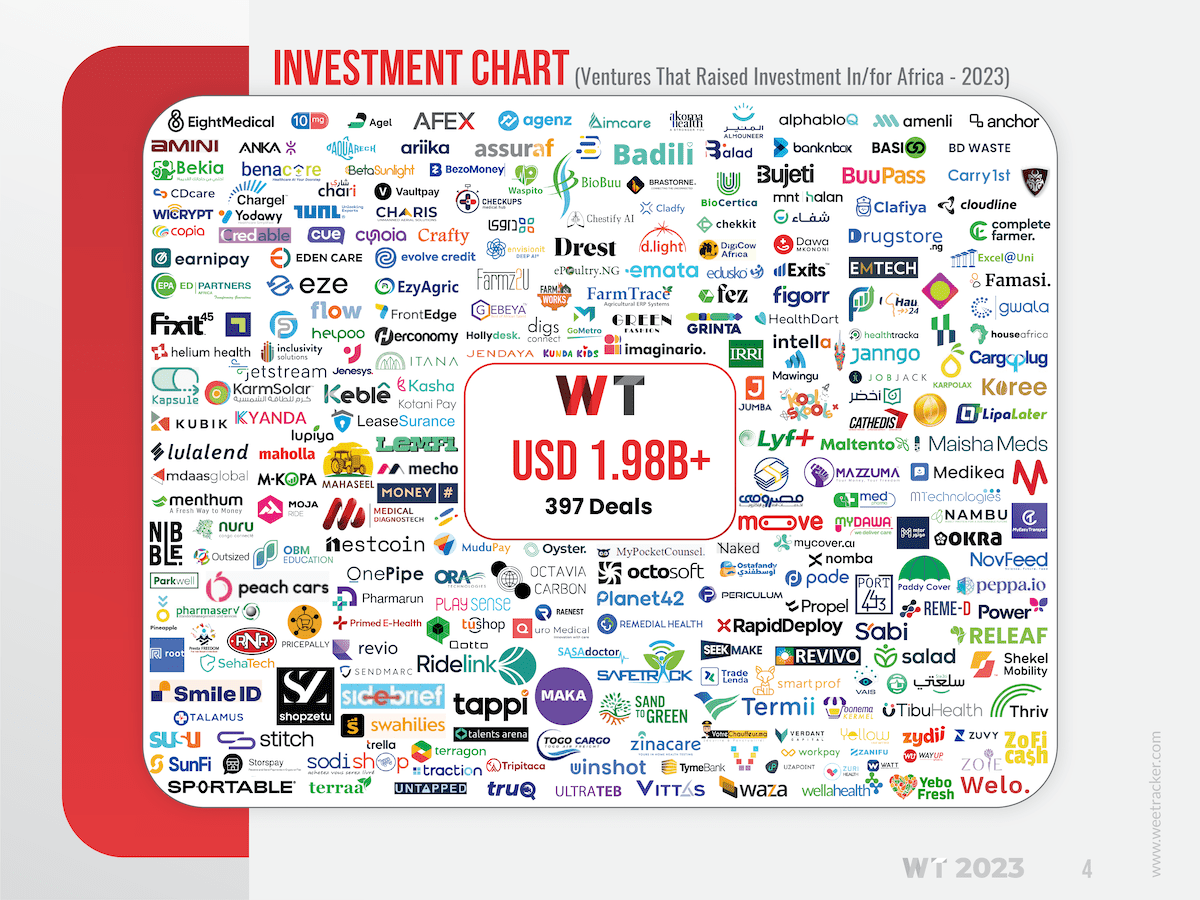

African Ventures Raised USD 1.98 B in 397 Deals – WT Report

Snapshot

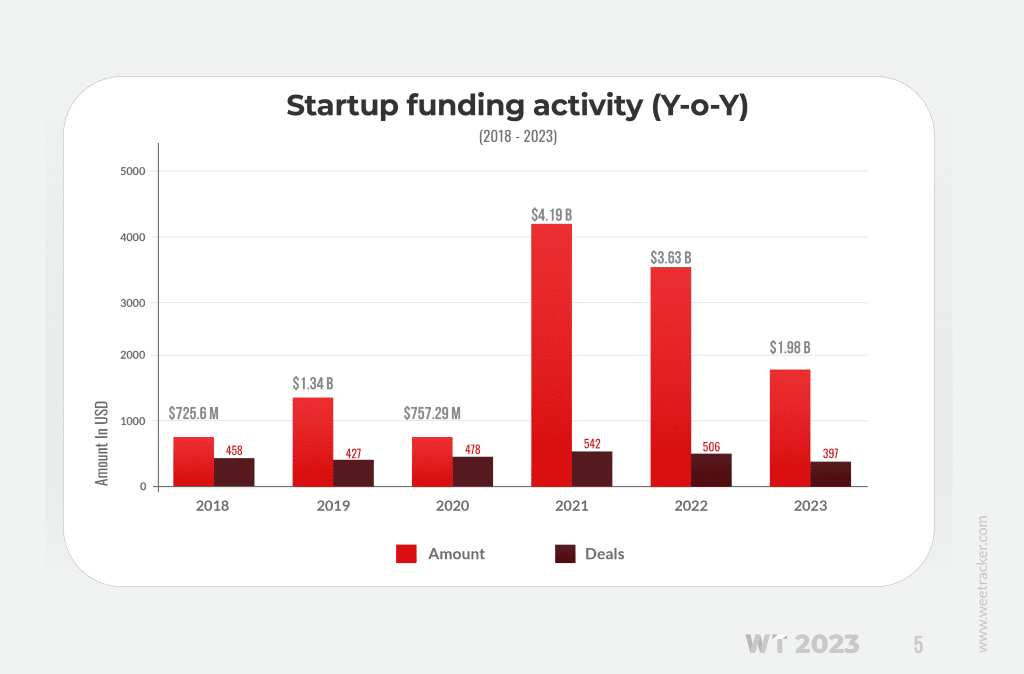

In the year 2023, African startup funding had a relatively decent year with a healthy mix of acceleration, early-stage, growth-stage, and debt deals. As per the publicly disclosed data collated by WT, African startups raised USD 1.98 B in 397 deals. This amount is 47% less than the previous year’s (2022) total funding value of USD 3.63 billion and represents a decline of 27% in total number of deals.

Compared to the previous years (2021 and 2022) where the funding amount experienced a surge in activity due to spillovers and surplus in external funding, 2023 was a year of ‘correction’. It is important to note that the funding activity in 2023 is almost similar to that of 2019.

In 2019, African startup funding crossed the billion-dollar mark for the first time. In 2023, it almost reached the two billion dollar mark, which appears to be the consequence of organic funding activity. Although several companies shut down in 2023, very few did so due to lack of funding. These shutdowns dominated conversations throughout the year. It would appear that the pressure of Venture Capital expectations from this growing ecosystem puts it under much strain.

