Africa’s BNPL Startups Look To Succeed Where Global Giants Faltered

Despite the doubts fuelled by niggling concerns in the form of economic malaise, traditional consumer spending culture and flaws in the process, the prospect of buy-now-pay-later loans powered by tech startups is rising across Africa. But a real test has emerged in the shape of a drastic reversal of fortunes that has upended the sector across the globe.

Over the last two years, there’s been significant activity on the continent around such tech-enabled platforms that enable consumers to make purchases and pay for them at a future date, in keeping with a global boom fuelled by the Covid pandemic and a capital splurge that sparked unbridled growth.

In the face of multiple headwinds – rising interest rates, spiralling inflation, bad debts, a crowded marketplace, and tightening venture purse strings – that have cratered the industry and its biggest players in the past months, local startups and merchants are looking to defy the odds.

For businesses such as OgaBassey; a thriving electronics store located in the Yaba axis of Nigeria’s commercial nerve, Lagos, sales shot up significantly following an experiment with instalment payment plans, and the establishment has since doubled down on it.

“We saw a 300 percent revenue growth in 2020 as a result of the instalment payment option powered by Sterling Bank and we have since added other partners like Carbon Zero,” Bassey John, Founder and CEO of OgaBassey, told WeeTracker.

This Buy Now Pay Later option, or BNPL as it is commonly called, is gradually becoming sticky and customers who use the “pay later” option typically spend more, according to Seyi Olaniran, Head of BNPL, at Zit.ng; an online home appliances retailer.

“We are seeing customers spend up to 50 percent more with the instalment payment plan,” said Olaniran who works at a six-year-old establishment that launched a BNPL option two months ago in partnership with Carbon Zero, the BNPL product of the credit-led digital banking startup, Carbon (which, interestingly, was formerly known as Paylater).

The race for asset-based credit

Short-term financing for specific items is not exactly new in Africa as is evident in the traditional “hire purchase” model especially popular in the informal economy, as well as an extension of the model observed in asset-financing arrangements, particularly in the mobility sector.

However, local tech startups and their backers have ploughed venture dollars into the space in recent years, revamping access and expanding the product category to ignite consumer interest rather than commercial motivation. Items typically range from home appliances to personal gadgets valued at as much as USD 3 K or more, with payment tenures that can be up to 6 months.

The service is a bit touch-and-go at the moment but par for the course, according to Olumuyiwa Olowogboyega, PR and Content Manager at Lemonade Finance, who said he bought a laptop in Lagos earlier this year, and spreading the payments was convenient for his cash flow.

“It works as advertised but the process is still far from perfect. One gets the sense that they’re still iterating, but it’s reliable (if they manage to respond to your application on time),” Olowogboyega told WeeTracker.

“On the whole, when you’re trying to use BNPL services, it’s hard to miss the fact that there’s very little trust in Nigeria. Lots of verification, lots of protection for the company, etc.,” he added.

The absence of robust integrated credit scoring systems, underdeveloped consumer credit culture, and the fragmented nature of identity collation and management infrastructure mean local startups have had to improvise on their own to sell credit, however tedious the resultant processes might seem at times.

Data-based battles

South Africa’s BNPL provider, Payflex, which was acquired by Australia’s Zip in 2021, says it “references credit bureau data and other data points to confirm eligibility and spend limits.” In Nigeria, both CDcare and Carbon Zero say they have proprietary systems in place to perform automated credit checks on every customer.

“Because we don’t charge interest on repayments, it is vital that a customer’s level of affordability and credit profile is determined before we allow them to transact,” emphasised Richard Faderin, a Product Manager at Carbon.

