All Forgiven? World Bank And IMF Finally Come To Africa’s Rescue Despite Its Debt Bundle

Two international organizations who both agree that Africa is piling debt it cannot repay have had a much-needed reconsideration. Despite strongly believing that the continent’s borrowing habit is doing more harm than good, the World Bank and the IMF have seemingly buried the hatchet. For now.

All these are in a bid to cushion the impact of the coronavirus pandemic, which has already cost African economies a whopping USD 29 Bn loss.

Debt Suspension

First off, both monetary organizations have hit the pause button on current debt dealings. The WB and the IMF called on all bilateral creditors to suspend debt payments from the International Development Association (IDA) countries that request forbearance.

The move aligns with the national laws of the creditor countries, expected to be effective immediately. These Bretton Wood institutions had this directive pointed out in a joint statement made to official creditors.

Per the statement, the G20 (Group of Twenty) received a request concerning debt relief for the poorest countries in the world in the wake of the COVID-19 outbreak.

The G20 is an international forum for the governments and central bank governors from 19 countries and the European Union.

A WeeTracker report from two days ago (March 24) perhaps saw this leniency coming, as it pointed out the COVID-19 crises calls for these insitutitions to look past Africa’s unsustainable debt.

Africa’s Benefit

Currently, 76 countries are eligible to receive International Development Association (IDA) resources. A perhaps shocking fact is that 39 of these countries are from Africa, the largest for any continent served.

This points to relative poverty, defined by the World Bank as GNI per capita below an established threshold and updated annually (USD 1,175 in fiscal year 2020).

To put things in perspective, there are only 3 IDA countries in Middle East and North Africa, 5 in Europe and Central Asia, and 6 in South Asia. Though East Asian IDA countries are 15, it still does not come close to Africa’s 39.

So, it is easy to see how African countries will mostly benefit from this revision of debt, especially in the coronavirus pandemic.

However, South Africa, the continent’s most indebted country with 792 Bn, is not an IDA country. The country has the most coronavirus cases in Africa—currently at 709—and just entered its third recession since 1994.

IMF’s USD 50 Bn

The IMF appears to be leading by example on the call for debt suspension, as it has dedicated USD 50 Bn to low-income and emerging-market countries, most of which are in (Sub-Saharan) Africa.

The monetary organization will include USD 10 Bn in concessional loans, all of which will be available by early April.

“Our member countries need us more than ever,” the IMF said on its website Wednesday. “Discussions between IMF teams and country officials are advancing quickly.”

The IMF has received requests for emergency financing from almost 20 countries in Africa and expects 10 additional countries on the continent to seek its help, it said.

Earlier this month, the IMF said it “stands ready” to use its USD 1 Tn lending capacity to help countries around the world that are struggling with the humanitarian and economic impact of the novel coronavirus.

There’s no word yet from the World Bank for a COVID-19 loan for Africa, but the Group has already packaged USD 12 Mn in immediate support to assist countries coping with the effects of the outbreak.

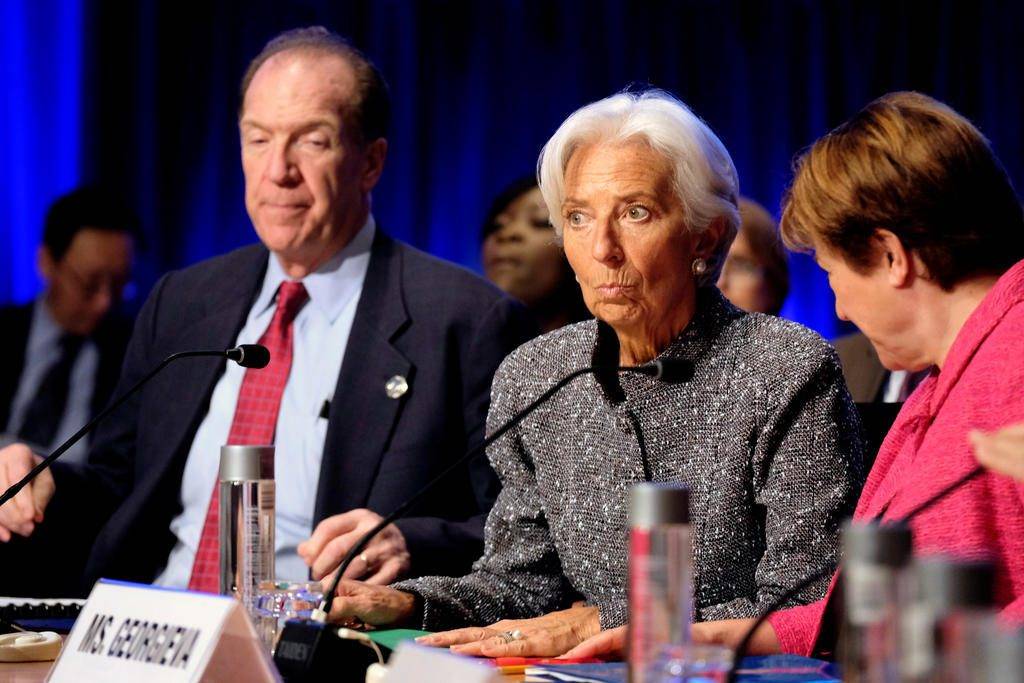

Featured Image: Today Online