Egyptian Remittances Double in Ten Years and Surge 66% in One Year

Egyptians abroad are sending more money home than ever before, delivering a critical boost to the country’s economy.

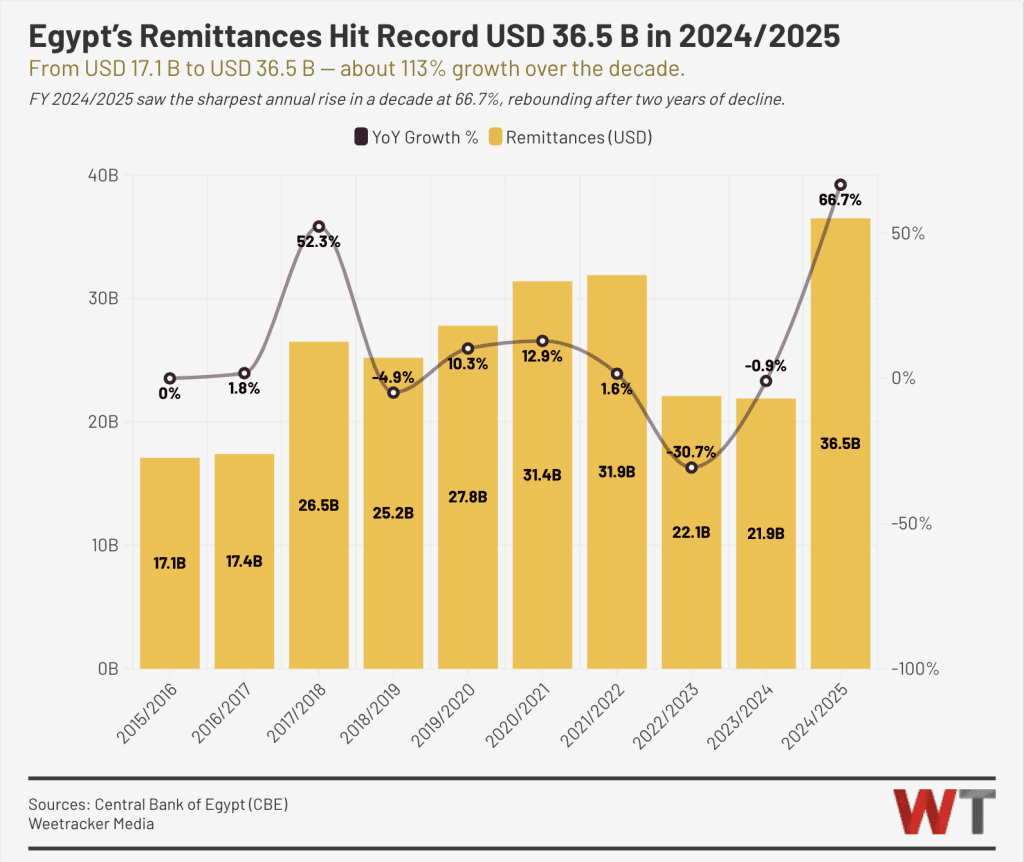

According to new data from the Central Bank of Egypt (CBE), remittances soared to an unprecedented USD 36.5 B in the 2024/2025 fiscal year. That marks a leap of 66.2% compared to the previous year’s USD 21.9 B and more than double the USD 17.1 B recorded just a decade earlier in 2015/2016.

The surge has been nothing short of dramatic. In July 2025 alone, Egyptian expatriates sent back USD 3.8 B, the highest monthly inflow on record. This came on the heels of a similarly strong USD 3.6 B in June, itself up 40.7% year-on-year from June 2024.

The latest fiscal year shows a trend of consistent growth. Between January and May 2025, remittances increased by 59% compared to the same period the previous year, reaching USD 15.8 B. In the final quarter of the fiscal year, from April to June, inflows climbed to USD 10 B, representing a 34.2% increase from the USD 7.5 B recorded in 2024.

Looking further back, the trend underscores how far Egypt has come in just a few years. Inflows had stood at USD 31.4 B in 2020/2021, rose slightly to USD 31.9 B in 2021/2022 during the peak of the 2020 pandemic, then fell back to around USD 22.1 B in 2022/2023 and USD 21.9 B in 2023/2024. The rebound in 2024/2025 marks a significant turnaround, propelling remittances to levels never before seen.

A Lifeline for the Economy

For Egypt, the importance of this surge extends beyond the statistics. Millions of families depend on money sent from relatives working in the Gulf, Europe, and beyond. For them, these transfers mean food on the table, tuition fees covered, and medical bills paid.

At the national level, they represent a direct inflow of foreign currency that helps stabilize the exchange rate, ease inflationary pressures, and reduce dependence on external borrowing.

The impact is most visible in Egypt’s foreign reserves, which have risen in lockstep with remittances. Net international reserves reached USD 49.3 B in August 2025, up from USD 48.7 B in June. By contrast, reserves were only USD 17.5 B in June 2016. In less than a decade, they have nearly tripled, giving Egypt greater capacity to withstand global shocks ranging from volatile oil prices to disruptions in international capital flows.

The scale of these flows has turned the Egyptian diaspora into an indispensable partner in the nation’s economic stability. Each transfer, whether small or large, strengthens household security and contributes to the country’s balance of payments.

In aggregate, they have become one of Egypt’s most reliable sources of foreign exchange, arguably more stable than portfolio investment and less volatile than global commodity markets.

Human Factor and Government Reform

Behind the record numbers lies Egypt’s vast diaspora, estimated at more than 10 million people spread across the Gulf states, Europe, North America, and beyond.

For those working abroad, remittances serve as both a form of family obligation and an economic contribution to their home country. For those on the receiving end, they are often the difference between stability and hardship.

This resilience has coincided with other positive developments. Tourism revenues, which collapsed during the pandemic, have recovered to record levels. Exports have been expanding steadily, adding further support to the external account. Together with remittances, these inflows have provided a more diversified and stable foundation for Egypt’s foreign currency earnings.

The Institute of International Finance has described the surge in inflows as a “robust buffer against global shocks,” highlighting how remittances, tourism, and exports together have reinforced Egypt’s external position.

Part of the story also lies in the government’s reform program. The International Monetary Fund has emphasized that the record remittances are also a reflection of faith in the government’s broader reform agenda, which began in March 2024 and included exchange rate adjustments, fiscal tightening, and measures to attract foreign investment.

With this trend, Egypt is making a comeback from dwindling reserves and remittance inflows in the past year and is set to reach a historic high of USD 40 B in 2026