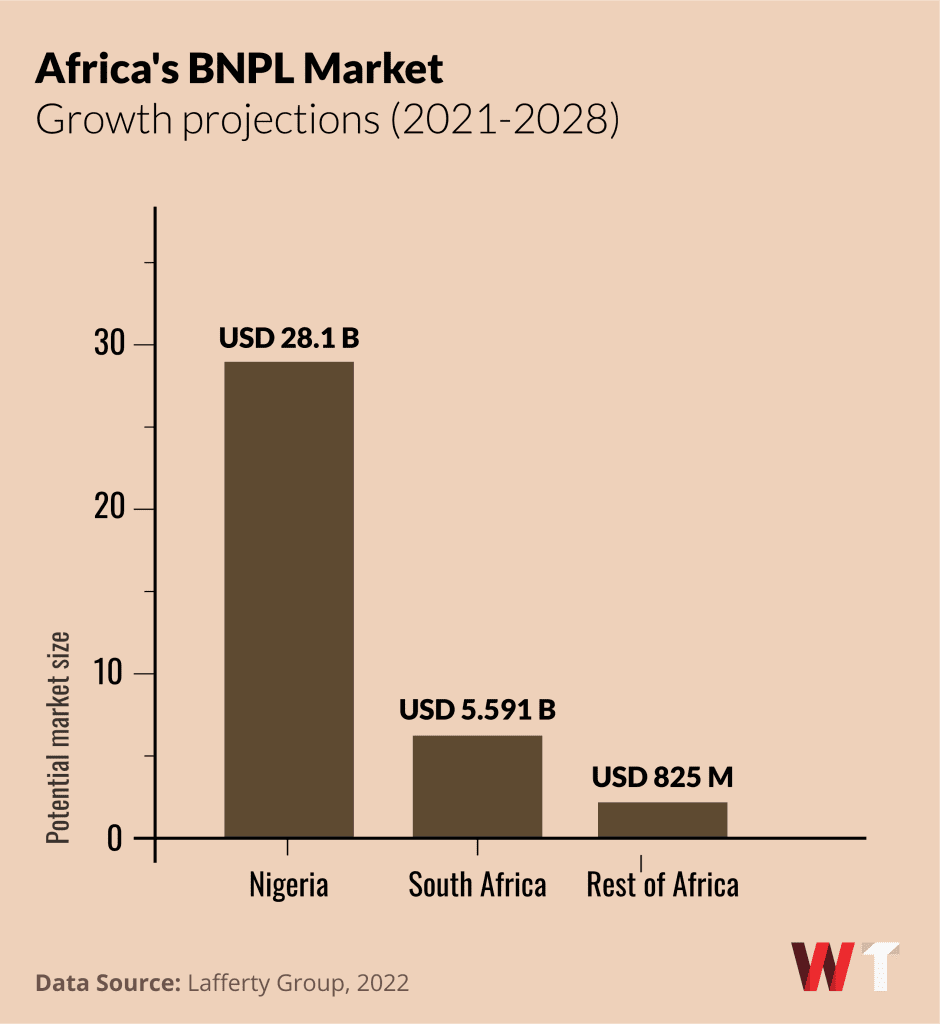

Despite the resulting information asymmetry created by the prevailing situation (where lenders hold data in silos as they do not share information about consumer loans with one another to the benefit of delinquent customers), Africa’s BNPL players have managed some measure of progress in a market projected to hit USD 85.4 B in sales by 2028.

Some of the leading BNPL players across the continent’s most vibrant markets have recorded impressive showings. M-KOPA, which started in 2011 as a solar-financing startup in Kenya but has since entered three other countries and expanded its product category to include smartphones, claims to have unlocked USD 600 M in credit to date and impacted 4.5 million people.

In the same vein, Nigeria-based CDcare shared that it has grown from selling five items per day to 100 items per day, closing over NGN 3 B (~USD 7 M) in Gross Merchandise Value (GMV) while keeping the default rate at less than 1 percent, and Carbon Zero says its GMV for 2022 is on track to surpass NGN 1 B (over USD 2 M) as it has gone beyond physical goods to include educational tutoring services.

On its part, Payflex revealed that its customers in South Africa have tripled over the past year, growing 10–15 percent per month and recording a 50 percent rise from the first to the second quarter of 2022. Other players such as CredPal, Shahry, Payfi, EasyBuy, PayJustNow, and Mobicred are also making a mark.

These suggest an uptick in uptake as BNPL arrangements are becoming a familiar payment option, both when shopping online and in-store. However, as raging headwinds ravage the sector globally, local providers face a stern test.

A spanner in the works

A combination of factors including worsening inflation, rising interest rates, and a cost-of-living crisis have put household budgets under pressure, leading to rising defaults on consumer debt.

