Kenya Plans To Tax Digital Service Providers—Including Google & Netflix

The Kenya Revenue Authority (KRA) is planning to capture digital service providers in its tax net, logically in an attempt to boost tax revenue. The change will affect ride-hailing platforms, streaming services and subscription-based digital newspapers.

Digital marketplace services like search-engine, web-hosting, downloadable digital content among others, are also included. That means, popular providers such as Google, Uber, and Netflix will be affected.

Generally, companies that offer digital services in the East African nation will be required to register for value-added tax or appoint a tax representative before they can operate, going forward. Should they fail to do so, the providers risk restriction of access to the Kenyan market.

Kenya did not just start expanding its tax net, neither did its upfront-ness with generating more revenue from it come overnight. The country, already, has a 1.5 percent digital tax policy on the value of online transactions, as provided in its Finance Bill 2020. The bill, also, introduced a levy VAT of 14 percent on a number of goods that are currently exempt.

East Africa’s largest economy, under the new bill, also wants to start levying a minimum gross sales tax of 1 percent, while proposing a minimum tax for all companies operating in the country. Nevertheless, the draft measure remains subject to approval as it is being presented to Kenya’s National Assembly.

Kenya is also one of the few African countries that have recruited new-age technologies to make it harder for people to evade tax. The Kenya Revenue Authority is recognized as a leading technology-driven revenue administrator in the continent.

It has implemented platforms such as i-Tax, Integrated Customs Management System (i-CMS), Customer Relationship Management System, Cargo Scanner Management Solution and Excisable Goods Management System and even Artificial Intelligence and blockchain as strategic instruments to improve tax compliance and minimize operation costs.

All the work has paid off, in part. Kenya’s tax revenue jumped to USD 115.3 Bn in 2019 from USD 13.9 Bn in the previous year, though that was a slight, unexplained shortfall of KRA’s expectations. Tax compliance also experienced an improvment.

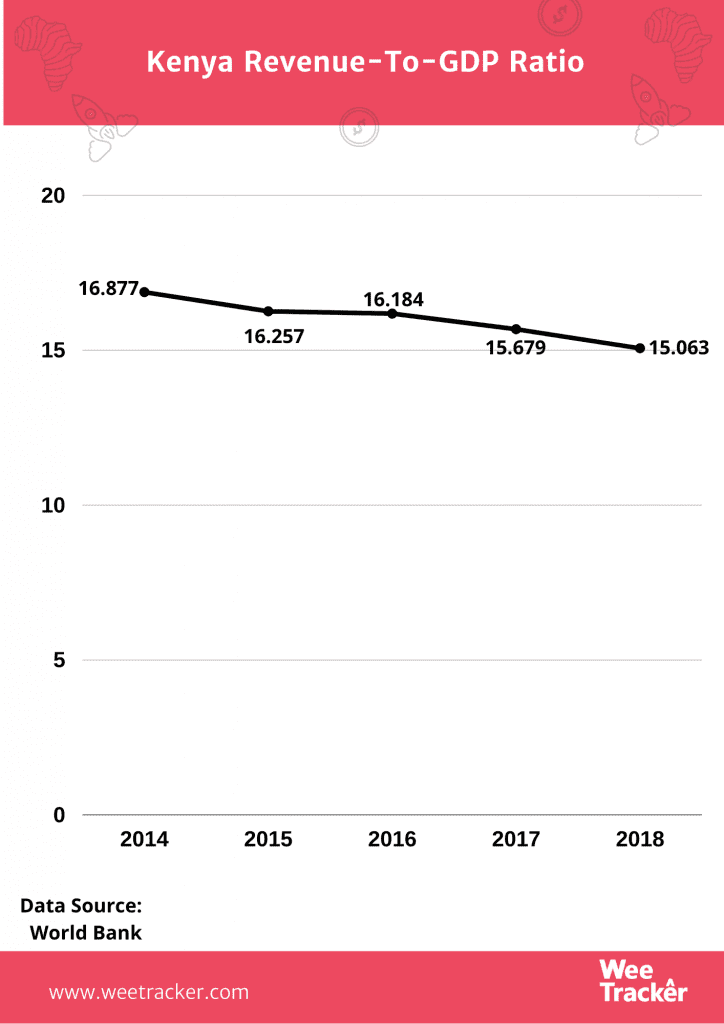

The nation’s goal in revenue mobilization is to raise the revenue-to-GDP ratio from 18.3 percent as recorded within the 2017/18 financial year to 19.2 percent by the 2020/21 financial year.

Nevertheless, tax revenue mobilization in Kenya has failed to match the speed of its relative economic growth, raising concerns regarding the buoyancy of its revenue collection practices. This, mostly, indicates the degree to which money collecte responds to changes in the nation’s overall economy.

A 2018 report from the World Bank point out the less-than-needed tax buoyancy as well as the steady dip in Kenya’s revenue-to-GDP ratio.

“A buoyant tax system has an elasticity with respect to growth in nominal GDP of at least one. However, the buoyancy of Kenya’s main tax categories, namely income tax and VAT, is much weaker,” says the 2018 the Group’s Kenya Economic Update 2018.

Featured Image: Kelly Sikkema Via Unsplash.