Paystack Claims Profitability, Unveils New Bet On AI In Structural Shakeup

Five years after its high-profile acquisition by global payments giant Stripe, African fintech Paystack has reached a financial milestone, announcing group-level profitability as it restructures into a broader technology holding company with plans to push into artificial intelligence.

The company is launching The Stack Group (TSG), a new parent company that will house its core payment business alongside newer ventures like a consumer payments app, a microfinance bank, and a venture studio focused on building a variety of products, including, notably, AI-led products.

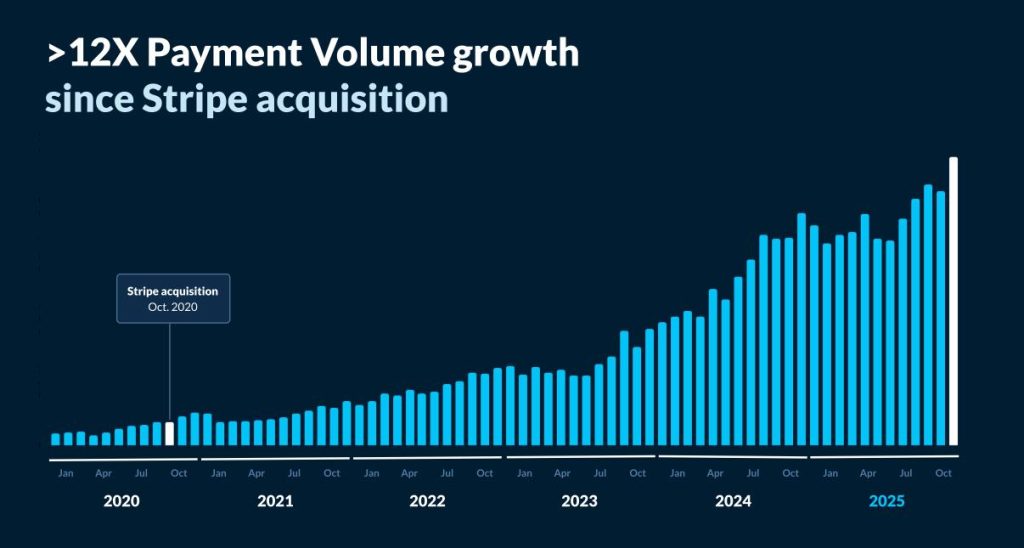

The move comes as Paystack reports its payment volume has grown more than twelvefold since Stripe’s USD 200 M acquisition in 2020. This scale-up has translated into profitability, providing the financial cushion for the company to experiment beyond its core business.

“Having worked with thousands of companies across the continent since 2016, it is clear that there are significant opportunities to support businesses beyond payments, and TSG enables us to address the challenges African companies face,” Paystack’s Co-Founder/CEO Shola Akinlade said in a statement.

TSG reflects a strategic pivot from being a single-product payments company to what its Chief Operating Officer, Amandine Lobelle, calls a “multi-brand technology group”. A key driver is gaining more control over its financial infrastructure.

Through its newly acquired microfinance bank (Paystack MFB), the company can now directly hold deposits and offer credit to its network of over 300,000 Nigerian merchants, reducing its reliance on third-party banking partners.

The new holding company structure is designed to manage risk and sharpen focus. The regulated, cash-generating payment and banking operations—Paystack, Zap, and Paystack MFB—will operate as independent subsidiaries. This separates their stable businesses from the higher-risk, experimental work of TSG Labs.

The model also has practical benefits. If one subsidiary, like the consumer app Zap, were to face regulatory penalties, the financial and operational impact on the group’s other businesses would be contained.

The most forward-looking part of the plan is TSG Labs, a venture studio tasked with building products “both within and beyond financial technology,” with AI-led offerings highlighted as a priority.

“The mandate is to solve both fintech and non-fintech problems that are critical to Africa’s digital future and development,” Lobelle says. The company declined to provide details on specific AI products in development.

The restructuring follows a broader trend in African fintech, where successful companies are evolving from narrow startups into diversified technology groups. Firms like Interswitch and Moniepoint have taken similar paths, creating holding company structures to manage multiple business lines.

Notably, Stripe remains a founding shareholder in the new TSG, alongside Paystack’s CEO Akinlade and existing employees. This suggests Stripe is granting its African subsidiary significant strategic autonomy to pursue growth beyond the original payments mission.

“The launch of TSG signals a larger scope of ambition for us and sets the tone for the next decade of our company,” Akinlade added.

Agreements for the new structure were signed in October 2025 and are pending regulatory approvals.