Africa’s climate tech scene is witnessing a massive influx of capital, as billions of dollars pour into startups and solutions across the continent.

From renewable energy to sustainable agriculture, entrepreneurs and investors alike are betting big on technology’s potential to not only mitigate the devastating impacts of climate change but also create economic growth in a region increasingly vulnerable to its effects.

Yet, beneath this optimism lies a tension between hope and hype. While there’s little doubt that climate tech offers transformative possibilities, some stakeholders are cautious about whether the current investment boom is grounded in African realities or driven by global hype cycles.

Others warn that while the money is flowing, the practicality of many climate tech solutions remains unproven in Africa's unique market.

A flood of capital

The numbers tell the story. This year, climate tech has claimed a third of the continent’s total funding with USD 413.9 M raised as of September, data from our deals database WT Elite shows. Among this year's top deals are D.Light's USD 176 M round, Spiro's USD 50 M raise and BasiGo's USD 42 M debt and equity raise most recently.

That figure, already twice as much as the 2023 total, is a sharp rise from previous years where climate tech lagged behind sectors like fintech and e-commerce.

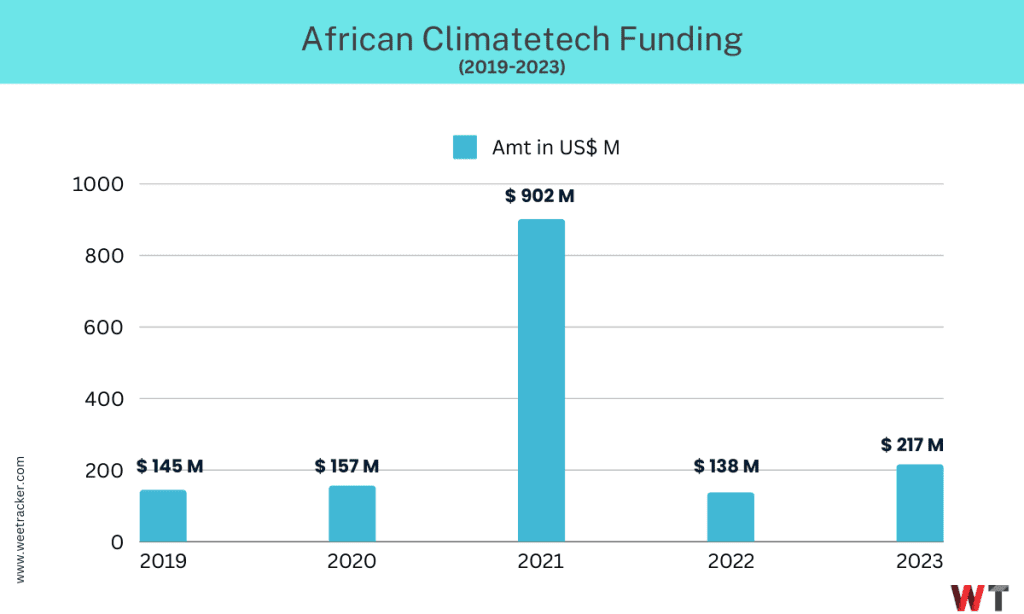

Maxime Bayen, coordinating partner at Catalyst Fund, a notable investor in climate-resilient tech, offers some perspective: “Climate tech funding has been growing in absolute numbers over the past five years. Yet, it didn’t benefit from the 2021 and 2022 investment booms as much as fintech. However, in 2023 and 2024, the tide shifted, with climate tech funding regaining its share,” he told WT.

Funding for climate tech startups in Africa has been steadily increasing, with over USD 1.5 B raised since 2019, per WT Elite. Africa is now home to a growing number of climate tech startups, spanning sectors such as renewable energy, sustainable agriculture, and mobility.

Some of these startups have reached later-stage funding rounds, such as SunCulture, Pula, and Roam, signalling that the sector is maturing, as Bayen asserts. He emphasises that this growth is far from a short-lived bubble: “We’re talking about an 8 to 10-year trend, quite far from a bubble. Climate tech is not new, and the growth we’re seeing is a continuation of that trend.”

But is all this money well-spent?

Not everyone thinks so. Idris Ayodeji Bello, founding partner at LoftyInc Capital, is cautious: "A lot of it is going to go down the drain. It’s great but a lot of it is not sustainable. Climate tech is still a buzzword. We see money going into sectors like EVs, but that’s not sustainable in Africa yet. There’s no FOMO for us when it comes to climate."