Carbon Shows Earnings In Latest Financials-Reveal, An African Tech Rarity

It came as a surprise when Carbon, a Nigerian fintech startup that started out as a digital lender before morphing into a neobank for individuals and small businesses, put its audited 2018 financial statements in the public domain for the first time in July 2019 and stated its intention to do so every year from then. A surprising move, because volunteering to open books publicly is largely unheard of for African private businesses, though not as uncommon in Western markets.

Nevertheless, Carbon has kept at it, releasing subsequent financial statements for 2019 and additional year-in-review summaries in a rare showing of transparency for an African startup, despite industry-wide concerns that such openness could backfire.

Local startups generally play it close to the vest due to somewhat valid concerns that such transparency might reveal losses that breed negativity, provide rivals with market information, or draw unwelcome regulatory scrutiny. Also, there’s the issue of possibly losing leverage in negotiations if a company’s disclosures paint a rosy picture.

Carbon, now in its tenth year under the leadership of sibling/co-founder duo, Chijioke and Ngozi Dozie (interestingly from a well-known family background rooted in banking and financial services), has shared that the unusual transparency is founded on responsibility and a desire to inspire confidence and conviction.

In Carbon’s just-released unaudited 2022 overview which offers a peek into its profit and loss statements for the last four and a bit years, the founders shared that Carbon “went into 2019 on the back of two years of profitable growth but were impacted negatively, like many other banks globally, by the losses from the Covid pandemic.”

This, they say, interrupted the release of financial results for 2020 and 2021, given that total focus was put into weathering the storm.

Chijioke, one half of the founding duo, stated that “the worst is behind us and we have emerged stronger as a company with new habits that will allow us to continue our promise to provide unrivalled value to customers and promote transparency always.”

After the two-year financials-reveal hiatus, Carbon, which has raised a relatively modest USD 15 M to date, claims it is back in profit having launched new machine learning models and more robust decision engines which have helped it cut underwriting losses to levels lower than what was seen before the pandemic.

“We know ‘profit’ can be a controversial word for startups and investors but we love it!,” reads a part of the document seen by WeeTracker.

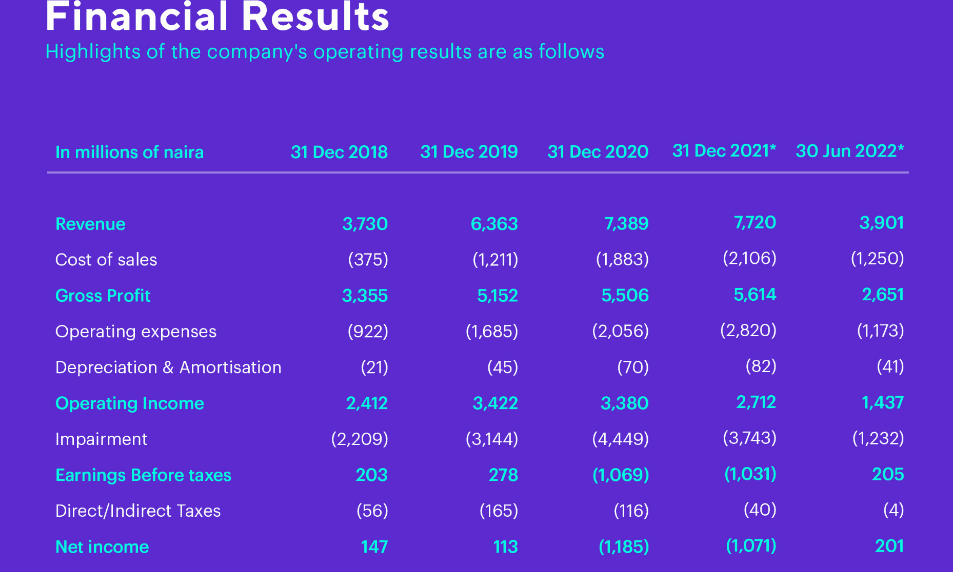

The just-released snapshot, like its annual reports, reveals gross earnings, profit/loss before and after tax, net impairment loss, total assets, liabilities and equity, among others.

As seen in the document, Carbon saw gross profits of ~NGN 5.5 B (UD 12.6 M) and ~NGN 5.6 B (USD 13 M) in the year ended 31st December 2020 and 31st December 2021 respectively, on revenue of NGN 7.38 B (USD 17 M) and NGN 7.72 B (USD 17.7 M) in those respective years, while managing to cut impairments across that period. (Note that the naira has fallen by ~20 percent since 2019 going by the official rates and significantly more going by parallel rates.)

However, Carbon’s earnings before taxes and net income reflect a somewhat subdued showing as total liabilities appear to have inched up.

Carbon says it aims to spark in payments the sort of revolution that it engineered in digital lending over the next decade, and it’s looking to keep up the cash discipline with which it is proving that a resilient digital bank can be built upon customer value and unit economics, contrasting notable recent revelations of staggering losses at one the continent’s most recognised neobanks.

Efforts aimed at turbocharging Carbon’s buy-now-pay-later product, Carbon Zero, which the startup says is seeing remarkable adoption, as well as newer conquests in payments and SME lending, are to be key pursuits in the coming years, according to the startup. But challenges can be expected in an environment that is increasingly laden with competition and regulatory uncertainty.

Featured Image Credits: Carbon