The Rightsizing Of A Troubled SA Telco Puts 546 Jobs On Chopping Block

The many troubles of South Africa’s third-largest telecom player, Cell C, is well-documented. And the latest installment of the struggle tale has it that the beleaguered telco is shedding quite a sizeable portion of its workforce.

Cell C has now revealed plans to shutter more than half of its retail stores throughout South Africa and this will come with job cuts. Up to 128 of Cell C’s 240 retail stores have been earmarked for closure and 546 jobs are on the chopping block.

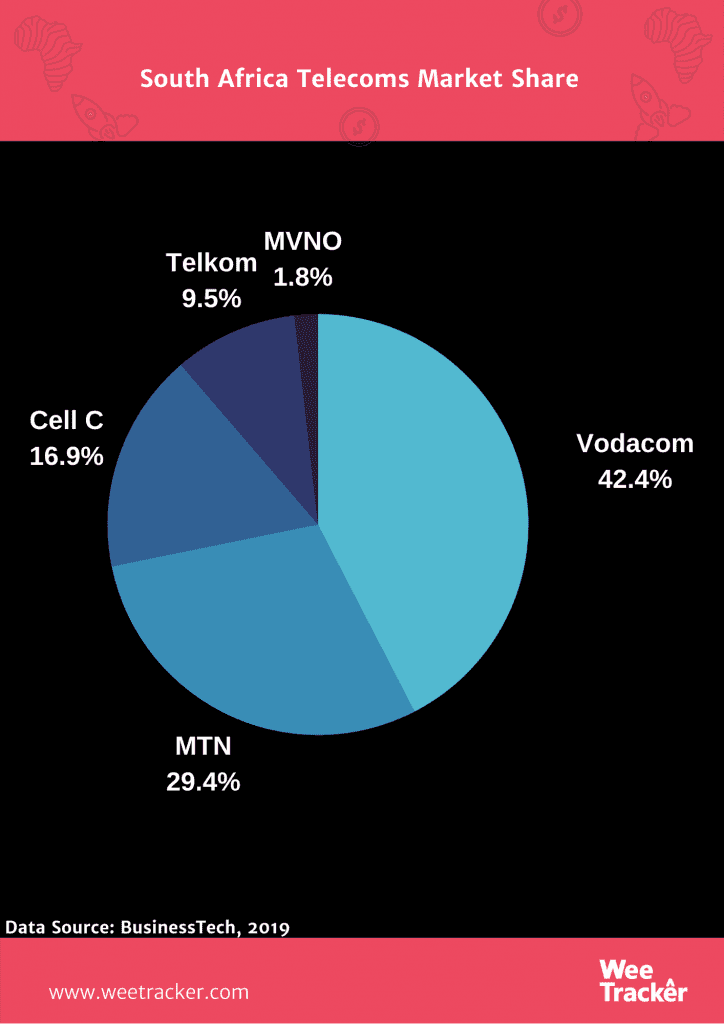

Mobile operator Cell C has struggled to keep up with industry frontrunners since arriving in South Africa 19 years ago. During that time, the telco has struggled to make a strong business case despite building a subscriber base that constitutes 16.9 percent of South Africa’s telecom market as of 2019 — only bettered by Vodacom (42.4 percent) and MTN (29.4 percent).

Cell C has been a business in distress for a number of years, crumbling under the weight of mounting debt. The mobile operator may have fancied a reprieve back in 2017 when JSE-listed firm, Blue Label, became the telco’s largest shareholder after the acquisition of a 45 percent stake.

But the dramatic resurgence that would have flipped the script didn’t quite materialise. Cell C’s financial challenges have proven to be a difficult task to manage, such that Blue Label took the decision to fully write off its investment in the firm in May 2019.

Cell C’s recapitalisation in 2017 included a ZAR 5.5 Bn (USD 388 Mn) buy-in from Blue Label, while Net1 UEPS Technologies bought a 15 percent stake for ZAR 2 Bn (USD 141 Mn). The recapitalisation cut the company’s debt from ZAR 20 Bn (USD 1.4 Bn) to around ZAR 6 Bn (USD 423 Mn).

Cell C’s debt levels have now climbed back up to around ZAR 9 Bn (USD 640 Mn) and it is understood to be attempting to secure new funding from a group of investors.

Last December, Cell C’s interim CEO, Douglas Craigie Stevenson, opened up publicly about the “financial and other challenges” the mobile operator is battling in an open letter to the media.

In the said letter, he mentioned that the operator had hired legal and financial consultants to probe Cell C’s business practices and advise on a restructuring. Stevenson also revealed a rightsizing of Cell C was imminent as they had implemented “significant austerity measures” and a hiring freeze.

Some talk of Cell C being taken over by the smaller but seemingly revitalized state-owned telecoms player, Telkom, was also mooted but the much-anticipated deal fell through. Telkom did reveal that its takeover bid for Cell C had been rejected, and it had something to do with Cell C expanding a roaming agreement with MTN Group.

Since then, Cell C has gone about rejigging its operations in an attempt to salvage the business.

Earlier this year, senior management positions were aligned to Cell C’s revised operating model and new organisational structure. This process was completed in May and resulted in 30 redundancies.

In June, the company said it had kickstarted a consultation process under the Labour Relations Act (LRA) that would probably send 960 employees (or nearly 40 percent of its workforce) packing. This retrenchment will hit junior management and semi-skilled staff and the company has now expanded this process to include its retail store network.

According to reports, the decision to decrease its retail store footprint is tied to evolving trends in retail, partly shaped by the pandemic. It’s also understood to be part of a broader effort to adjust to a more efficient and competitive model.

Featured Image Courtesy: Moneyweb