Is This Telco The Final Answer To The Disgruntling Internet Rates In Africa?

Africa’s generally poor internet penetration rate remains a huge concern to those whose livelihoods are hinged on the internet itself. Being a crucial factor to economic and technological development, more and more people need to have access to a steady and strong source of connectivity, more internet service providers need to emerge with higher and constant speeds.

In as much as the number of Africans connected to the internet is rapidly on the rise, the internet speeds across the continent are still below the global minimum standard.

The Real Problem

In countries with the slowest internet speeds, it could take up to 24 hours for one to download an HD film of, say, 7.5 GB. According to a report, most of the countries with the poorest internet penetration are in Africa. But that’s not the only problem, because the region has one of the most expensive connectivity packages in the world.

Depending on location, buying just one gigabyte of data from an ISP could put a USD 35.00 hole in one’s pocket. Not much progress has been recorded to match the rapidly spiking smartphone penetration, and findings from different reports confirm that affordable internet is still out of the reach of too many Africans to ignore.

According to an Alliance for Affordable Internet (A4AI) report, only 24 of 60 studied low and middle-income countries met the UN Broadband Commission’s target of affordable data gigabyte below a cost of 2 percent of average monthly income.

In the global countries considered in this report, it was discovered that users pay no less than 5.5 percent of their monthly income purchasing just a gigabyte of data. This problem was found to be more serious in Africa than anywhere else, where users in the region literally pay the most for mobile data relative to an average monthly income.

In what was a similar find by Ecobank Research, their study revealed that Africa’s mobile data is the most pricey, in both real and income-associated terms.

A single gigabyte of data in internet-expensive countries such as Zimbabwe, Swaziland, and Equatorial Guinea, according to the report, costs more than USD 20. Africa’s at-large estimation is at USD 7.04, with most of the countries selling data at prices beyond the UN Broadband Commission’s target of 2 percent of monthly income.

Another extractable information from the report is that data prices in countries with more than one local internet service providers are usually low due to the competition.

Nigeria is a good example, where MTN, Globacom, Airtel, and Etisalat are in something similar to a tug-of-war to get the most internet subscribers from connected citizens of the West African country. The price of one gigabyte of data in countries with only two networks is higher, but at a low in markets where up to three or four networks are competing rivals.

Hope For Connectivity?

February this year, a new mobile operator launched, bringing hopes of a more affordable internet not just for the country, but the entire continent. Rain, the continent’s first 5G network, was rolled out at Mobile Network Congress, and it offers data-only SIM cards that have more or less become a disruptive force in a country that suffers from skyrocketing mobile data costs.

The internet provider which operates in all the major metropolitan areas with 3,000 towers, offers its services with intentions to have 5,000 of such towers in the next two years.

Fifth-generation connectivity is something that is still vague to even many developed countries of the world. Yet, this Southern African mobile player partnered with leading global ICT solutions firm Huawei to “give Africa an opportunity to leapfrog in technology.”

The continent’s internet connection speed is most known as 3G and 4G, even as some of the countries in the region prepare to roll out their own fifth-generation facilities to be more strongly connected to the web.

In S.A, Rain offers an unlimited data package of USD 18.00 per month, with exceptions only for the company’s peak hours of 6 PM and 11 PM. The data provider’s other packages cost USD 3.60 per gigabyte, which neither expires nor does it require a contract.

Well, to a very significant extent, this offer is a great one for the country, where data costs are not just over the bar, but as well entwined with contracts that do not live past the end of a month. Never mind that the pricing for data bundles is usually too opaque for comfort.

The largest network in South Africa, Vodacom, was in the thick of social media scorching just after announcing that it would charge South Africans to roll over data on a sliding scale, depending on the amount.

Per figures announced, the development meant that internet subscribers would pay USD 3.50 to make use of their data package in a subsequent month for a 1-gigabyte bundle which costs USD 10.00. Perhaps due to the backlash that trailed the announcement, Vodacom backtracked on the fees, but the packages, according to the firm, will be rolled over only if users purchase the same package the following month.

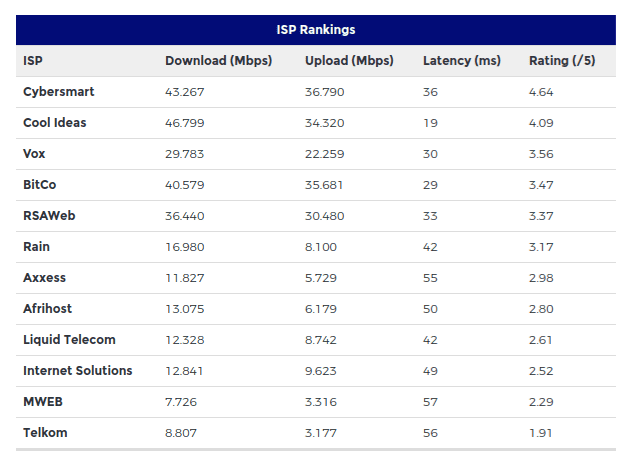

According to a speed test and ISP rating conducted by MyBroadband for Q3 2018, Cybersmart is the top-rated fiber and ADSL service provider in South Africa. Per Q3 2018 data, the average download speed in South Africa was 15.35 MB/s, while the average speed was 11.09 MB/s.

Cybersmart debuted with something that sparked competition among ISP firms in S.A, a move which preceded a huge cut in price by the company on its uncapped fiber-to-the-home (FTTH) products, offering one of the most competitive prices in the country. With an increased speed of its products from 400 MB/s to 500 MB/s for no added costs, the internet provider is poised for even greater penetration to further its advantage in Q4.

How It’s Made

Data networks often tend to be at their peaks of activity during the hours 6 PM to 11 PM. Rain said: “Given that we have ’empty seats on our plane’ during off-peak hours, we can offer customers a very good deal at these times. We think our offering is financially sustainable and provides exceptional value. This is particularly true for folks that have access to alternatives during peak times.”

5G-supported phones are still on their way, but when they do hit the continent, Rain chair, Paul Harris, said at the launch of the initiative that a “big tsunami will hit us when devices become available at the end of the year. 5G will promote economic growth in our country, and it will promote it in the world.”

On his part, Rain Group CEO, Willem Roos, said that the company is in a second-to-none position because it has the capacity to leverage its current 4G network to roll out the said 5G in “a rapid and cost-effective way.”

There are many high-value global telecom markets in places like the United States and Australia who have expressed interest to work with Huawei on 5G, in the wake of perceived relationships between the company and the Chinese government.

One of the largest mobile network operators in Switzerland, Sunrise, is currently looking to launch its commercial 5G services, in partnership with Huawei too. While some countries have banned Huawei outright, it has added the Swiss operator to its Rain win to leverage on the possibilities of creating a more connected world.

A more digital and connected Africa is the hope and dream of many in the region, from big corporates to mid-sized companies and most especially the region’s Small and Medium-scale Enterprises. Individuals are also users, particularly as tech jobs are on the rise. Internet penetration in Africa is better than it used to be, at least for a country such as Nigeria which plans to roll out 5G in 2020. While incredible internet comes at a very uncomfortable rate in some parts of Africa, the cuts – which often is as a result of competition – are highly expected.