Jumia Is Returning To Its Old Playbook After ‘Plan B’ Flops

African e-commerce heavyweight Jumia faced a significant setback in Q2 2023, as the company reported a 28 percent dip in active customers, a hefty 37 percent plunge in orders, and a 15 percent slide in revenue compared to the previous year. The decline was attributed to unfavourable macroeconomic conditions and struggles with local currency depreciation in African markets.

In the first half of the year, Jumia saw a drop of 1 million customers and 6 million orders compared to the same period in 2022, according to its Q2 earnings report released on August 15. During the April-to-June timeframe, Jumia’s sales value nosedived by 25 percent to USD 202 M, leading to a 15 percent revenue reduction to USD 48.5 M. The customer count remained steady at 2.4 million for the year.

Jumia’s CEO, Francis Dufay, pointed to the company’s grappling with “a very challenging macro environment” for its performance woes, a rationale he had previously employed to explain the Q1 downturn. Dufay highlighted a substantial average inflation of 14 percent across Jumia’s 11 markets in June 2023, which adversely affected consumer spending and sellers’ stockholding capacities.

Notably, Jumia managed to curtail its losses, reporting a USD 19.3 M loss in Q2, representing a 66 percent drop compared to the previous year. This marked its lowest quarterly loss in four years, attributed to prudent expense management in areas like deliveries, sales, and advertising.

Despite its efforts, Jumia’s attempts to pivot toward profitability have yielded limited success since its landmark 2019 New York Stock Exchange debut. A strategic shift from higher-end products to more commonplace items like cosmetics and food delivery failed to deliver desired outcomes. Dufay acknowledged the failure during the recent earnings call.

In response to challenges posed by inflation and currency depreciation, Jumia is now revisiting its original strategy of focusing on high-value items. This shift entails a move away from unprofitable categories with limited customer lifetime value.

Jumia’s course correction doesn’t end there. To counter the downturn, the company is investing in expansion into rural areas for new customer acquisition, aiming to diversify its sales landscape after a strong urban focus. Nigeria, Ivory Coast, Kenya, and Uganda have shown promise in this regard, Jumia previously communicated.

Dufay’s streamlining has led to the discontinuation of Jumia’s Prime program, an unsuccessful emulation of Amazon’s model in Africa. Additional cost-cutting measures include company-wide layoffs, ending grocery deliveries and removing certain products from the platform. These decisions reflect a shift toward pragmatism.

While the decline in losses signifies some progress, Dufay must navigate a market climate that could further amplify macro issues hampering user growth. The prospect of rising inflation and currency devaluation is anticipated to exacerbate these trends, raising questions about when Jumia can anticipate a rebound in growth.

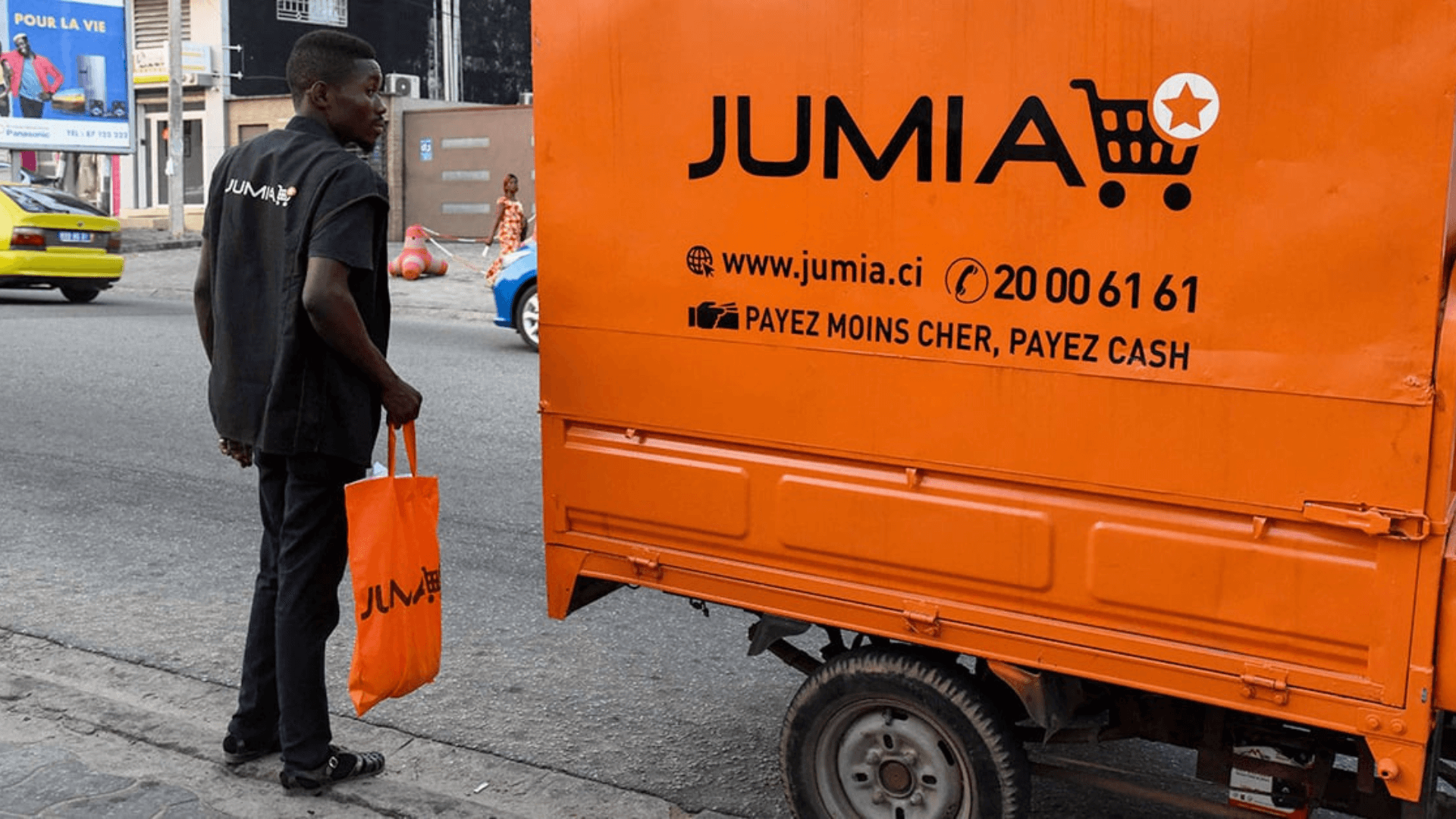

Featured Image Credits: Jumia Group