A USD 15 Bn Share Sale Bleak For HKEX As Alibaba IPO Gets Drowned In City Protests

Alibaba, the largest e-commerce platform in China, has hit the snooze on its plan to listing on the Hong Kong Stock Exchange, an IPO that could raise the giant a possible USD 15 Bn.

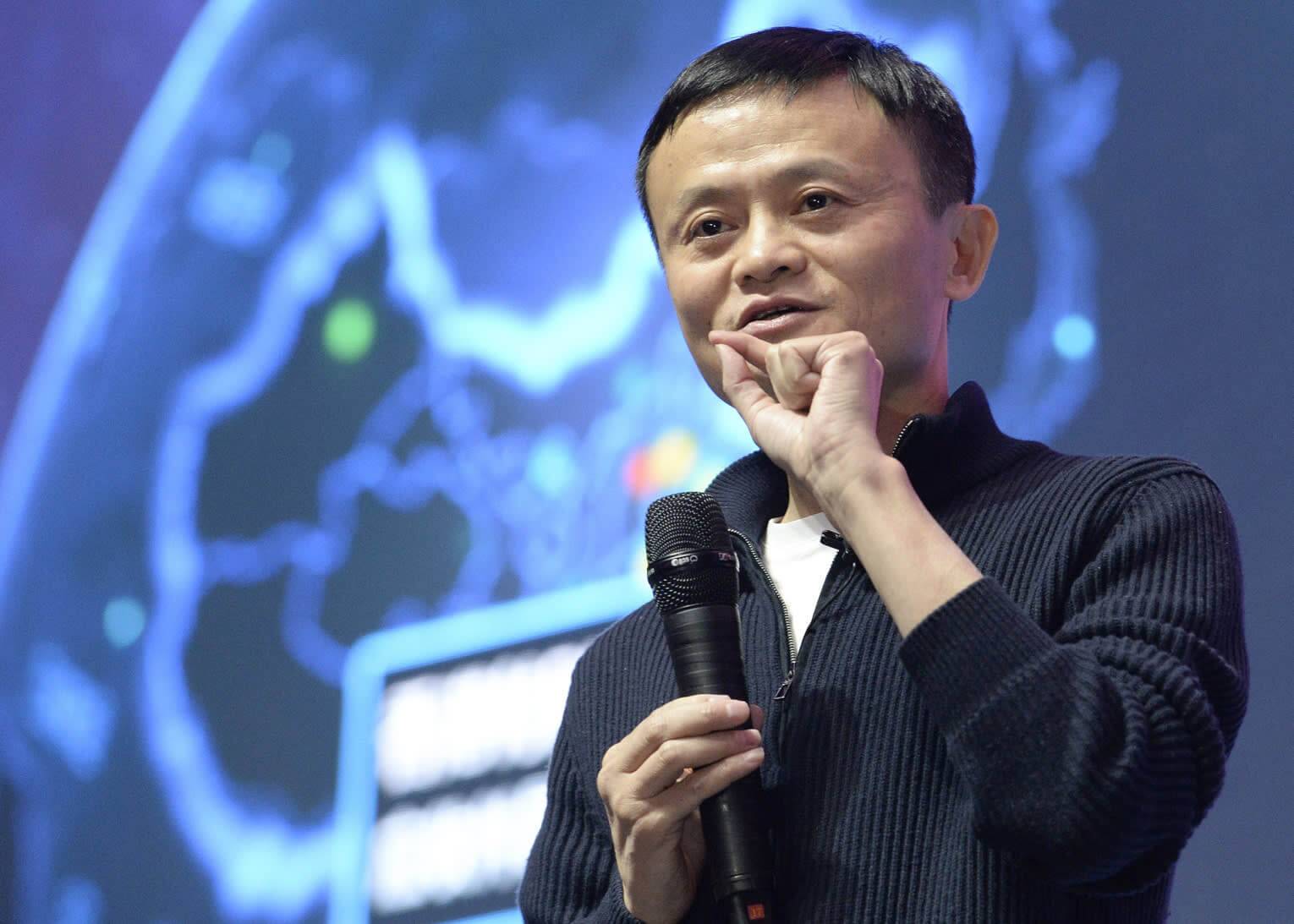

The political turmoil happening in the Asian financial hub is making the stock exchange lose it’s biggest catch in years again, while this may just be another postponement for the Jack Ma-led company.

It appears that the Hong Kong Stock Exchange is on the losing side of the fiasco. Alibaba currently has a market cap of USD 461 Bn, and it’s most recent interim reports showed that its second-quarter revenue surged 42 percent to USD 16.7 Bn over last year.

The e-commerce giant’s net income more than doubled in the same period to USD 4.5 Bn. Alibaba, in 2014, made history when it pulled off the world’s most significant IPO, raising USD 25 Bn.

If past actions are anything to go by, it’s safe to say that Jack Ma is the kind of founder who believes that if a company waits until it needs cash before raising it, it’s too late.

Apparently, Alibaba does not really need the money. The future is, in fact, brighter for the local stock exchange, who through the USD 15 Bn sale would deliver a big deal of transaction and listing fees.

HKEX forewent the chance to lay claim to Alibaba’s all-time-high 2014 IPO because the company wanted to go public with what were essentially dual-class shares. The deal was to give the Chinese group’s small group of managers greater control of the company.

It appears the stock exchange wanted to hammer on the “one shareholder, one vote” maxim, wittingly rejecting Alibaba’s offering. While it’s primary B2B business -Alibaba.com – were already listed in a 2007 Hong Kong IPO, Alibaba took it’s proposal to where the grass proved greener.

As we may agree, the exchange cannot afford to lose a second shot at an Alibaba IPO. With all the makings of the globe’s biggest equity deal of the year and the largest follow-on sale in seven years, this listing will give the e-commerce platform a war chest for technology investments. HKEX recently went soft to lure overseas-listed Chinese tech giants into listing where it’s closer to fatherland.

Smartphone maker Xiaomi Corp was the first to take advantage of the new rules, raising USD 4.72 Bn in a USD 54 Bn valuation. The modification as well helped the stock exchange become the world leader in IPOs last year, with 135 companies raising a combined USD 36.5 Bn.

It’s understandable to see why the listing, which Reuters says might be postponed till October, is very critical for the exchange. At least, by then the protests would have been resolved as China will be in the spirit of celebration for its 70th anniversary on October 1.

Alibaba is not the only Chinese company in an IPO development. The smartphone maker Transsion Holdings is also planning to list on the darling Shanghai STAR Market with intentions to raise USD 426 Mn.

Featured Image: TechSpot