Madagascar’s New Commercial 5G Was Built By Ericsson, Not Huawei

Much of Africa’s commercial 5G development has been made possible by partnerships with Huawei Technologies, the Chinese company that builds both fifth-generation networks and mobile phones. Its dominance in the market is about to change, however, as Sweden’s Ericsson built the new 5G infrastructure in key parts of the continent.

Faith In Huawei

Despite security-related tussles with the United States, partly because it is a Chinese-born technology company, African governments have more or less shown faith in Huawei. From Kenya to South Africa, African leaders have no problem partnering with the telecoms equipment maker, perhaps not sharing the same concerns hampering the company’s opportunities in many western markets, not just America. Though not statistically confirmed, there is reason to believe that the Shenzhen-headquartered multinational already has up to 70 percent share of Africa’s 5G market.

Rain 5G, the data-only service provider responsible for Africa’s first 5G rollout, partnered with Huawei to launch the network in South Africa, in 2019. Rain’s 3.6GHz spectrum adopts Huawei’s 5G end-to-end network products and terminals, enabling the Rainbow Capital-owned operator to build a cost-effective network and limit the required additional sites, yet still providing comprehensive coverage. Rain is also cooperating with Wits University and Huawei to establish a 5G Innovation Lab at the Johannesburg university.

Before now, South Africa and Lesotho were the only two places where 5G was available in Africa. In partnership with Huawei still, Vodacom South Africa has the fifth-generation network in these two neighboring countries. Actually, Vodacom claims to have launched Africa’s first commercial 5G fixed wireless access (FWA) network in Lesotho. At the point, it revealed that the technology was ready for deployment in South Africa when the spectrum is assigned.

To East Africa’s telecoms sector lies the region’s most valuable company, Safaricom—who also appears to have no problem partnering with Huawei bringing 5G to Kenya. Earlier this year, the telecoms operator suggested that the demand for more bandwidth and more speed offsets the spat the United States and its European allies have with Huawei. We will use Huawei in 5G. What will we do in terms of the American statements about not using Huawei? We don’t have that situation in Africa, Acting CEO Michael Joseph said.

Ericsson’s Entry

Huawei is not the only builder of 5G infrastructure in the world. Apart from Ericsson, who has now entered the African market, there are Altiostar, Cisco Systems, Datang Telecom/Fiberhome, Nokia, Qualcomm, Samsung, and ZTE. More importantly, there is now 5G elsewhere in Africa—Madagascar—and, this time, Ericsson is the one whose technology forms the groundwork. Telma Madagascar chose the Swedish firm last October, but the 5G was switched on only a few days ago, with two critical use cases: enhanced mobile broadband (eMBB) and Fixed Wireless Access (FWA).

Interestingly, Telma Madagascar is not the first mobile operator in Africa to be patronizing Ericsson. A few days ago as well, MTN South Africa finally joined the race to expand 5G across major South African cities, with the help of the same builder. Added to providing end-to-end 5G capabilities, Ericsson has been chosen to modernize MTN South Africa’s existing LTE and legacy radio access networks as part of a three-year deal signed in 2019.

With Telma’s launch in Madagascar, Ericsson now has 41 live 5G networks in 24 countries across the world. Its live networks are part of the 95 commercial 5G agreements or contracts the company has with operators globally, of which 55 are publicly announced 5G deals. Under the agreement with Telma, Ericsson will provide core network expansion, network optimization services, and software upgrades of both Telma’s core and the radio access network. This is just the starting point for the Stockholm-based multinational in Africa, but it sees a continuous deployment of more network infrastructure in the coming years.

