Deal-Street Africa [July 5- 9]: Nine African Tech Startups Selected For Y Combinator S21 Batch

![Deal-Street Africa [July 5- 9]: Nine African Tech Startups Selected For Y Combinator S21 Batch](https://weetracker.com/wp-content/uploads/2021/07/April-19th-23rd.png)

Egypt’s E-commerce Platform Zeew Raises USD 170 K In Funding

Egypt-based e-commerce enabler platform Zeew raised USD 170 K from Sanabil 500 MENA Seed Accelerator, a joint initiative of Sanabil Investments and 500 startups. The new finding raises the total raised by the startup to date to USD 400 K. The startup plans to use the funding to help it expand globally, get more clients, and enter other relevant verticals.

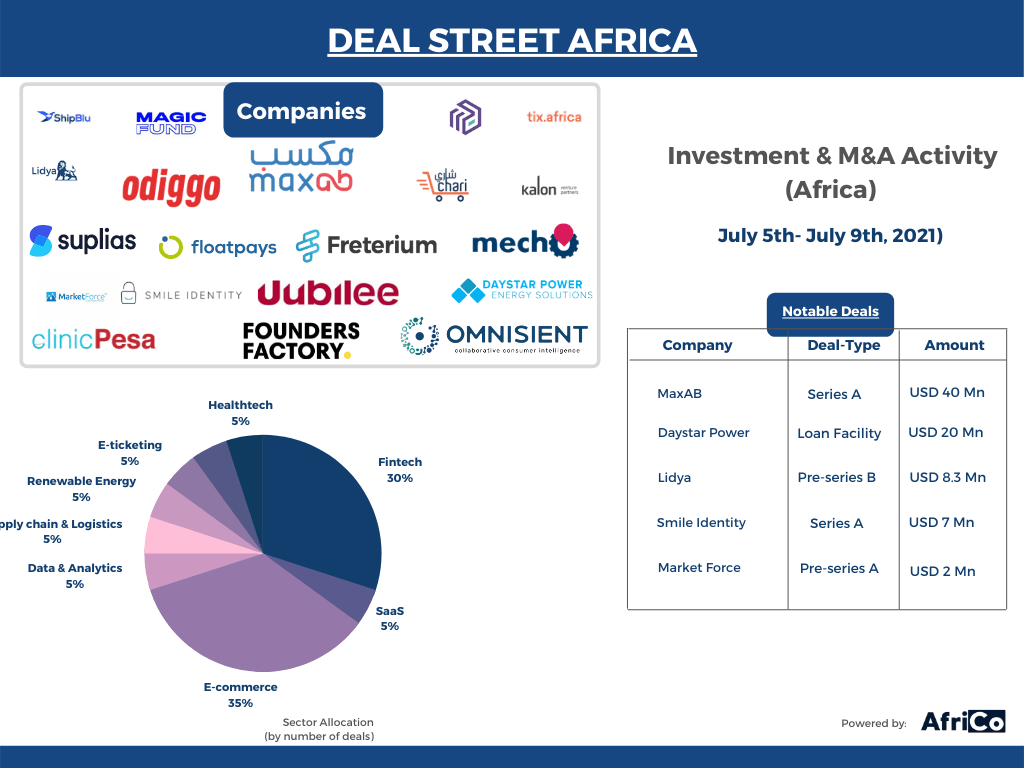

Egyptian Startup MaxAB Raises USD 40 Mn For Expansion

MaxAB, a Cairo-based startup that offers a network of traditional Egyptian food and grocery stores, raised USD 40 Mn in Series A funding. Investors in this round include IFC, Flourish Ventures, Crystal Stream Capital, Rise Capital, Endeavour Catalyst, and Maxab’s existing investors Beco Capital and 4DX Ventures. The startup intends to use the fresh funding to grow across Egypt’s major cities by the end of the year, followed by other markets in the region. The funds will also be utilized to expand newly established sectors such as supply chain and embedded finance.

Venture Capital Firm Kalon Ventures Raises USD 17.5 Mn Fund

Kalon Venture Partners, a South African venture capital firm, concluded its final Section 12 J capital raise, with assets under management totaling over ZAR250 million (USD 17.5 Mn). The Section 12J scheme was established in 2008 to encourage investments in startups and small businesses.

Nine African Tech Startups Selected For Y Combinator S21 Batch

Nine African tech startups are among the 117 that have been confirmed to be participating in the Y Combinator accelerator in Silicon Valley. Each startup received USD 125 K in seed funding and additional investment opportunities at a demo day. Nigeria and Egypt lead the way with three each. Mecho Autotech, which connects auto owners with mechanics and smart part sellers; Suplias, a B2B platform for mom and pop shops; and Lemonade Finance, a multi-currency payments system, are the Nigerian representatives. Egypt is represented by licensed online insurance brokerage Amenli, car parts marketplace Odiggo, and ShipBlu, a last-mile e-commerce delivery and fulfillment company. Chari, an e-commerce and fintech app for traditional retailers, and Freterium, a collaborative SaaS platform connecting organizations, people, and technologies in the logistics value chain, are from Morocco. Floatpays, an on-demand wage access platform from South Africa, rounds out the list.

