From Gift Cards to Fintech: Inside Nigerian Cardtonic’s Bootstrapped Story

Nigeria’s fintech industry has rapidly grown into one of Africa’s most vibrant startup ecosystems, driven by mobile payments, digital banking, and alternative finance solutions. Within this landscape, gift cards—once viewed simply as retail vouchers—have taken on a new role as tools for liquidity, remittances, and online transactions. Analysts estimate Nigeria’s informal gift card trading market exceeds USD 2 B annually, with platforms now stepping in to formalise the space, adding layers of trust and convenience.

Cardtonic, founded in 2019 by Faturoti Kayode & Balogun Usman, has been one of the pioneers of this transformation. What began as a platform for Nigerians to convert unused gift cards into cash securely has since expanded into a multi-service fintech operation with a presence in Nigeria and Ghana. In this interview, co-founder Faturoti Kayode a.k.a. Kay, reflects on Cardtonic’s founding story, self-funded growth, and the company’s evolving role in Nigeria’s digital finance ecosystem.

Q: Take us back to the origins. What gap did you and your co-founder see in the market that led to the birth of Cardtonic?

Kay: In 2018, moving money in and out of Nigeria was a real headache. The banks weren’t making it easy if you wanted to pay for something abroad. I remember clearly that my girlfriend at the time, a makeup artist, was trying to place an order on Sephora but couldn’t get the payment. I started digging around and found someone on Paxful selling Sephora gift cards. I bought one, redeemed it on the site, and the order went through just like that.

That small workaround planted a seed in my mind: if she had this problem, thousands of others had to be in the same boat. At the time, though, I was tied up running an edutech platform for Nigerian students and doing freelance development gigs on Fiverr and Upwork so I couldn’t chase the idea immediately.

Around then, Usman was already in my circle — we had known each other since our student days. A few months earlier, he helped me close a real estate deal, and two things stood out: his hustle and honesty. In fact, he once returned a discount he didn’t even have to mention. That stuck with me. So when this idea began to take shape, I knew who to call. I pitched it to him, put ₦5 million on the table as starting capital, and asked him to run operations. That was the beginning of Cardtonic.

In the early days, we got traction from forums like Nairaland. Everything was manual then — finding people who needed to make international payments, sourcing discounted gift cards, and selling them at slimmer discounts. It worked, and soon dropshippers started coming to us. At one point, we had more than 100 dropshippers relying on us for orders, which boosted revenue.

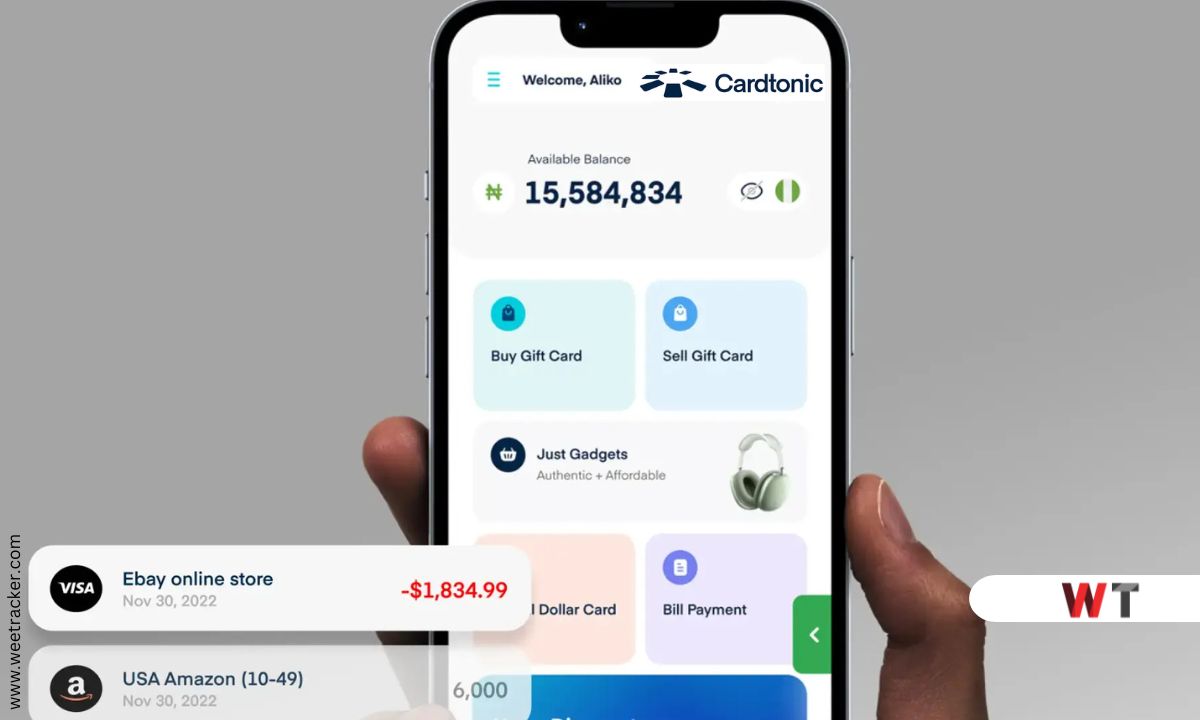

By 2020, we launched the first version of the Cardtonic app, moving from a manual process to a proper digital platform. And in 2021, when Nigerian banks slashed international spending limits on Naira cards to as little as USD 20 per month, gift cards stopped being a hack and became a lifeline. Cardtonic was right there to meet that surge.

