How The Fall Of The Favourite Startup Bank Rocked Africa’s Tech Scene

A whirlwind 30 or so hours that culminated in the rapid implosion of Silicon Valley Bank (SVB); the favourite bank of startups and venture capitalists (VCs), has sent shockwaves through the global tech industry with fears of a contagion that could have far-reaching consequences.

The current mood in the tech industry is largely one of apprehension. This is fed by fears of the implications of potentially lost funds to the tune of billions of dollars which a reported 37,000+ small businesses and investment firms had held with the California-based lender that fell to a bank run. It was the second high-profile bank failure in a turbulent week that also saw crypto-linked Silvergate Bank and Signature Bank go bust.

The impact of the crisis has predictably crossed borders, unsettling industry hotspots across the globe. This includes companies rooted in Africa’s burgeoning tech scene which has seen an influx of capital from the west in recent years, much of which is typically parked in foreign banks, such as SVB, at any one time.

Startup bank sends shockwaves

SVB, which tripled its deposits to USD 189 B within 3 years as founders and VCs parked cash with the bank during a frenetic VC boom, fell apart after making some bad bets in securities amid decreasing inflows and increasing outflows in a depressed tech funding landscape. Question marks about SVB’s financial position quickly spread and spooked its customers, leading to mass withdrawals that would cripple most banks.

The unravelling of SVB, which has now been closed by U.S. authorities, has put vast amounts of operational capital deposited by businesses under a cloud of uncertainty. This leaves many tech companies at risk of running out of cash even to make payroll in the next few weeks, which could potentially trigger waves of furloughs, outright job cuts, or the sudden shuttering of establishments that employ thousands.

While the extent to which African ventures are exposed to the upheaval at SVB – and the potential fallout – is still unclear, indications have emerged that there may be cause for concern. However, information disclosed at this time suggests at least two African startups emerged largely unscathed.

African ventures weigh impact

One such startup, NALA; a fintech company facilitating money transfers across African borders and beyond, experienced something of a close shave, according to its Founder/CEO Benjamin Fernandes, who shared that SVB was holding much of its funds.

“The last 36 hours has[sic] been a nightmare for many. We had most of our money in SVB. Moved it all to another bank. Literally an hour later, couldn’t log back in to SVB. A whole movie,” he tweeted the morning after the bank folded.

Check in on your fellow tech founder friends.

The last 36 hours has been a nightmare for many.

We had most of our money in SVB.

Moved it all to another bank.

Literally an hour later, couldn’t log back in to SVB.

A whole movie.

— Benjamin Fernandes 🇹🇿 (@Benji_Fernandes) March 11, 2023

While African payments unicorn Chipper Cash, which notably had SVB lead its USD 100 M Series C round in 2021, was not as lucky in pulling out funds, word is out that the impact is minimal. This counters speculation about potential further turbulence at Chipper which recently underwent two waves of layoffs and a valuation slash in the wake of the tech downturn and the fall of FTX, one of its backers.

“While this is a very worrying time for so many tech firms, the impact of SVB’s collapse on Chipper is insignificant overall,” Ham Serunjogi, Chipper’s Co-Founder/CEO said in an emailed statement to WT that was expounded upon in a blog post that later went public.

“We hold funds in a diverse portfolio of bank accounts within the U.S. and around the world,” he explained. “Our total exposure with SVB was limited to only around USD 1 M, and we expect to get back about half of that in the next day or two. Importantly, our global customer operations have not been, and will not be, impacted. Furthermore, Chipper has a broad set of investors who remain supportive of our long-term vision for the business,” the chief executive added.

Reports from Egypt have it that almost 50 local companies are said to be affected. Enterprise cites sources which revealed that a list is circulating among local players that includes the names of 46 startups and two VC firms that were banked with SVB.

