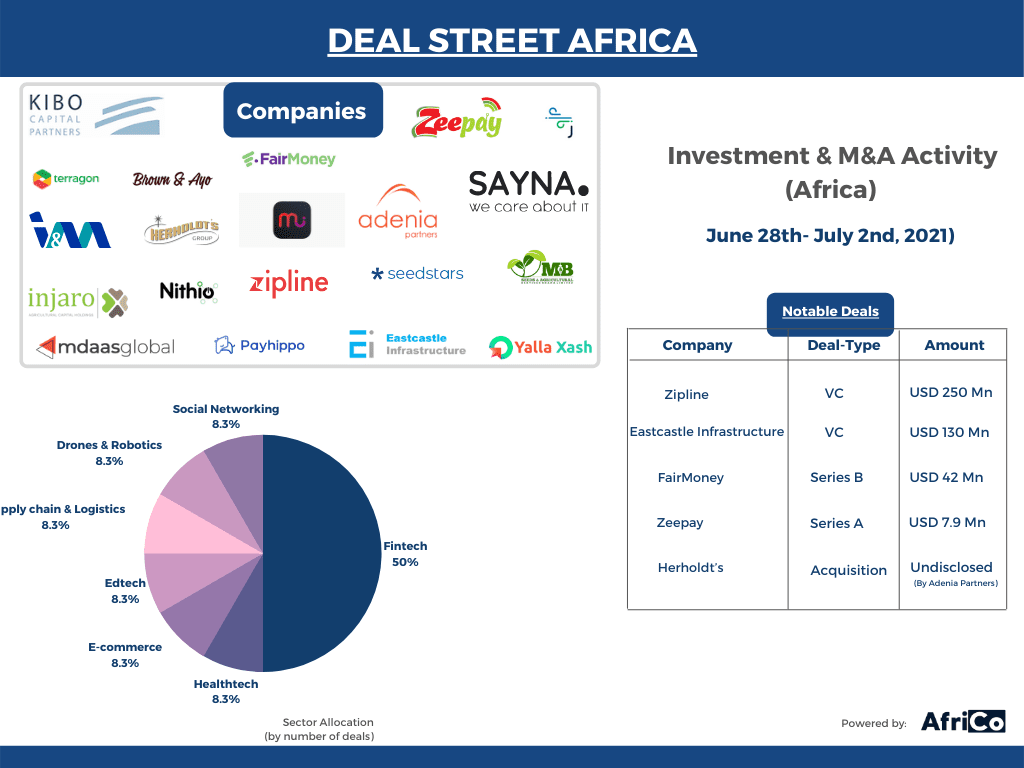

Deal-Street Africa [June 28- July 2]: Fintechs Take The Funding Spotlight

![Deal-Street Africa [June 28- July 2]: Fintechs Take The Funding Spotlight](https://weetracker.com/wp-content/uploads/2021/07/JULY.png)

Egyptian Startup Minly Raises USD 3.6 Mn Funding

Minly, an Egypt-based creative economy platform, closed a USD 3.6 Mn seed round to allow stars across the MENA region to connect with their fans in a real, personalized way. The round was led by 4DX Ventures, B&Y Venture Partners, and Global Ventures. The round also included participation from unnamed regional funds and angel investors like Scooter Braun, founder of SB Projects; Jason Finger, co-founder of Seamless and GrubHub; Anthony Saleh and Jeffrey Katzenberg of WndrCo; Arieh Mimran of Groupe Mimran; and Tamim Jabr.

Seedstars Africa Ventures Secures Commitment From LBO France

Seedstars Africa Ventures received a commitment from French private equity firm LBO France towards its USD 100 Mn fund for early-stage African tech startups. Seedstars partnered with the Paris-based VC firm First Growth Ventures to launch the fund in 2019. LBO France has provided EUR 6.3 billion (USD 7.5 Mn) for the fund. The fund focuses on financing innovative companies operating in Sub-Saharan Africa in seed and Series A rounds.

Nithio FI Receives USD 4.5 Mn Investment From FSD Africa Investments

Nithio FI, an AI-enabled financing startup that intends to standardize credit risk assessments and attract further capital to the sector, received a USD 4.5 Mn investment from FSD Africa Investments (FSDAi), the investment arm of FSD Africa, to scale its off-grid energy access.

Kibo Capital Partners Exit I&M Bank Rwanda

Kibo Capital Partners announced the completed sale of its 6.01% stake in I&M Bank Rwanda (IMR), the second-largest bank in Rwanda. The acquisition was made in April 2017 by The Kibo Fund II LLC as part of the bank’s successful IPO. This exit marks the first full exit of The Kibo Fund II LLC.

Injaro Strikes An Exit From Ghana’s Maize Seed Producer M&B

The impact investment fund managed by Injaro Investments, Injaro Agricultural Capital Holdings Limited (IACHL), sold its 30% stake in seed producer M&B Seeds and Agricultural Services Ghana Limited (M&B) to the founder and other shareholders. After a ten-year holding period, this share transaction reflects a complete exit from M&B. The financial details of the transaction were not disclosed.

