The Stage Is Being Set Up For MTN To “Suffer From Success” In Ghana

After watching the company become a juggernaut in the country’s telecoms space, Ghanaian authorities now appear to be concerned about MTN’s grip on the Ghanaian market.

The National Communications Authority (NCA), seems to be wary of MTN Ghana; the Ghanaian subsidiary of South Africa’s MTN Group, pulling off “a Safaricom Kenya in Ghana,” and have moved to check the company’s dominance.

Like Safaricom which commands a market share of over 63 percent in Kenya (Safaricom controls 56.8 percent and 95.5 percent of voice and SMS market share respectively, and 90 percent of the mobile money market), MTN is eating up the competition in Ghana.

Indeed, MTN has the biggest market share in 13 out of the 21 countries where it operates mobile networks in Africa and the Middle East.

This is according to MTN’s five-year review 2019 document published in April. The review shows that back in 2015 the pan-African operator had the biggest market share in 15 countries, but that dropped to 14 countries in 2017 and then to 13 in 2019.

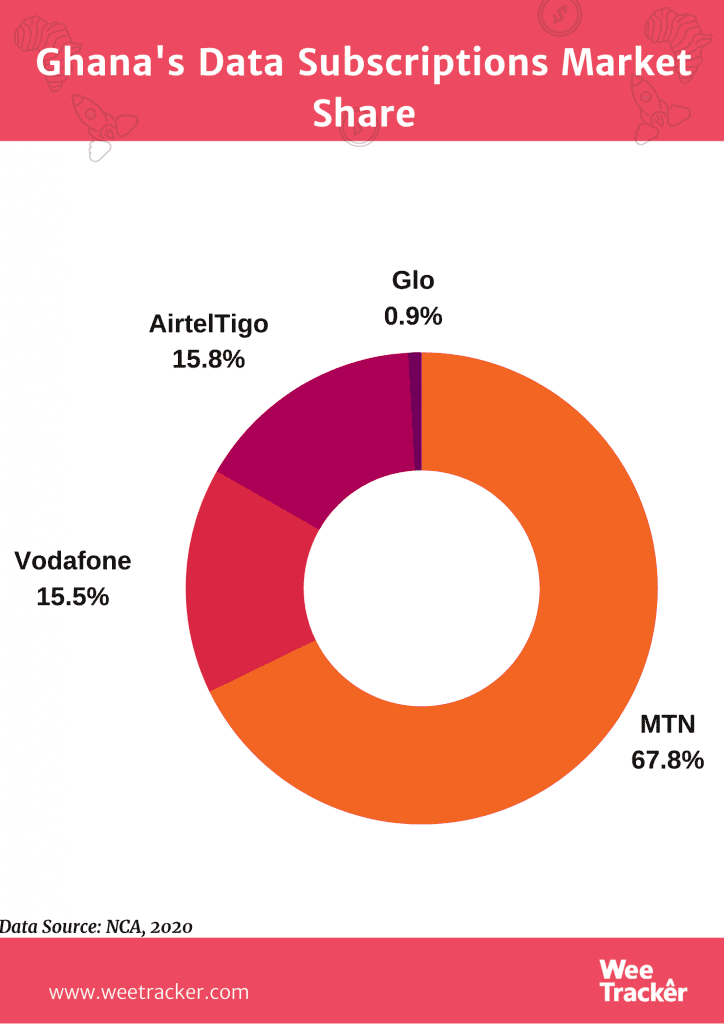

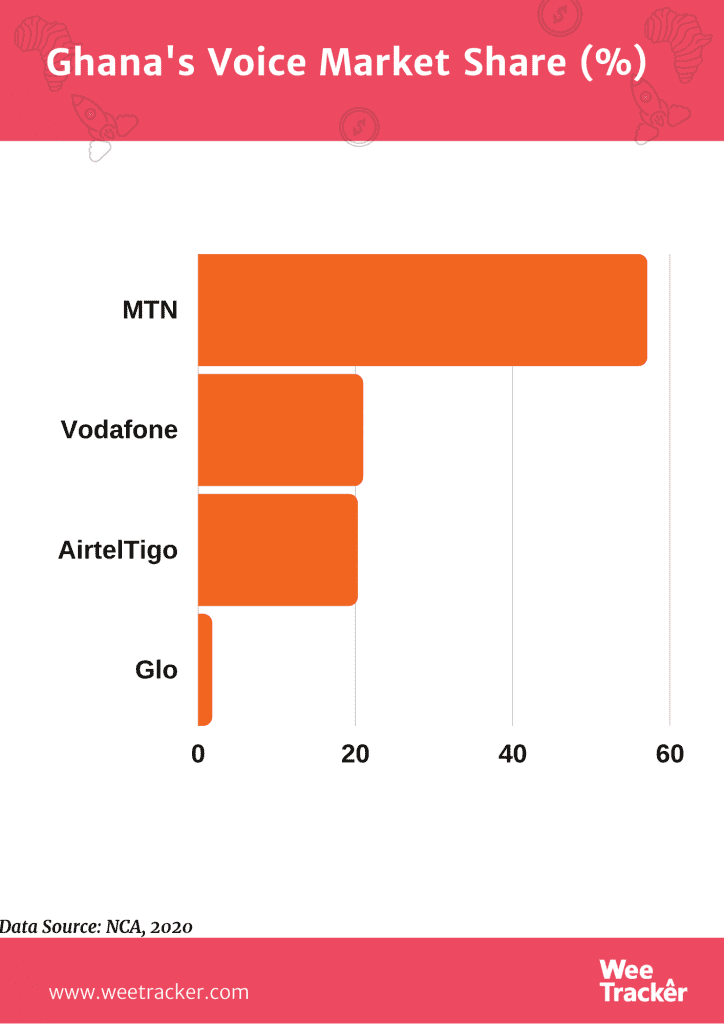

MTN Ghana currently controls nearly 70 percent of the country’s data subscriptions market share and just under 60 percent of voice. It also owns the leading mobile money platform in Ghana, by far outstripping other telcos and even outdoing banks.

It accounted for more than 90 percent of deposits with a combined value of USD 453.8 Mn as of October 2017. AirtelTigo claimed second place, controlling 3.6 percent of the total, while Vodafone took third place, with 2.5 percent.

According to the World Bank, Ghana is the fastest-growing mobile-money market in Africa, and MTN Ghana is pretty much pushing the rapid growth. In a country of 29.7 million people as of 2018, MTN Ghana had 13 million customers on its mobile money service about the same period. At present, the telco is on course to hit 20 million mobile money users by 2022.

However, the highflying MTN Ghana may be about to see its wings get clipped. Ghana will adopt a set of policies to dilute the dominance of MTN in the country’s telecommunications market, the government said in a recent statement.

