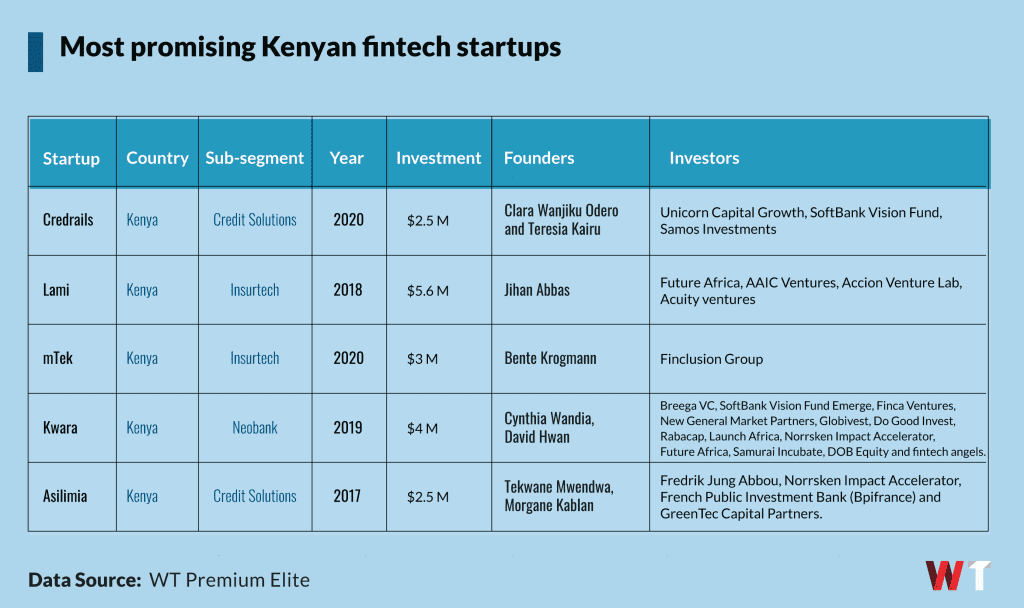

Top 5 Startups To Watch Amid Kenya’s Fintech Resurgence

Fintech continues to be the most illustrious and most funded startup sector in Africa, with Nigeria as the uncontended leader of the billion-dollar race. Of recent, nonetheless, Kenya has been making rounds to make its way into the local spotlight.

For longer than can be remembered, the Safaricom and Vodafone-backed M-PESA mobile money service has been the supreme overlord of the East African country’s fintech ecosystem. Ever since March 2007 when the platform was introduced, M-PESA has [literally] had a chokehold on the industry, a fact evident in its continually growing revenues.

Recently, the Kenyan government launched the Nairobi International Finance Center (NIFC), tailored to offer investors keen on the financial services industry support and offers such as tax and emigration incentives, as well as office spaces in the newly unveiled building dedicated to the initiative. This, alongside already existing innovation, aims to further drive financial inclusion.

More so, in the past few years, a new crop of fintech startups have emerged on the local scene, looking to reimagine the country’s financial services industry and cater to the younger Kenyan generation—particularly millennials and Gen Zs. Following the trend, funders are pumping more money than ever into the industry; 2022 is undoubtedly going to be a record-breaking funding year.

Considering key metrics such as funding scores and duration of operations, WeeTracker has curated a list of some Kenyan fintech startups worth keeping an eye on in the coming times.

Credrails

A finance infrastructure company, Credrails exists to connect banks, mobile money services, and offline data into a unified API platform.

By doing this, the startup is making it easier for customers to access the resources they need to offer and enhance their customized, innovative fintech solutions such as lending, KYC, KYB, and analytics. Succinctly, the company is aggregating the continent’s financial data.

Credrails’ API, prospectively, connects every country in Africa, giving fintech developers a system to build easily and quickly for the continent’s financial economy.

While being headquartered in Kenya, the startup has operations in Nigeria and claims to have access to about 250 million accounts in 33 countries in the region. Since its launch in August 2020, the business has grown 400 percent month-on-month.

Lami

A female-led company, Lami is bringing about digital innovation to Kenya—and in the long term, Africa’s—insurance sector.

Via an API, the startup enables businesses of different shapes and sizes to offer their users digital insurance, while using the same technology to manage their [own] insurance needs. Lami designs products alongside its underwriting partners and uses a B2B2C approach to facilitate insurance distribution.

Lami Technologies aims to close Africa’s insurance gap by using technological solutions which reduce the cost of offering the service, mainly via the use of bit-sized premiums.

The business also says that, in collaborating with its underwriters in several local markets, it is coming up with an all-risk coverage for buy-now-pay-later (BNPL) transactions.

mTek

Another actor in the insurtech space, mTek has a mission similar to Lami’s—driving access to digital insurance. However, its model is different as the startup focuses on providing a completely paperless system for the African insurance ecosystem.

The platform not only makes it easy for customers to purchase insurance premiums directly from insurance companies but allows them to compare policies and file claims from the comfort of their smartphones.

With its “paperless” approach, mTek has recorded significant growth since its launch in 2020, reportedly tripling its customer base and gross written premiums on a trimonthly basis.

The startup claims to have 65,000 users in Kenya, most of which come from the medical and vehicle insurance segments. On the backs of a Finclusion Group-backed fundraiser, it plans to expand further within the country and across the East African region.

Kwara

Succinctly, Kwara is building a neobank for credit unions in East Africa.

The company provides a simple, safe and inexpensive digital banking platform for savings and credit cooperatives societies (SACCOs) and their members in the region, a great number of whom were previously ignored or excluded by traditional banks and financial institutions.

Kwara’s proprietary backend-as-a-service (Baas) software connects cooperatives with banks, payments gateways, and other third-party digital services via an API infrastructure; the clients pay to use the single end-to-end solution.

Already, the startup serves more than 60,000 members and handles up to USD 40 M in monthly transactions, while growing its customer base by 40 percent month-on-month.

Asilimia

Asilimia’s mission is to build the supporting digital infrastructure for Africa’s overly fragmented and paper-based informal economy while using tech products to address the USD 360 B credit gap putting the continent’s over 150 million micro, small and medium-sized enterprises MSMEs at a disadvantage.

Generally, the startup is connecting these small businesses to the formal financial economy. Having created a cheaper and easy-to-use platform that formalizes payment, revenue collection, and accounting processes for business owners, Asilimia is making it easier for its customers to monitor and manage their enterprise activities on a single platform.

With the aid of their mobile phones, these entrepreneurs can record sales and expenses, track pending payments, connect mobile money accounts, and gain financial insights.