Sector, Country and Top Deals

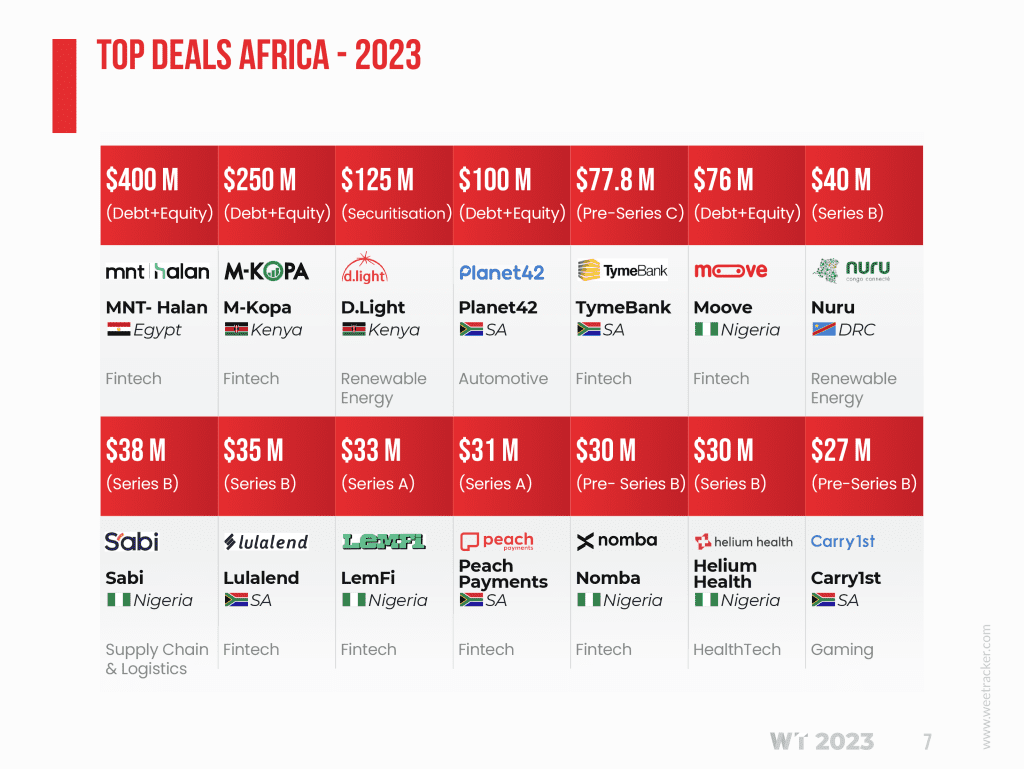

Investors in the African fintech sector continue to believe in its potential. This trend is driven by the scalability and importance of fintech products, which are mostly digital. Furthermore, the fintech industry offers a higher likelihood of mergers and acquisitions, or exits, than any other sector. In 2023, fintech startups in Africa raised a total of USD 1.16 B (105 deals), which accounted for nearly 60% of the total funding received. However, this value represents a 30% decline from last year’s (2022) fintech funding (USD 1.65 B), which was a 30% decrease from the 2021 funding value of USD 2.31 B.

It’s worth noting that Kenya emerged as the top destination for venture capital investments in Africa in 2023. This was an unexpected turn of events, especially considering that almost half of the total funding value of USD 522 M (84 deals) came from a single deal by M-Kopa worth USD 250 M. Despite this, Kenya managed to surpass Egypt’s total funding value, which included USD 400 M from MNT-Halan, the largest deal of the year. Egypt secured the second position with a total funding value of USD 473 M.

Interestingly, in both 2019 and 2023, the majority of the total funding amount came from the mega deals, accounting for 83% and 65%, respectively.

About the report

“Decoding Venture Capital in Africa – 2023” is our sixth Annual report on the African startup ecosystem. Through our platform, weetracker.com, we have been observing, discussing, and meticulously documenting the ecosystem. Our media platform forms the backbone of our insights into this robust ecosystem. The research report is based on the analysis of 397 publicly disclosed deals by startups, accelerators, prized competitions, and investors.

In our methodology, we do not consider deals that are privately shared with data collectors or aggregators, as the ultimate authenticity of the deals cannot be verified. We follow a conservative approach to assessment, and our numbers can be understood as the guaranteed minimum. Hence, we state our numbers as USD 1.98 B (+), which means the African startups have definitively raised no less than USD 1.98 B.

This report will provide information about top countries, sector-wise funding, most-active investors, fund launches, mergers and acquisitions, top deals, and many other data tables.

Our Annual Venture Capital Report is complimentary for our WT Premium Elite Members and at a 50% discount for WT Premium Annual Members. Guest readers and Freemium readers can access the report for USD 110 from the link below or subscribe to our Premium Elite Membership ($110/annum) and access the free copy of the report.

You can also check our previous reports here.