The NCA will, in the coming days, begin the implementation of specific policies to ensure a level-playing field for all network operators within the telecommunications industry,” the statement reads.

MTN has been declared a significant market power, making it necessary for the regulator to take corrective action to allow more market competition and prevent the creation of an unhealthy monopoly that might knock out the competition and lead to poor standards of service and bloated pricing, ultimately.

The corrective interventions talked up by the NCA include implementing a favourable connection rate for disadvantaged operators, the setting of minimum and maximum pricing on all telecoms and mobile money services, and ensuring that the various operator vendors are not subject to exclusionary pricing or behaviour.

If these measures are implemented, MTN could see its large market share in Ghana become smaller, though the telco maintains it is yet to receive formal notification from the regulator and was awaiting it to assess the details of the new policies.

In Kenya, Safaricom’s vice-like grip on the telecoms and mobile money markets has attracted similar concerns in the past but the telco continues to crush the competition. It’s ubiquitous M-Pesa mobile money platform facilitates up to 96 percent of all mobile money transactions in the country.

In July 2015, there were talks of the Kenyan government introducing new regulations in parliament that could lead to the splitting of Safaricom.

It was widely touted that breaking up Safaricom was going to reduce its dominance. This was supposed to be some kind of victory for rivals like Airtel Kenya, which has long argued that Safaricom’s dominance is anti-competitive.

In early 2017, leaked findings from Analysys Mason (AM); an independent consultant to Kenya’s telecoms regulator, recommended that Safaricom’s voice and data services be separated from its mobile money platform, M-Pesa.

A year later, the same firm sort of abandoned those same recommendations for unclear reasons. Throughout all those episodes, Safaricom played the victim — a company suffering from success.

At the moment, though, it appears Ghanaian authorities want to prevent things from getting that far.

Featured Image Courtesy: WorldRemit