OPay/OKash Shylock Lending Acts Exposed In Damning Report That Could Get The Lending Apps Banned From Play Store

Opera — the Norwegian software company that was taken over by a China-based consortium prior to its IPO in 2018 — is in danger of losing its lending business (which coincidentally accounts for up to 42 percent of the company’s revenue and much of its eye-popping topline growth).

A recent report put out by American forensic financial research firm, Hindenburg Research, lays out shocking revelations of flagrant violations and underhanded exchanges in the lending practices adopted by OPay/OKash (Nigeria), OKash/OPesa (Kenya), and CashBean (India). Opera operates its lending business operates through these four Android apps.

Opera’s Lending Apps May Be Predatory

Hindenburg Research tested Opera’s lending apps between December 2019 and January 2020 and found that all four of its apps were in “black and white violation” of Google’s rule. In fact, none of the loan products offered across Opera’s apps appear to be in compliance with this policy, despite these rules going into effect over 4 months ago.

In August 2019, Google updated its policies to push back on the proliferation of predatory lending taking place on its app ecosystem. The updated policies were much more specific, prohibiting “short-term personal loans” (defined as loans less than 60 days).

The updated policy reads: “We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued (we refer to these as “short-term personal loans”). This policy applies to apps which offer loans directly, lead generators, and those who connect consumers with third-party lenders.”

According to the report, all four of Opera’s apps ‘pretend’ to be in compliance with Google’s policies. But in reality, they all offer prohibited products and the only reason they are still available on Play Store is probably that Google is yet to notice, or perhaps Google does not really care as much as its policies suggest.

For what it’s worth, the forensic financial research firm suggests that the apps have not been banned or required to bring their terms into compliance because each app claims to be in compliance with the new policies in their respective Google app descriptions, but then offers prohibited loans once users have downloaded and signed up for the apps.

What Opera’s Lending Apps Really Offer?

To test the hypothesis that Opera’s lending apps zig despite promising to zag, the Hindenburg Research team tested OKash, OPesa, OPay, and CashBean.

For instance, the Google Play app description for OKash clearly states that its loans range from 91 days to 365 days, which would place it in compliance with Google’s policies.

But these products don’t appear to exist at all. An email from the firm to OKash’s app division even confirmed that loans range from 15 days to 29 days in duration. This was further confirmed after a local consultant applied for a loan through the OKash app. This consultant was given a 2-week loan. This same duration was given for similar loan applications on OPay, OPesa, and CashBean.

OPay, which has become quite popular in Nigeria, has an app description that also makes the same 91-day to 365-day loan term claim. When the company was reached out to for comment, they replied that the loan’s rate and term would be “an origination fee charged of 1.2 percent per day for a fixed term of 15 days.” Besides that, OPay also provided a loan application that offered only loans with a 7-day tenure.

According to the report, all of Opera’s apps exhibit the same pattern: a misleading description that looks to be in compliance, while serving up products that openly violate Google’s terms.

Not that Opera has even done a great job of masking this fact. About 2 months after Google instituted its personal loan policy change, Opera’s Chief Financial Officer, Frode Jacobsen, was asked about the company’s loan profile. Jacobsen stated on the company’s November 2019 conference call that its loan duration was still about 2 weeks.

This is corroborated by Opera’s most recent prospectus, dated September 2019 (after Google’s rule change). Disclosures show that Opera’s entire microlending business provides loans between 7 to 30 days, which all fall outside of Google’s policies. This same prospectus appears to conveniently leave out the detail about the rule change.

Further contact has been made by both WeeTracker and Hindenburg to find out if the company offers loans for any term loan longer than 15 days and no response has been gotten as of the time of publishing.