South African Startup Omnisient Secures USD 1.4 Mn Funding

Omnisient, a start-up based in Cape Town specializing in safe data exchange for enterprises, raised R19 million (USD 1.4 Mn) to extend its global footprint. The new round included Technova, Grand Bay Ventures, Tahseen Consulting, and Kepple Africa Ventures. The startup plans to use the funding to grow its workforce, accelerate product development, and expand internationally.

MAGIC Fund Raises USD 30 Mn To Scale Founders Backing Fund

The MAGIC Fund, a global network of founders, announced a USD 30 Mn funding round to support entrepreneurs in Africa, Europe, Latin America, North America, and Southeast Asia. The fund’s general partners are the fund’s 12 founders.

Moroccan Startup Damanesign Raises USD 450 K To Scale Operations

Damanesign, a digital trust solutions startup based in Morocco, secured MAD4 million (USD 450 K) from Maroc Numeric Fund II. Damanesign plans to use the investment to hone its digital products and develop its operations.

Nigerian Fintech Lidya Raises USD 8.3 Mn To Scale Operations

Lidya, a Nigerian fintech and lending startup, raised USD 8.3 Mn in a pre-Series B fundraising round. Alitheia Capital’s uMunthu Fund spearheaded the investment. Bamboo Capital Partners, Accion Venture Lab, and Flourish Ventures were among the other investors who took part. This new investment will see Lidya grow its lending operations for small and medium businesses across its markets.

Ugandan Health Fintech ClinicPesa Wins USD 250K Award

ClinicPesa, a Ugandan fintech focused on health, won USD 250 K in the Swiss-Re Foundation competition – People’s Choice Award. ClinicPesa is a portfolio company of Villgro Africa and received previous funding from GIZ, D-Labs, MIT, and FSDU totaling USD 500 K.

Nigeria’s Daystar Power Secures USD 20 Mn Facility From IFC

Daystar Power, a Nigerian firm that provides businesses with hybrid solar power solutions, announced closing a USD 20 Mn facility from the International Finance Corporation (IFC) to assist it in completing its project pipeline. Daystar Power’s Nigerian affiliate will receive a USD 20 Mn loan from the IFC to develop hybrid renewable energy systems. The investment comprises a subordinated loan of USD 10 Mn from the Canada-IFC Renewable Energy Programme for Africa and a local currency loan of USD 10 Mn from IFC.

Jubilee Holdings Raises Stake In Uganda’s Bujabali Power Plant

Jubilee Holdings, a financial services holding firm, invested an additional USD 40.7 Mn in Uganda’s hydroelectric power plant Bujagali in the year ending December 2020, bringing its ownership in the project to 40.9 %.

Egyptian Startup ShipBlu Raises Pre-seed Funding

ShipBlu, a Cairo-based startup, raised an undisclosed amount in a pre-Seed round led by Nama Ventures, with Y-Combinator and other famous angel investors from San Francisco and Saudi Arabia participating. ShipBlu also announced it had been accepted onto Y Combinator’s summer 2021 Batch.

Smile Identity Raises USD 7 Mn To Build Identity Verification Tools For Africa

Smile Identity, a company that provides ID verification and KYC compliance for African faces and identities, closed a USD 7 Mn Series A fundraising round. Costanoa Ventures and CRE Venture Capital, a pan-African venture capital firm, co-led the investment. LocalGlobe, Intercept Ventures, Future Africa, and unknown angel investors were among the other investors who took part. Existing investors, including Khosla Impact, ValueStream Ventures, Beta Ventures, 500 Startups, and Story Ventures, also participated.

Kenya’s MarketForce Raises USD 2 Mn Pre-Series A

MarketForce, a Kenyan B2B platform for retail distribution of consumer products and digital financial services, raised USD 2 Mn in a pre-Series A investment to expand its RejaReja platform in Nigeria. The new round included V8 Capital, Future Africa, GreenHouse Capital, Launch Africa, Rebel Fund, Remapped Ventures, and a couple of strategic angel investors on board. Y Combinator and P1 Ventures also participated in the round.

Founders Factory Invests In Three African Tech Startups

Founders Factory Africa, Johannesburg-based venture development and investment firm, added three additional African digital businesses to its portfolio, bringing its total to 25. The latest funded startups are Kenya’s Wazi, a digital mental health company connecting people to affordable, high-quality services; Uganda’s Asaak, an asset financing company that provides credit by lending motorcycles, fuel, and smartphones to drivers; and South Africa’s Revix, a fintech platform that makes investing in cryptocurrencies simple, engaging and automated.

Nigerian Startup Tix Africa Raises Pre-seed Round To Scale

Tix Africa, a self-service ticketing platform for event makers based in Nigeria, raised a six-figure pre-seed round to expand its event offerings and operations to Ghana and East Africa. The pre-seed funding round was led by HoaQ, with participation from several private equity investors.