While headlines trumpet a tech boom in Africa’s biggest economies, a quieter revolution is unfolding in the heart of Mozambique.

Despite boasting rich natural resources and a young, dynamic population, Mozambique's economic journey has been riddled with challenges. Political instability, natural disasters, and high public debt have tempered its growth. However, a vibrant startup scene is emerging, tackling these very hurdles with innovative solutions.

Roscas, a young fintech startup named after the acronym for "rotating savings and credit association (ROSCA)," is a prime example. It's chipping away at the vast unbanked population by leveraging technology to empower a deeply ingrained tradition: the self-help group.

These groups, typically comprised of friends, family, or neighbours, pool their savings regularly. They act as a vital safety net and access point to credit for those excluded from the formal banking system.

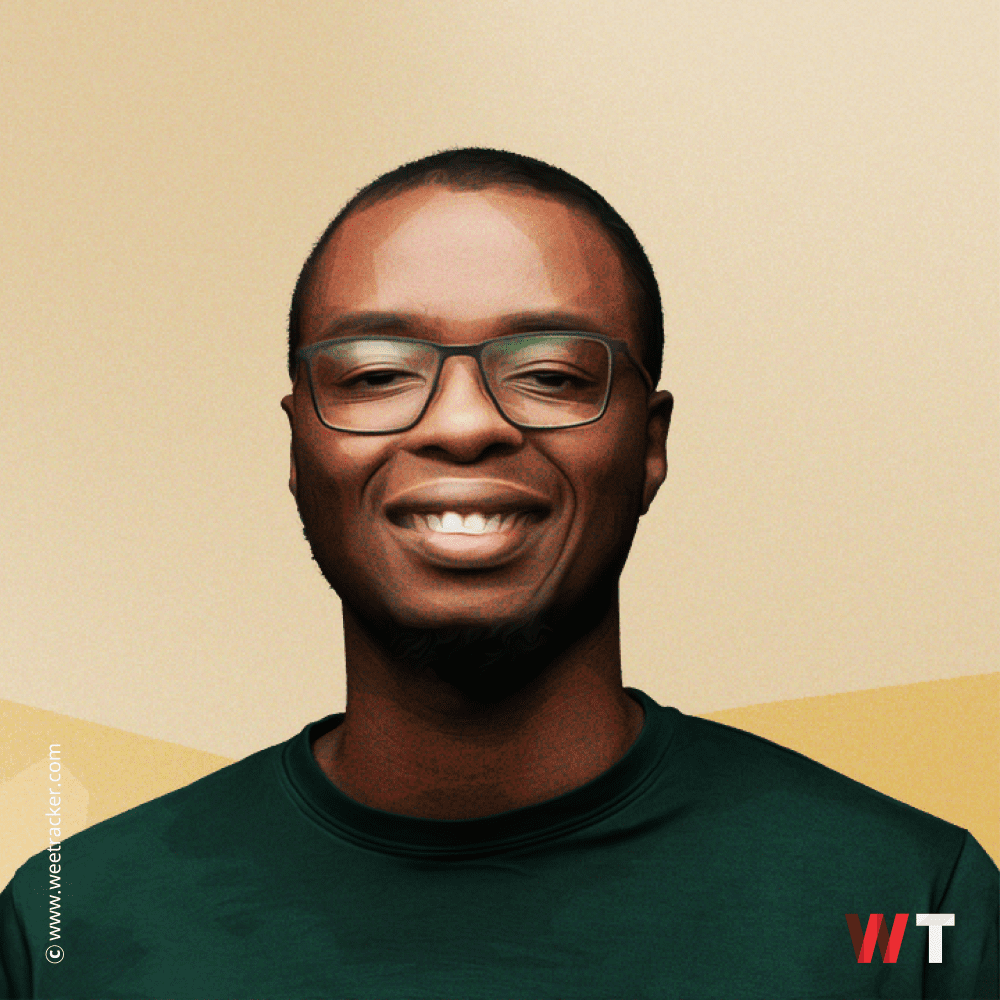

The scale of this informal financial sector is staggering. "The reality is that 80% of the population is informal," says José Samo Gudo, co-founder of Roscas. "They're not in the national pension scheme. There's a lot of problems to be solved."