Ethiopia Has Blacklisted Foreign Telecom Infrastructure Vendors Amidst Liberalization

Ethiopia’s move to privatize a significant portion of its telecoms industry was both historic and applauded. But the move to sell a stake in state-owned Ethiopia Telecom and let down the wireless carrier veil in invitation to interested telcos has taken a sudden twist. Foreign telecom infrastructure vendors are no longer part of the picture.

Not So Liberal After All?

Ethiopia is one of the last remaining monopolies in the world. In 2019, it announced that it would allow 2 new service providers to enter the East African country, while selling a 40 percent stake in incumbent Ethio Telecom.

The liberalization process saw the Ethiopian Communication Authority (ECA) receive bids from a number of telecom and telecom infrastructure companies interested in the space.

Mobile operators like Orange, Safaricom and Vodacom, in a company of 12, are vying to have a share, while a telecom infrastructure company like Helios Towers is looking to provide the needed infrastructure to aid the expansion of wireless reception.

While things appear to be going as planned on the telco side of the development, the telecom infrastructure part of its has come to an abrupt complication.

Ethio Telecom has complained to the Ethiopian government that it has invested heavily in telecom infrastructure over the past years, facing the threat of all going down the drain if the likes of Helios Towers are allowed to foray into the landscape.

In response, the Ethiopian government has already banned foreign telecom infrastructure firms, in what could be an ironic twist of a “liberalization” effort.

Stiff At The Start

Building new telecom infrastructure and renting it out to telcos who finally win the Ethiopian license was all part of the plan, at least for Helios Towers, a United Kingdom-based towerco whose presence in Africa cannot be undermined.

The towerco was optimistic about entering the country at the best possible time, having set aside USD 364 Mn from its USD 1.45 Bn London IPO in 2019. The company also raised about USD 1 Bn from debt markets, to have just enough gravy to kick off its African expansion by acquiring more towers.

Nevertheless, Ethiopia is but one part of Helios’ African expansion. The tower firm’s other destinations are Morocco, Egypt, and Madagascar—3 countries that happen to have some of the continent’s fastest internet speeds.

For now, the Ethiopian government has decided to leave a de facto monopoly in place as regards telecom infrastructure provision. The ban means only Ethio Telecom will be allowed to rent or sell towers, cables, and kits among others, except incoming carriers decide to get theirs themselves.

“We have built sufficient telecom infrastructures like fibre cables and mobile base masts that we can rent it to the newly entering companies. So the incoming telecom operators will either use our existing infrastructure by renting or build their own,” Ethio Telecom chief executive Frehiwot Tamiru told media on Thursday.

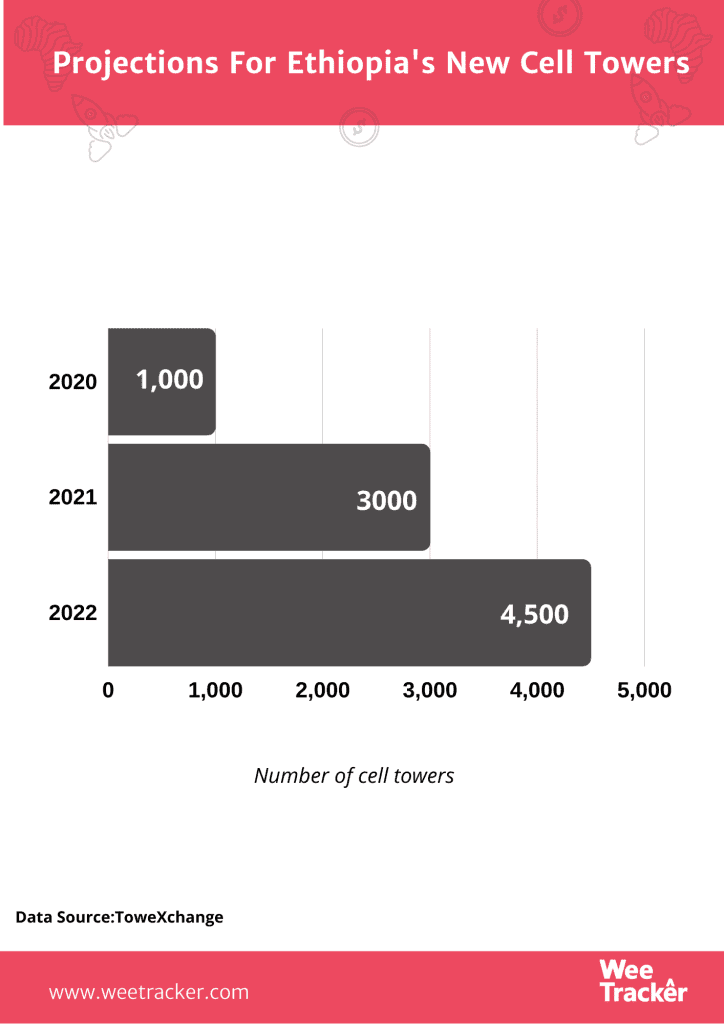

In preps to remain competitive even after liberalization, Ethio Telecom split its network infrastructure department in five, creating different divisions to ensure the efficacy of service. The operator hopes to generate income by renting out 7,100 of its towers and more than 22,000 km of fibre optics to interested entrants.

Implications

While the ban on foreign telecom infrastructure companies partially cripples the million-dollar expansion of Helios and possibly the confidence of non-Ethiopian and non-African mobile operators, it also points to Ethiopia’s longstanding restriction habit.

Conversations around the matter point to Ethiopia’s internet shutdowns. 5 times in 1 year is enough to show the adverse effects of a closed telecoms space. There were hopes as to the possibility of new entrants—whose strings can’t be easily pulled—reducing the number of web blackouts in the country.

The liberalization of the country’s telecommunications infrastructure—albeit limited to local companies—nonetheless, could affect how closely tied it is to government.

The bid for telecoms licenses among carriers is still ongoing. But the new ban may have shaken the process, at least a little. There’s no telling to what extent it will impact the telcos bidding for the licenses and how it will change perceptions.

The liberalization process continues to move slowly. But the fast-growing Ethiopian market is reason enough for interested companies to press on.

Featured Image: Les Corpographes Via Unsplash.