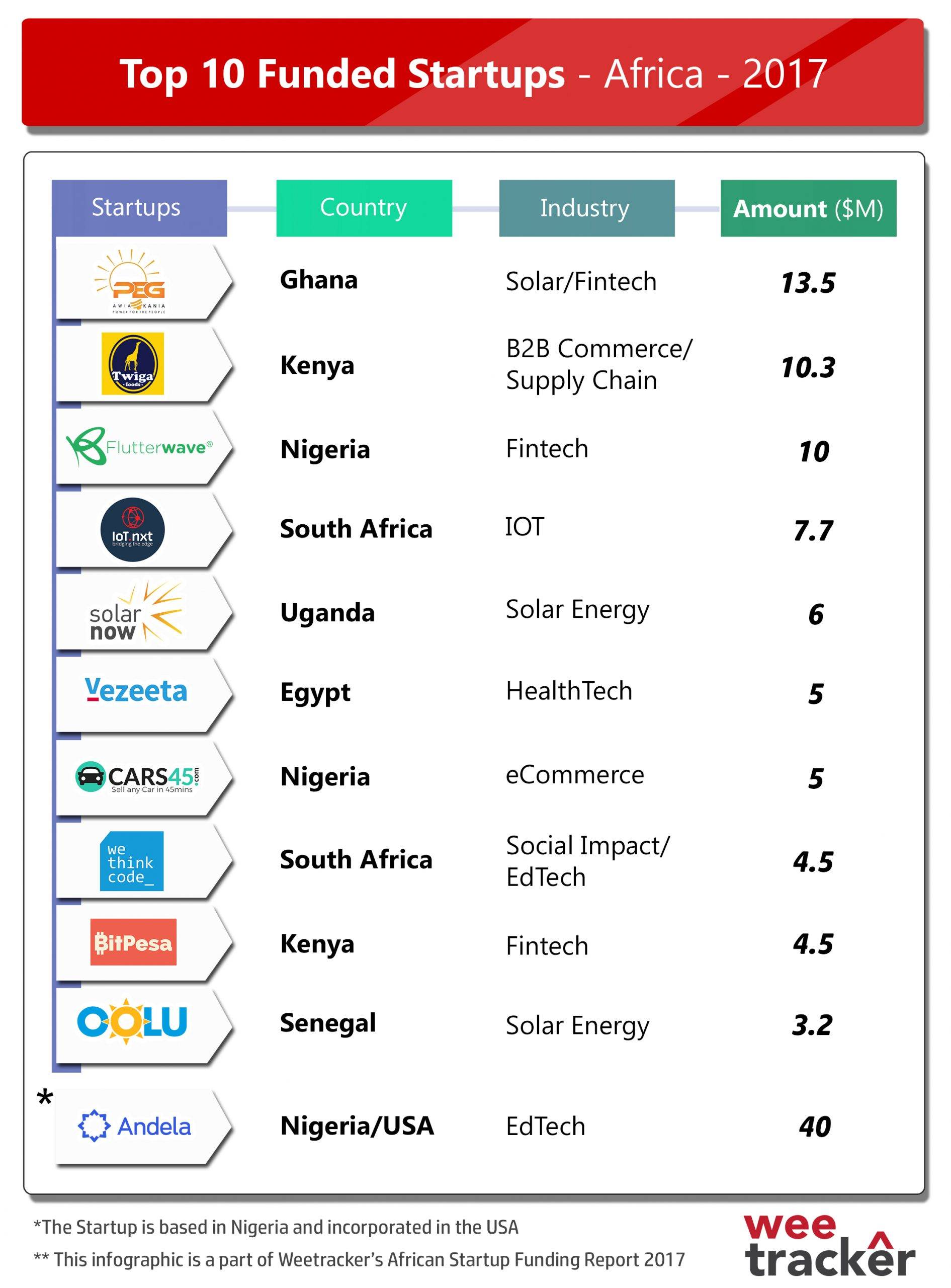

Top Funded Startups of Africa – 2017

In continuation with WeeTracker’s ‘Africa in 2017’, this is our next presentation on Top 10 funded startups for year 2017.

In our recent report, Fintech sector secured the maximum number of deals last year with close to 47 deals. But among the top funded startups of 2017, Cleantech secured the first spot. Also, interestingly though seed money was the most preferred investment method, the biggest funding were raised in follow up rounds. We are enclosing the list of 10 companies that featured in the list top funded startups amongst 201 which were funded last year. The total value raised by these top 10 constituted close to 36% of total disclosed investments i.e. $ 167.7 M last year.