Some of the world’s biggest BNPL players, having soared on the back of the pandemic, are now in the midst of what could be described as a crisis, exacerbated by the sweeping tech rout. Global payments giants such as Square and PayPal, which famously got in on the act at the height of the growth tear, have endured a rude awakening.

“The ability to spread payments over time is valuable for a consumer society. But I do think a number of things have been overdone in this bubble, particularly growth and valuations,” shared Andrew Nevin, Partner and Chief Economist, PwC Nigeria.

“Growth tends to be fast if you’re offering credit but you are subject to credit losses which can be massive in some environments,” he told WeeTracker.

Laxities in credit checks and heavily-marketed offers that encourage mindless consumerism around even basic consumer goods have increased bad debt and credit losses among leading players including Zip, Afterpay, Affirm, and Klarna. With bad debt on the rise, BNPL companies have resorted to tightening lending standards, which has yielded the undesired consequence of slowing top-line growth.

Furthermore, with interest rate hikes becoming a fixture in response to rising inflation, costs have surged and the margin on the loan book is effectively shrinking. And with consumer spending declining at the same time due to economic hardship, BNPL companies are making less money.

These, coupled with the reality that BNPL companies typically fund the gap between paying merchants in full upfront and receiving staggered payments from consumers, make for turbulent times under the prevailing macro environment.

BNPL companies typically refrain from charging interest/fees and only earn from commissions, hence, earnings are fixed. Thus, rising costs sparked by inflationary trends, which are hard to offset without upping earnings by charging customers, have stymied the industry.

In Australia which is a hotspot for flexible payments providers, BNPL stocks have plummeted spectacularly over the past year – from a high of USD 80 B+ in market cap as of March 2021 to just around a billion dollars at present.

Some big-name BNPL companies have seen their stocks fall by as much as 90 percent over the past year and big private firms have stumbled too. The collapse observed in developed markets is fuelling scepticism over the prospects of the emerging local scene.

“BNPL in Africa is still at its nascent stage even though it is gaining traction, with more consumers opting for this mode of payment. However, the current macroeconomic environment has shrunk consumer discretionary spending, impacting most BNPL companies’ consumer balance sheet which is a critical buffer for default risk,” said Ese Osawmonyi, Senior Analyst at SBM Intelligence; a respected research consultancy headquartered in Lagos.

“The current BNPL business model, wherein consumers do not pay interest rates, will likely be reviewed due to a possible increase in consumer default rates and revenue shortfall. Furthermore, access to funding to support or expand this business model in light of the current cost-of-living crisis and shrinking consumer spending threshold in Africa will be difficult,” she argued.

Headwinds or tailwinds?

African startups powering flexible payment solutions, however, remain upbeat about their chances, encouraged by intensive credit risk assessment mechanisms in place, modified models, and rising demand.

“The margin on the BNPL product is very tight, so we take great care to only accept good risk customers who are very likely to pay back the advance,” said Paul Behrmann, Founder and CEO of Payflex.

BNPL customer default rates in South Africa are the lowest in the Zip portfolio globally, according to Behrmann, disproving the idea that South Africans do not honour their financial commitments.

Western players are struggling because they encourage questionable credit habits, reckons Oluwatobi Odukoya, Founder and CEO of CDcare.

“Encouraging impulse purchases will always lead to high defaults. Unlike the Western BNPL model, CDcare encourages people to save consistently before giving credit, and our credit has collateral which are the items we deliver,” he pointed out.

In the face of widespread deteriorating economic conditions that have suppressed consumer purchasing power and depleted income, Africa’s fledgling BNPL providers appear to fancy their chances – reiterating that dire economic realities also drive demand for budget-friendly alternatives.

“The rapidly rising cost of goods actually means that for someone intending to make a large purchase, they are actually likely to spend less by choosing to buy now at today’s price and then defer the remaining cost for a later date. The alternative would be to save up and then go to buy the item, but over the course of a few months, the price may have risen by 20 percent or even more,” Faderin explained.

Positioning as an inflation hedge (to enable purchases at today’s prices rather than potentially pay more in the future) and acting as a financial buffer (to ease the burden of coughing up a lump sum in lean times) could prove points in favour of BNPL startups.

“While the road ahead seems challenging, it is still manageable because the cost-of-living crisis in Africa has created a market segment that requires the solution BNPL companies provide,” Osawmonyi acknowledged.