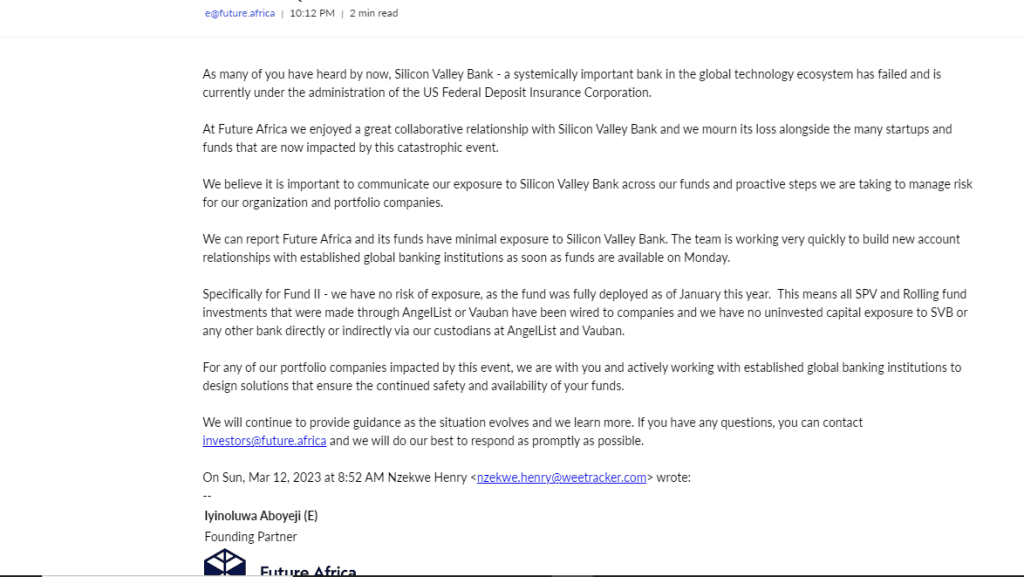

Future Africa, a homegrown funder which operates one of the most active early-stage VC funds in Africa, also revealed some exposure to SVB albeit to a small extent, as seen in an emailed statement received late Sunday from its Founding Partner, Iyinoluwa Aboyeji.

Will there be a silver lining?

Nevertheless, there is a feeling among local industry stakeholders that the direct impact of the crisis on African tech could be minimal as SVB wasn’t exactly popular with clients operating out of Africa. There has been some chatter on social media from seasoned local tech founders implying that SVB had, for an extended period, maintained a posture that locked startups operating in Africa out of its banking services for reasons it often put down to “too much risk.”

That stance may have eased up in recent years, however, as global investors doubled down on funding tech companies attacking untapped opportunities in African markets. An apt evidence of this is the fact that at least two household names in tech, Y Combinator and Techstars (both of which are accelerators known to partner with SVB) have funded 130+ African startups between them since 2015, including notable companies such as Flutterwave, Paystack, Wave, TalentQL and Payday.

However, this also signals the possibility that YC- and Techstars-backed startups are also caught up in the storm. YC has revealed there’s some significant exposure even though specifics remain unavailable.

“In the Y Combinator community, one-third of startups with exposure to SVB used SVB as their sole bank account,” writes Garry Tan, CEO/President of Y Combinator.

“As a result, they will fail to have the cash to run payroll in the next 30 days. By that measure, we can estimate that payroll-related furlough or shutdown will impact more than 10,000 small businesses and startups. If the average small business or startup employs 10 workers, this will have an immediate effect of furlough, layoff, or shutdown, affecting over 100,000 jobs in the most vibrant sector of innovation in our economy,” he warns, in a petition urging swift government intervention that has garnered 3,500+ signatures from CEOs and founders.

The implications are grim in the event that deposits go unrecovered or are inaccessible for months. Apart from the possibility of crippling the tech industry and leaving a trail of damaging losses in its wake, it could worsen the capital crunch in an already subdued funding landscape and trigger a similar move on other smaller banks as depositors are rattled and seeking safety. Indeed, another U.S. lender, Signature Bank, closed its doors abruptly on Sunday, after regulators said that keeping the bank open could threaten the stability of the entire financial system.

With SVB now closed by U.S. regulators following a bank run triggered by a liquidity crisis that unsettled depositors, all eyes are now on the insurer in the hopes of a resolution that would avert a crisis that could lead to thousands of folded companies and lost livelihoods from San Francisco to Kampala.

Fresh reports that federal banking regulators have stepped in to clean up the mess at the failed bank and ensure that all depositors have access to all of their money starting Monday, March 13, would offer some comfort, as would the latest news that SVB’s U.K. arm has been rescued following its acquisition by HSBC, the giant British lender.

UPDATE: Article updated at 10:50 am WAT on 13/03/2023 to include new information about the acquisition of SVB’s British branch.

Featured Image Credits: Crunchbase News