![]()

PEG secured a $ 13.5 M funding in Series B led by Blue Haven Initiative with participation from EAV, Investisseurs & Partenaires, ENGIE Rassembleurs d’Energies, Acumen and PCG Investments. The Ghana based Cleantech provides access to assets like solar home systems to 10000+ households. They recently launched in Côte d’Ivoire and plan to expand in other countries across West Africa in the coming years.

Twiga Foods , a Kenya based B2B commerce/ Supply chain startup raised $ 10.3 M in Series A from Wamda Capital, Omidyar Network, DOB Equity, Uqalo, 1776, Blue Haven Initiative, Alpha Mundi and AHL. Twiga is a mobile-based supply platform for Africa’s retail outlets, kiosks, and market stalls.

Flutterwave a Nigerian Fintech raised $ 10 M in Series A round from Y combinator, Glynn Capital,Greycroft Partners , Green Visor. Africa has become the global leader in mobile money with more than 100 million people having mobile money accounts in 2016, according to McKinsey research. Flutterwave provides the underlying technology platform that allows businesses to make and accept payments anywhere in Africa. They are headquartered in San Francisco with offices in Lagos, Nairobi, Accra, and Johannesburg. So far, Flutterwave claims to have processed $1.2 B in payments, 10 M transactions.

SolarNow, Uganda based Solar Energy startup, raised $ 6 M in Debt in investments led by SunFunder with the participation of responsAbility Investments AG and Oikocredit. SolarNow is a for profit social business with Dutch origins, providing solar energy and financing solutions in East Africa. Currently they have 46 branches across Uganda with plans to grow in East Africa.

Vezeeta , Egypt based Healthtech secured $ 5M as VC investment from BECO Capital and also featuring Vostok New Ventures, TDF and Silicon BadiaSeries. They are developing to automate the healthcare ecosystem by connecting various healthcare providers using digital cloud based solutions. It gives patients a platform to reach doctors and fix appointments without any human intervention. Vezeeta offerins a, free, user friendly online search engine and app where one can search for doctors by speciality, area, and fees.

Cars45 , a Nigerian E-commerce startup raised $5 M in Series A round from Frontier Cars Group . Cars45 is a car buying service with the goal of helping hundreds of customers to sell their cars. They are building the infrastructure for commerce that allows sellers and buyers of Nigerian used Cars to exchange value, cheaply and with unhindered access to independent relevant information required for decision making. They have opened inspection centres for their customers to sell their cars.

IoT.nxt is a based IOT startup which received US $ 7.7 Mn from Talent Holdings. The platform creates enterprise wide data-connectivity between new data sources such as sensors or things, less sophisticated legacy systems, enterprise systems, applications, machines and cloud services, allowing people and machines on any network using any operating system to connect and interact.

Oolu, a Senegalese Y Combinator-incubated startup has raised US $ 3.2 M Series A funding led by Persistent Energy Capital and joined by Y Combinator and others. Founded in 2015, Oolu provides in-home solar kits composed of three adjustable lights and two USB plugs, powered by a battery that holds a charge for up to six hours with maximum output. The startup installs the system and performs any necessary maintenance for a minimal monthly fee.

Bitpesa, a blockchain payments company raised US $2.5 M Series A round from US-based Draper VC in January, and then a follow up round of US $2 M led by Greycroft Partners, a VC firm founded and run by Alan Patricof – the father of Venture Capital. Founded in 2013. BitPesa accepts bitcoin payments and exchanges the bitcoin for local currencies, which it then deposits into bank accounts or mobile money wallets. Transactions are available in over 30 currencies.

WeThinkCode, a free programming and coding training programme dedicated to eliminate the tech skills shortage in Africa, raised US $ 4.49 from BCX. As part of the two year full-time programme, the students also participate in internships at BCX and other Telkom Group partners, to enable them to gain real workplace experience. It also launched a campus in Cape Town in December 2017.

***Andela, a coding school that provides software development training and global placements, secured US $ 40 M in Series C financing led by CRE Venture Capital, with participation from DBL Partners, Amplo, Salesforce Ventures and TLcom Capital. We have not considered this part of top funded startups owing to the dispute in the origin of the startup. Although the startup is oncorporated in the US but hast it major operations in Lagos.

Watch this space for more detailed insights, coverage and reports. We will be bringing more value driven information and data for our readers and will focus to create synergies between all the stakeholders of the startup ecosystem. In case we have missed out or quoted any information incorrectly, do bring to our notice by dropping an email at [email protected].