Is Your Bank In Good Shape? CBN’s Stress Test Shows 7 Banks Facing Serious Risk

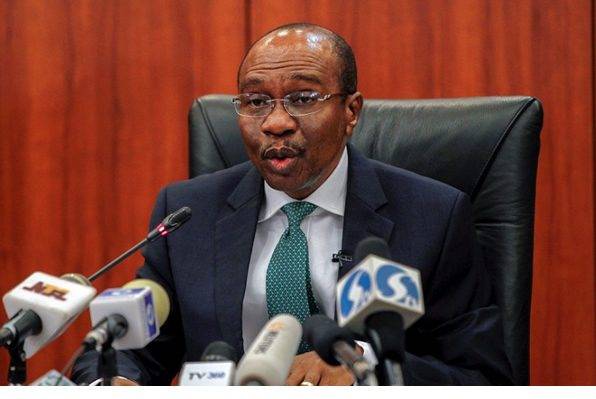

Every once in a while (more like once every year), the Central Bank of Nigeria (CBN) really looks into Nigerian banks.

Actually, the apex bank does quite a good job of lording over commercial banks in Nigeria and keeping them in line. But once a year, it takes a much closer look at those banks to find out which ones are in great shape, and which ones are one financial crisis away from a total meltdown.

The CBN does this by conducting a stress test. And from the latest financial stability report published on CBN’s official website on Thursday, October 17, it can be surmised that, at least, seven banks in Nigeria are not in a good place.

The stress test is part of CBN’s efforts to significantly minimise the impact of risks on the Nigerian financial system. It is used to test the resilience of financial institutions against any future situations. The stress test is carried out to help check the level of a bank’s assets, as well as evaluate internal processes and controls.

And from the data in the latest financial stability report, seven out of 24 commercial banks in Nigeria are not adequately funded in 2018.

The CBN says those seven banks failed the stress test in terms of adequate funding at the end of 2018. The apex bank also revealed that in the less-than-30-day period analysis, seven Nigerian banks were not adequately funded, while in the 31-to-90-day bucket, nine banks had funding gaps.

The CBN, however, left the name of the banks in question unmentioned, possibly to avoid setting off undue panic on the part of the customers. Such panic would only accelerate the very negative outcomes that the CBN is doing the most to avoid.

As per the latest financial stability report, the cumulative position for the industry overall showed an excess of NGN 4.8 Tn assets over liabilities.

It was also stated that the baseline capital adequacy ratio (CAR) for the banking industry at end-December 2018 was 15.26 percent, indicating a 3.18 percent points increase from the 12.08 percent recorded at the end of June 2018.

The stress test result revealed that after a one-day run scenario, the liquidity ratio for the industry fell to 34.69 percent from the 51.87 percent pre-shock position and to 17.55 percent and 13.48 percent respectively, after a 5-day and cumulative 30-day scenarios.

CBN’s latest report also showed that under 5-day and cumulative 30-day run scenarios on the banking industry, liquidity shortfalls fell to NGN 1.58 Tn and NGN 1.98 Tn respectively.