Uchumi, A Kenyan Homegrown Retail Brand, Is Still Struggling With Debt

The fall of Nakumatt has to be one of the best-known sagas in the Kenyan retail landscape, as well as that of East Africa as a whole. But while the curtain is gradually drawn on the former retail giant’s stage play, another homegrown brand is struggling with similar problems.

Uchumi, a Nairobi Securities Exchange-listed firm, has been given a 6-month ultimatum to settle its debt of KES 4.7 Bn, a more than USD 44 Mn sum it owes to over 100 suppliers. Arguably one of the largest retailers in the East African nation, the brand has to pay this or face auction of its assets by creditors and possible real estate eviction.

Last week, it got a reprieve from the High Court ad the judicial body marked an insolvency petition against the retailer as settled and withdrawn. This followed an out-of-court deal with Uchumi’s suppliers. In spite of opposition, especially from the UBA Bank, the court allowed the implementation of a Company Voluntary Arrangement (CVA) which was agreed to by 121 suppliers back in March (2020). Under this, the business’ creditors will have to take a loss of 70 percent on amounts owed to them. Meanwhile, the retailer is expected to set up a committee to ensure timely payment of debts.

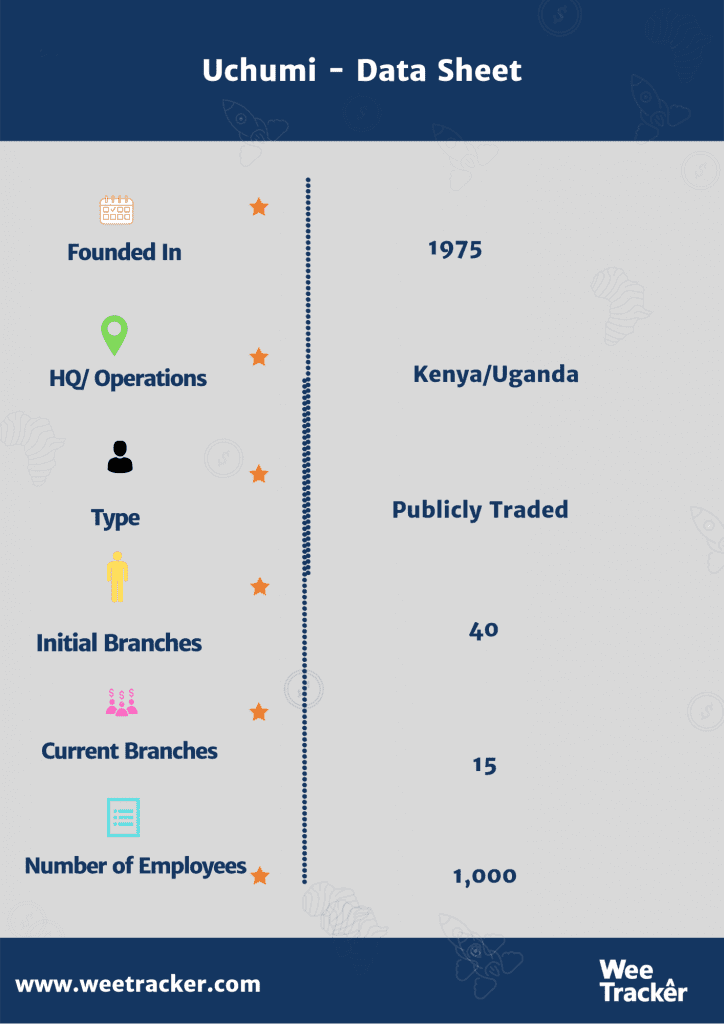

Established in 1975 to open outlets for the distribution of commodities and create retail for Kenyan manufacturers, Uchumi is a supermarket which grew to become one of Kenya’s most-told retail success stories. Nevertheless, for a retailer who was once delisted from the Nairobi Securities Exchange (NSE) and temporarily closed down in 2006, there is much to go by as apart from its current cash-strapped situation.

The highest point of the debacle appears to have been in June 2015 when the retailer gave its chief executive the boot for alleged gross misconduct and a audit which covered the loss of funds obtained through a rights issue. Subsequently, a mass exodus on unpaid suppliers turned the company’s shelves into empty platforms, even as its losses mounted.

There was an attempt to turn things around for Uchumi, but the plans stalled, leading to the hiring of another CEO, Julius Kipng’etich, albeit reviving the chain. But it does seem that most of its plans have fell through, because the business is yet to heave a sigh or relief. In November 2019, Uchumi was granted leeway by commercial banks who agreed to write off and restructure a debt settlement plan of outstanding debt. At the very least, this was meant to aid its recovery plan and enable it return to normalcy amids pressure regarding payment obligations.

To finally break the ice, Uchumi owed its creditors and suppliers more than 36 Mn, a figure way above the June 2018 value of its assets, USD 13 Mn. Translation: even if all the retailers assets are sold, it will still have to dig into other sources to augment what is needed to clear its debt.