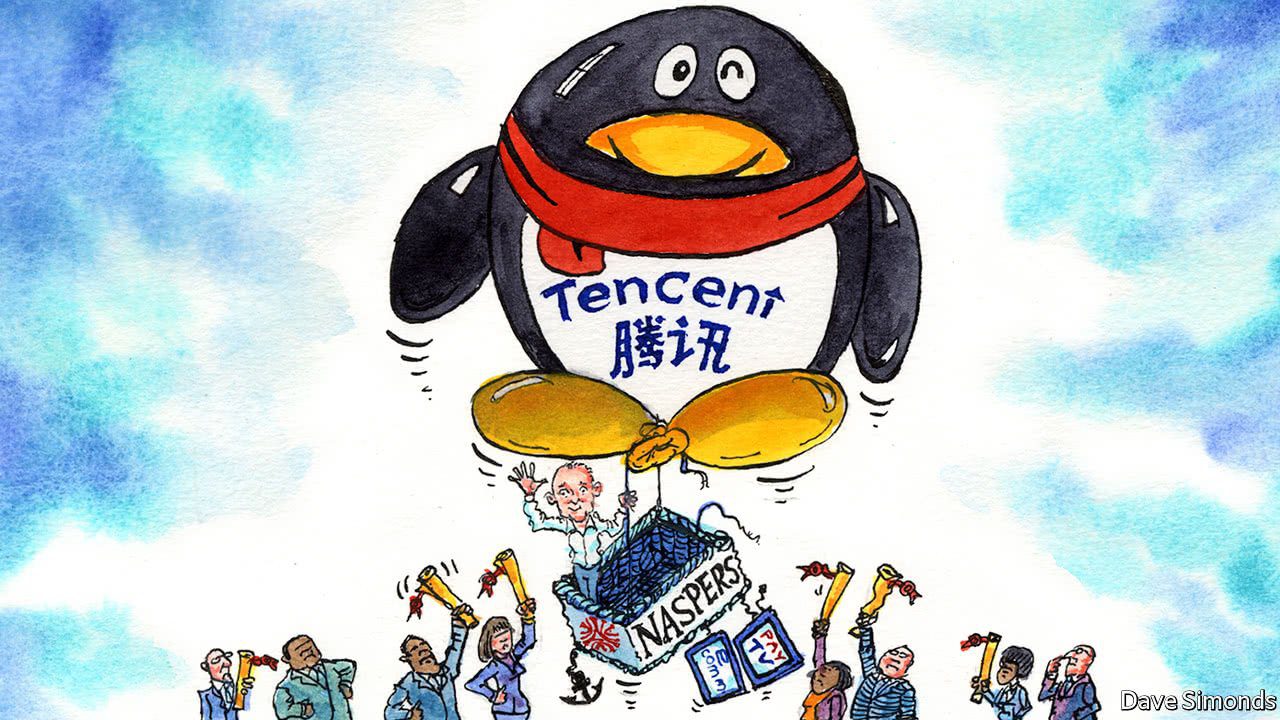

Naspers: A Disturbance In China Batters Africa’s Most Valuable Company

The South African multinational, Naspers, which is perhaps best known for its iconic investment in Chinese technology giant, Tencent, has taken quite a hit.

The Cape Town-based firm, which tops the pile as the most valuable company in Africa on account of a slew of groundbreaking investments in tech/non-tech ventures within and outside Africa (think: Multichoice, Takealot, Media24, Byju’s Swiggy, etc.), has its stock tumbling due to a number of events in China.

Naspers stock plunged in morning trade on Monday, losing more than ZAR 100 B (~USD 6.6 B) in value as it faces a potential fine in China through its biggest investment, Tencent. Naspers shares had fallen 13.92 percent to around ZAR 1.5 K (~USD 100.00) around midday, giving the group ZAR 673.86 B (~USD 44.7 B) market cap.

Naspers and its subsidiary Prosus, which holds a 29 percent stake in Tencent, are plunging following a big decline in Tencent on Monday. Tencent, which owns China’s dominant super app: WeChat, faces a record fine after China’s central bank alleged its WeChat Pay had violated anti-money laundering rules, the Wall Street Journal reported, citing people familiar with the matter.

The People’s Bank of China alleged Tencent’s payments platform had allowed the transfer of funds for illicit purposes such as gambling, the newspaper reported. WeChat Pay was also judged non-compliant with other rules that required Tencent to identify users and merchants transacting on the platform.

Tencent and other Chinese stocks listed in Hong Kong had their worst day since the global financial crisis on Monday, as concerns over Beijing’s close relationship with Russia and renewed regulatory risks sparked panic selling.

The mass sell-off coincides with the release of a report citing U.S. officials that Russia has asked China for military assistance for its war in Ukraine. Although Chinese authorities distanced themselves from the report, traders appear to be uneasy, fearing that Beijing’s potential overture toward President Vladimir Putin could bring a global backlash against Chinese firms, even sanctions.

A combination of the above factors, as well as fresh Covid-induced lockdowns in tech hub Shenzhen and the northern province of Jilin, and concerns over the risk of Chinese firms delisting from the U.S. following renewed pressure from the Securities and Exchange Commission (SEC), has made investors jittery about Chinese stocks in general at this point in time.

For Naspers, the pummelling it has taken in China is yet more bad news in what has been a rough start to the year. Naspers has lost 38 percent of its value since January, and there’s cause for concern that it could get worse.

In any case, this isn’t the first time Naspers is suffering this sort of ordeal. Back in August 2020 when tensions were heightened in the protracted US-China trade war, the then-U.S. President Donald Trump signed a pair of executive orders prohibiting U.S. residents from doing business with the Chinese-owned apps, TikTok and WeChat, citing national security concerns.

As a ripple effect, Naspers found itself reeling as it was unavoidably caught in the crossfire because of its ties to Tencent.

Naspers, dropped 4.4 percent a day after President Trump signed the executive orders. Naspers holds the majority stake in WeChat’s owner, Tencent, which plunged as much as 10 percent in Hong Kong on that same day. Naspers subsidiary, Prosus, which holds the company’s stake in Tencent, dropped 5.4 percent.

The structure looks something like this: Tencent owns WeChat and many other services that cut across social network, music, web portals, e-commerce, mobile games, internet services, payment systems, smartphones, and multiplayer online games. And Naspers happens to be the largest shareholder in Tencent with a 29 percent stake.

Naspers bought into Tencent back in 2001 when it made an early investment of USD 32 Mn in the then startup, acquiring 46.5 percent of the company from early investors like PCCW and IDG Capital.

When Naspers sold part of Tencent stake in March 2018 for USD 10 B, its initial USD 32 M investment had ballooned to a stake worth over USD 175 B. Indeed, that USD 32 Mn investment has been described as one of the most successful venture capital investments of all time.

As a matter of fact, the market value of Naspers’ Tencent holdings is greater than the market cap of Naspers itself. Naspers has been listed on the Johannesburg Stock Exchange (JSE) since 1994.

Thus, it follows that when Tencent takes a beating, Naspers gets a shudder too, despite having other huge investments in internet communication, entertainment, gaming, and e-commerce.

Featured Image Courtesy: The Economist