Adenia Partners Acquires Majority Stake In South Africa’s Herholdt’s

Adenia Partners, a private equity firm focusing on Africa, acquired a controlling share in Herholdt’s, a renowned South African distributor of low-voltage electrical and solar equipment. The transaction’s financial specifics were not disclosed. The main advisors on the deal were Andrew Bahlmann and Nicolas Souvaris from Deal Leaders International.

Malagasy Edtech Startup Sayna Raises Funding From I&P, Miarakap

Sayna, a Malagasy edtech startup, raised funds from I&P Acceleration Technologies, a program dedicated to African digital startups led by Investisseurs & Partenaires (I&P), and Miarakap, an impact investment firm to increase access to its training program and launch additional platforms.

Ghanaian Startup Jetstream Closes USD 3 Mn Seed Round

Jetstream, a Ghana-based startup, closed a USD 3 Mn seed round. The round included local and international investors such as Alitheia IDF, Golden Palm Investments, 4DX Ventures, Lightspeed Venture Partners, Asia Pacific Land, Breyer Labs, and MSA Capital.

Ghanaian Fintech Zeepay Raises USD 7.9 Mn Series A Funding Round

Zeepay, a Ghanaian fintech startup, raised USD 7.9 Mn in Series A funding to help it expand. Its Series A round is a combination of equity and balance sheet funding to support its operations and was led by I&P, which invested in USD 3 Mn and supported by ARK Holdings, which contributed USD 800 K. GOODsoil VC made a USD 800 K follow-on investment, while Zeepay raised an additional USD 3.3 Mn in debt capital to support balance sheet activities, primarily for liquidity. Absa Bank Ghana spearheaded the initiative and supported by First National Bank Ghana.

Nigeria’s MDaaS Secures USD 2.3 Mn Seed Extension

MDaaS Global, a healthcare company based in Lagos, raised USD 2.3 Mn from investors, including Newtown Partners, Imperial Venture Fund, and the CRI Foundation. FINCA Ventures, Techstars, and Future Africa are among the existing investors who took part.

Drone Delivery Startup Zipline Raises USD 250 Mn Funding

Zipline Inc., a drone delivery startup, raised USD 250 Mn in funding to expand its operations in Africa and the US. The funding round was led by Baillie Gifford and supported by returning investors Temasek and Katalyst Ventures and new investors Fidelity, Intercorp, Emerging Capital Partners, and Reinvest Capital.

Morocco’s Fintech Startup Yalla Xash Secures USD 675 K Funding

Yalla Xash, a Moroccan fintech startup, secured MAD6 million (USD 675 K) from Maroc Numeric Fund II. Yalla Xash currently operates on the North America-Morocco line and plans to expand to other corridors in the coming months with the new funding.

South Africa’s Brown & Ayo Receives USD 280 K Investment

Brown and Ayo, a black hair care and lifestyle business based in Cape Town received an R4 million (USD 280 K) investment from Enygma Ventures. The investment aligns with the venture capital firm’s continuous aim to help women entrepreneurs in the SADC region. The funding will allow the startup to scale across Africa and internationally.

Nigerian Fintech Startup FairMoney Raises USD 42 Mn Series B Funding

FairMoney, a Nigerian microlending startup, raised USD 42 Mn in a Series B round led by Tiger Global, a US hedge fund and investment firm. DST partners, Flourish Ventures, Newfund, and Speedinvest, are among the existing investors who participated in the round. The startup intends to develop and broaden its present offers.

Nigeria’s Terragon Secures Investment From VestedWorld

Terragon, a marketing technology business based in Nigeria, received investment from VestedWorld, an Africa-focused early-stage investment firm, to expand its geographic reach, expand its product suite, and build new collaborations. The terms of the transaction were not disclosed.

Eastcastle Infrastructure Gets USD 130 Mn Backing For Africa Towers

Adenia Partners (Adenia), a private equity firm focused on Africa, African Infrastructure Investment Managers (AIIM), one of Africa’s largest infrastructure-focused private equity fund managers, and the International Finance Corporation (IFC), a member of the World Bank Group, partnered to invest USD 130 Mn in Eastcastle Infrastructure (Eastcastle), a company specializing in Africa’s telecoms tower sector.

Nigerian Fintech TeamApt Raises Series B Funding Round

TeamApt, a Nigerian fintech startup that delivers financial services to Africa’s underserved mass market, closed its Series B funding round, as it looks to expand after switching its focus from B2B to B2C. Novastar Ventures led the round with participation from FMO, Global Ventures, CDC, Oui Capital, Kepple Africa Ventures, Soma Capital, and a syndicate of local angel investors, including Gbenga Oyebode.

Fintech Startup Payhippo Raises USD 1 Mn Pre-seed For Expansion

Payhippo, a Nigerian startup that provides business finance, raised USD 1 Mn in a pre-seed round led by Pan-Africa VCs, Ventures Platform, Future Africa, and Launch Africa. Sherpa Ventures, an Africa-focused venture capital firm, Hustle Fund, and Mercy Corps Venture are among the other investors. The startup plans to use the fund to expand its reach to more Nigerian cities and build its engineers’ team.