Then in 2023, we doubled down by launching Virtual Dollar Cards, which gave people a reliable way to pay for international services, shop globally, and sidestep the constant restrictions tied to local bank cards. For us, it was a natural extension of the same mission: if people can’t pay, we’ll find another way to make it possible.

Q: Cardtonic has been bootstrapped since inception, unlike many fintechs that rely heavily on venture capital. Why did you choose this path?

Kay: From the beginning, Cardtonic was designed to be self-sustaining, such that the business funds itself. That discipline scales, it’s what allows us to pay salaries and grow the team without outside money.

We also run a lean mindset, even if we’re now 120+ people. We don’t chase vanity projects or unnecessary expenses. You’ll hardly see us on billboards or other marketing spends that we can term ‘not necessary’. We believe a good product speaks for itself.

And finally, it helps that we’re solving a real, urgent problem. People need alternatives for payments in Nigeria, and that demand fuels steady revenue.

That steady revenue is what keeps the lights on. So the coping mechanism is simple:

- Build around real cash flow.

- Stay lean and intentional.

- Let growth pay for growth.

Q: What were some of the milestones that validated your approach?

Kay: Cardtonic’s growth has been steady, intentional, and accelerated by real market gaps in Nigeria’s digital payments landscape.

2018 → Idea & Manual Start:

Sparked by a personal frustration, we validated the idea that gift cards could solve international payment problems. I put up ₦5M in seed capital, and with Usman running day-to-day operations, Cardtonic started with a completely manual process, sourcing discounted gift cards and reselling to individuals.

Within this phase, we had fewer than 500 active customers.

2019 → Early Scaling:

Expanded from selling to individuals to serving dropshipping businesses that needed reliable payment methods. Revenue jumped significantly because B2B volumes were larger and more consistent.

Within this year, we had more than 2000 active customers. However, revenue grew by almost 500% due to B2B volume.

2020 – Cardtonic 1.0 App Launch:

Transition from manual to product-led. The first app version went live, enabling structured transactions at scale. This was our first major inflexion point in user growth. Within this year, we scaled to more than 50,000 active customers.

2021 → FX Restrictions Boost Adoption:

Nigerian banks slashed international card spending limits to as low as USD 20 per month, forcing people to find alternatives. Cardtonic became the go-to solution, and adoption skyrocketed. Within this year, we scaled to more than 300,000 active customers.

2022 → Cardtonic 2.0:

A complete product revamp, better UX, new categories, and more automation. Community effects began to take hold, with referrals and organic search driving user growth.

Within this year, we scaled to more than 650,000 active customers.

2023/2024 → Cardtonic 3.0:

Major expansion into virtual dollar cards to further double down on the alternative payment method solution. At this point, Cardtonic evolved into a multi-product digital marketplace. User base crossed 1M+, with 300K MAU and 20K DAU.

Within this year, we scaled to more than 1,200,000 customers.

2025 → Today:

We’re now at 1.5 million users.

Q: Nigeria’s fintech space is known both for innovation and for challenges like regulation, fraud, and infrastructure. How has Cardtonic navigated these hurdles?

Kay: Fraud has always been a major risk in any space dealing with money, so we tackled it from day one with strict KYC and layered security systems. On regulation, we’ve built adaptability; we know policies can change overnight, and we are ready to adapt just as fast. And for infrastructure challenges like payment or internet downtime, we’ve invested in redundancies so customers never feel the impact. At the core, our approach is simple: anticipate the hurdles, design around them, and keep customer trust intact.

Q: Beyond gift card trading, how do you see Cardtonic evolving in the next five years?

Kay: Over the years at Cardtonic, we’ve realised one big truth: people need reliable alternative payment options. That’s why our Virtual Dollar Card has been making waves, solving real payment problems and delivering results we’re proud of.

Looking ahead, the next five years are about scaling beyond individual users and doubling down on B2B. We will be focused on deeper financial integrations, faster payouts, and a more unified ecosystem.

Cardtonic’s story is emblematic of Nigeria’s fintech journey—innovative, self-driven, and adaptive in the face of challenges. From its roots as a gift card trading platform, it has grown into a diversified service provider, offering thousands of users digital payments, gadgets, and financial tools.

Yet, the broader Nigerian fintech space remains a double-edged sword: on one hand, it’s Africa’s most dynamic market, attracting global interest; on the other, it faces hurdles around fraud, shifting regulation, and infrastructural gaps. Cardtonic’s bootstrapped survival highlights how resourcefulness and customer-centric design can help fintechs thrive without massive outside funding.

As the ecosystem matures, Cardtonic’s trajectory—from plugging a market gap in 2019 to innovating new services in 2024 and beyond—illustrates both the potential and resilience required to scale in Nigeria’s ever-changing fintech landscape.