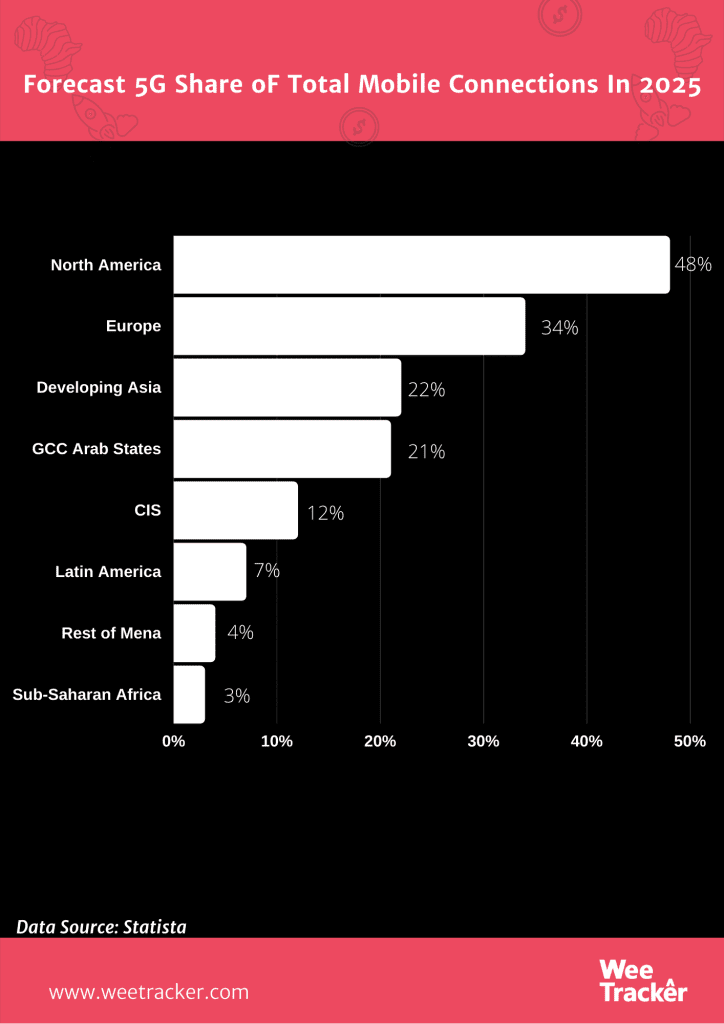

According to Ericsson’s Mobility Report, by 2025, Sub-Saharan Africa’s mobile broadband subscriptions will increase to around 70 percent of mobile subscriptions, with increased 4G coverage and uptake as the main engines. Driving factors behind the shift include a young and growing population and the availability of lower-priced smart and feature phones. Only time will tell of the million-dollar tussle to tap the market will continue to be between Ericsson and Huawei, or whether other players would join.

Who’s Winning So Far, Elsewhere?

Africa’s commercial 5G is still taking baby steps compared to what is already the norm in the western part of the world, where all telecom equipment builders are in an unending fifth-generation tug of war. While the tussle has just started out in the continent, the face-off between Huawei, Ericsson, and Nokia is rocking the globe’s 5G market. Huawei may be the heavyweight champion in Africa, but it is gradually being blown out of the water by its rivals, a situation that is probably fuelled by its odd relationship with the United States and its diplomatic retinue.

So far, Ericsson seems to have the upper hand. In a USD 80 Bn-a-year cellular equipment industry, the Swedish company is emerging as the steadiest player. This is because the firm makes a technically advanced product that Huawei may not be able to make in future due to its cold war with America. Nokia Corporation was also late to develop the kind of 5G products Ericsson thought of and rolled out. To finally break the ice, Washington is lobbying foreign countries to ban Huawei, saying Beijing could direct the company to spy on or sabotage communications.

In Singapore, Huawei lost the 5G belt to Ericsson and Nokia, an occurrence similar to what happened in Canada’s telecoms industry. Germany’s Telefonica Deutschland also favored the Swedish company over the Chinese counterpart, a choice it says will safeguard the next generation of mobile phone and network users. Nevertheless, it is no secret that Ericsson is facing some financial troubles. Meanwhile, Huawei’s balance sheet continues to experience steady sales growth. That means, Ericsson will have to turn the ship towards profitability and growth waters, to make good on the existing favor over Huawei.

Photo by Avi Richards Via Unsplash.