Africa’s Largest Wireless Tower Operator Is Planning Africa’s Biggest American IPO

IHS Holdings, a network infrastructure provider with a primary focus on Africa, has come back to the fore with its listing plans in the United States.

The wireless tower operator, as such, is planning what could be the biggest ever Initial Public Offering (IPO) on an American stock exchange.

Having selected Citigroup and JPMorgan Chase as it global coordinators for the listing in February, the company has now updated plans on a possible USD 7 Bn share sale.

Nevertheless, IHS flagged the listing last week Friday (August 14) that the number of shares to be offered and the price range of the listing remain undetermined.

This is the second time the tower operator is reviving its IPO plans. The intention first came to the surface in 2018, but they were scrapped as a result of the uncertainty that beclouded presidential elections in Nigeria, IHS’ main market.

Perhaps due to the coronavirus pandemic, nothing tangible could be gathered from the company since February when the plans resurfaced.

In just 2 decades since the firm was founded, IHS Holdings has grown to become the most extensive tower business in Africa, having over 23,000 towers in 4 countries in the continent.

Crunchbase data indicates that the company has raised up to USD 652 Mn in funding since its inception, coming from 7 different investors.

In 2019, IHS got USD 1.3 Bn from debt markets to fuel its expansion drive for its tower network after recently buying portfolios from MTN and Etisalat—2 of Nigeria’s biggest mobile operators. Its expansion, both in existing and new markets, is based on the relatively low mobile penetration rates in Africa.

With this IPO, most likely on the New York Stock Exchange where some of the largest tower companies are based, IHS Holdings would raise just about enough markets to turbocharge its operations in Africa.

If this goes according to plan, the USD 7 Bn IPO will surpass that of its immediate rival, Helios Towers.

Another bigwig telecoms tower leasing firm operating in Africa, Helios went public on the London Stock Exchange (IPO) in 2019, where it raised USD 364 Mn at a valuation of around USD 1.5 Bn. The towerco has already started its expansion drive in the continent, but has run into a slight problem in Ethiopia were it was revving its engine.

Nevertheless, if there is anything learnable from the two most noteworthy foreign listings in the African tech ecosystem, those of JUMIA and Interswitch, it is that African IPOs—especially the international types—do not always go according to plan. What’s more, Wendel, Goldman Sachs and South Africa’s MTN are shareholders at IHS.

IHS Holdings is believed to be the largest mobile telecoms infrastructure provider in not just Africa, but also Europe and the Middle East in terms of tower count.

It is also the third-largest independent multinational tower company in the world. Sam Darwish founded the company in Lagos, Africa’s largest city, in 2001. It has acquired 3 organizations, the most recent being Cell Site Solutions on December 23, 2019.

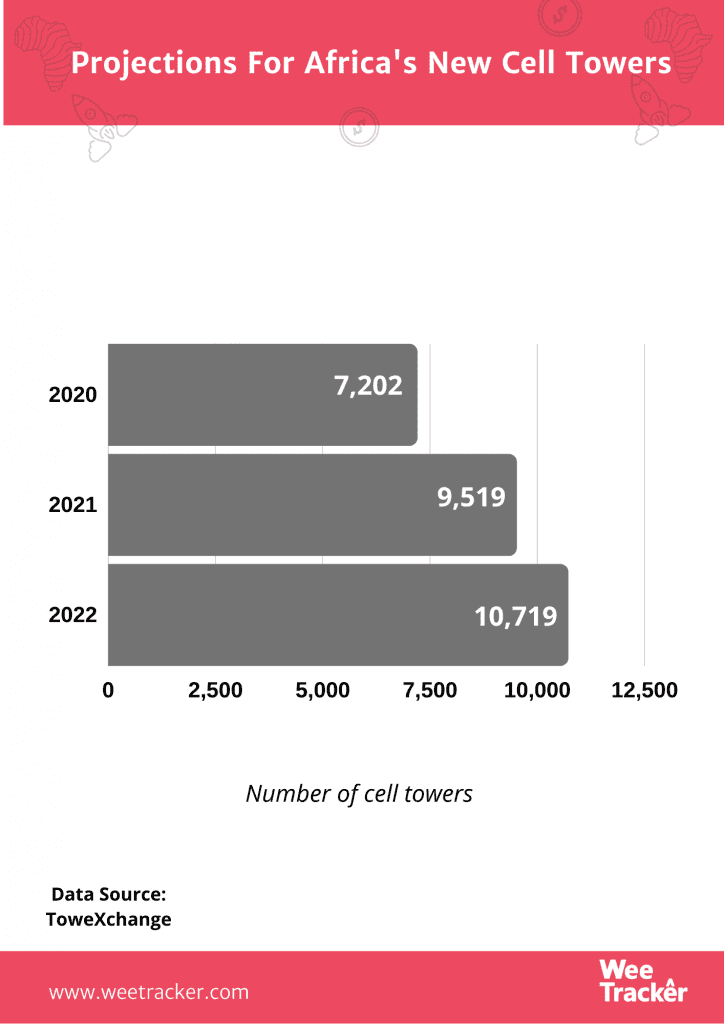

Due to the facts that a good number of customers are yet to own a mobile device and join the transition to advanced network technologies like 4G, the growth potential for tower operators remains firmly stood in Africa. In May 2019, Eaton Towers, another Africa-focused towerco, got acquired for USD 1.85 Bn.

Featured Image: Miga.org