Opera’s Lending Apps May Also Be Employing Other Underhanded Tactics

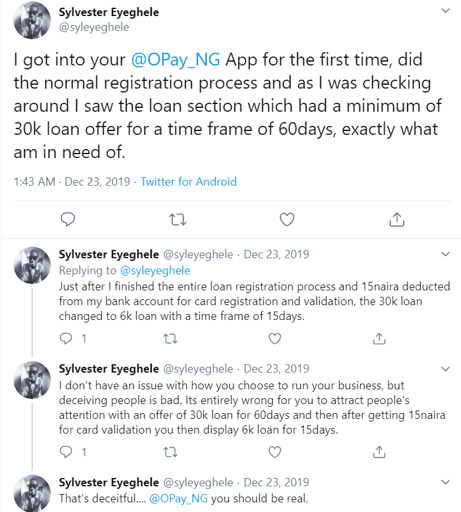

Hindenburg Research also uncovered what looks like a pattern of luring unsuspecting borrowers with a classic bait-and-switch move.

The system works such that the app description lures in users with low rates and long loan length terms. Then once downloaded, the app would suggest users apply for a loan, showing a slightly longer loan length and terms that suggest a higher interest rate.

In a rather rude twist, once the user inputs their personal information and applies (the application attracts a compulsory fee), the apps either denies the borrower or grant a short-term loan with insane rates.

In other words, when users actually apply — a process that requires providing personal information and paying a fee — they appear to instead be granted 15-day loans for significantly lower amounts than they wanted.

Indeed, there have been many complaints on social media about this underhanded tactic. Also, the report said that a former employee of OKash described how unemployed individuals were often totally unaware of the high-interest rates they were to pay until it was too late.

It appears lending apps like OPay also mislead people on the actual amount of interest accompanying the loans. The fine print in loan documents obtained from OPay says the interest rate is 1 percent a day, plus another 1 percent per day if a user is late.

That equates to 365 percent per year, or 730 percent for late borrowers even as OPay’s app description states the loans come with a ‘maximum’ interest rate of 24 percent a year in the form of an origination fee.

It gets even more complicated because when users get into the app, they see options for 60 to 90-day loans with origination fees that correspond to a 91 percent APR.

Opera May Be Tanking Its ‘Best Surviving’ Business By Itself

Opera’s android lending apps — CashBean, OKash, OPay, and OPesa — provided approximately 5 million loans valued at USD 250 Mn in Kenya, India, and Nigeria in Q3 of 2019.

Much of Opera’s lending business is operated through apps offered on Google’s Play Store. Google/Android has over 84 percent market share in Kenya, over 94 percent market share in India, and over 79 percent market share in Nigeria, making it the overwhelmingly dominant platform that individuals in these markets use for personal loan apps. Opera’s access to the Google Play Store is therefore critical to the success of its lending apps.

But now the company risks tanking the lending business that now accounts for much of its revenue, especially since its browser business is in decline.

Opera went public in mid-2018 based largely on prospects for its core browser business. Now, its browser market share is declining rapidly, down by about 30 percent since its IPO. Browser gross margins have collapsed by 22.6 percent in just one year.

Prior to its IPO, Opera was purchased by a China-based consortium. It doesn’t help that the largest investor and Opera Chairman/CEO, Yahui Zhou, was recently caught up in a Chinese lending business that listed in the U.S. and plunged 80 percent in 2 years amidst allegations of fraud and illegal lending practices.

In the midst of its browser struggles, Opera pivoted to lending in Africa and India after the IPO. The pivot has seen the loan business become the company’s symbol of top-line growth while accounting for 42 percent of its revenue, albeit amidst massive defaults and worsening cash flow.

However, the findings in the report may come as an eye-opener into why the lending business has witnessed such astronomic growth in such a short time.

Given that much of Opera’s lending business is operated through apps offered on Google’s Play Store — whose policies those apps are directly in violation of — that business is at risk of disappearing or being severely hit when Google notices.

And who are the worst casualties? That would be the investors caught up in the deceptive game who Opera never told that its ‘high-growth’ microfinance segment is pretty much running afoul of Google’s new laws.

Indeed, the report alleges that the company went on to raise a further USD 82 Mn in a secondary offering, months after the new rules were put in place, without disclosing Google’s changes to investors.