With cinemas still shut, it can be expected that many more moviemakers will consider the viewership on these platforms and opt to release new films on them, giving cinemas something to worry about.

The odds stacked against cinemas in Africa

MultiChoice is a South African company that operates the popular DStv Satellite Television service, a major satellite TV service in Sub-Saharan Africa. Born and bred in Africa, the pay-TV operator boasts a team of more than 2,750 individuals working in 15 countries and delivering content to millions of people in 49 countries.

Netflix, on its part, is currently available in nearly 200 countries (including 54 countries in Africa). The subscription-based streaming service which Reed Hastings and Marc Randolph first launched in the U.S. as the world’s first online DVD rental store, with only 30 employees and 925 titles available, has grown into a giant with 167 million subscribers globally and annual revenue of USD 15.8 Bn.

In recent times, Netflix has revved up its African affair with a particular interest in the prolific movie industry in Nigeria and the film industry in South Africa. In December 2018, Netflix announced plans to commission original series from Africa.

Already, Netflix has scored its first original African series in “Queen Sono” which was released on February 28 and has since been renewed for a second season.

In 2018, the streaming platform acquired worldwide rights to Genevieve Nnaji’s “Lionheart.” This acquisition was Netflix’s first original project from Nigeria.

Since then, the service has acquired several Nollywood movies and series including blockbuster movies like “King of Boys,” “Merrymen” and “Chief Daddy.” Netflix has also commissioned a Zambian animation series called “Mama K’s Team 4,” which premiered in April, and South African series – “Blood and Water.”

Most recently, Netflix announced a partnership with Nigerian producer, Mosunmola Abudu (AKA Mo Abudu), to adapt two Nigerian literary classics into series.

Data from Digital TV Research in London estimate that there are fewer than 1.5 million Netflix subscribers in sub-Saharan Africa, of which most are from South Africa.

Netflix has plans to grow its subscriber base in Africa to 5 million by 2025 and the company seems to have identified locally-sourced content as one way to go about it. On its part, Amazon Prime Video, which is available in nearly as many countries as Netflix, is trying to catch up.

Analysts predict that the market for streaming in sub-Saharan Africa will surpass USD 1 Bn by 2024. For perspective, that figure was just USD 223 Mn as recently as 2018.

With internet connectivity becoming cheaper and better around the subcontinent, VOD platforms are starting to thrive. And by merging pay-TV with VOD, a winning combination is on the cards.

And where does this leave cinemas?

Africa’s cinema culture has started to pick up in recent years after a protracted malaise. For perspective, as recently as 2015, there were no cinemas in Cameroon, and filmmakers who really wanted to get stuff done could only get their movies across to audiences through DVDs.

That reality was true for many African countries where cinemas had disappeared abruptly after becoming part of life in the 1960s and 1970s. Indeed, Cameroon’s capital city, Yaoundé, was home to up to seven cinemas in the 196os. But they were all forced out of business due to a combination of economic constraints and the emergence of the cheaper home video alternative.

Cinema chains started to return in several countries in the mid-2000s but that progress has been lopsided.

Whereas a country like South Africa boasts a good number of movie theaters and riding on the “Nollywood effect,” Nigerian entrepreneurs have begun to breathe new life into the country’s homegrown theatres, regions like Francophone Africa are lagging way behind.

On the whole, despite the fact that cinemas have become more popular on the continent and there are now a lot more cinemagoers upping cinema spending, there is still a huge void.

“Can you guess how many cinemas in the whole of Africa? Less than 1,000! That’s less than one cinema per million people,” claims this 2017 article. That year, there were 169,198 cinema screens globally, according to Statista. That means fewer than 1 percent of the world’s cinema screens were in Africa as of 2017.

The most recent statistic suggests that as of 2019, over 195,000 cinema screens are available worldwide. Yet, in a country of around 200 million people like Nigeria, there are currently under 100 cinemas.

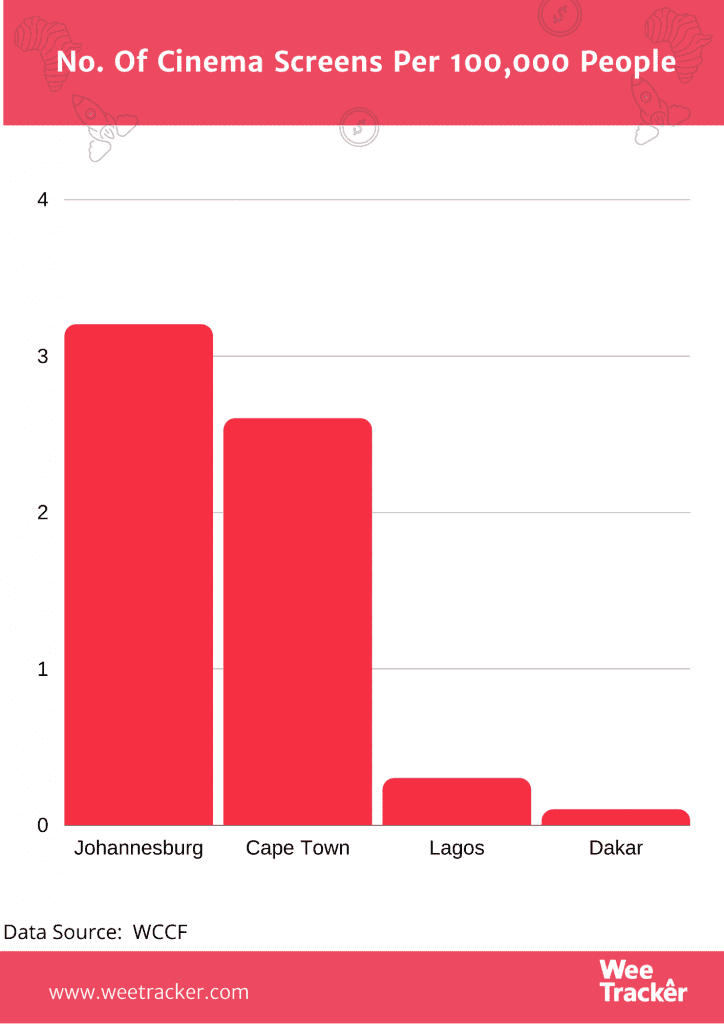

Another data source has it that for every 100,000 people in Lagos, Cape Town, Johannesburg, and Dakar, there are 0.3, 2.6, 3.2, and 0.1 cinema screens respectively — the lowest figures globally.

More context: In one night in China, the popular Black Panther movie made more than twice what it made in the whole of West Africa. A staggering poverty level, a small middle-class, and shrinking disposable income are some of the factors thought to be holding back cinema culture in Africa.

At the moment, cinemas are not working due to restrictions around the outbreak of the novel coronavirus.

Now, pay-TV, which is a lot more popular around the continent, is teaming up with VOD which is riding on increased broadband penetration and cheaper internet to gain a foothold in Africa. And cinemas will probably be feeling threatened.

Featured Image Courtesy: QuartzAfrica