Most of Africa’s Debt Relief Could Come From China After All

The coronavirus-controlled debt tussle in Africa put China in a controversial place. Beijing’s influence in the continent was, once again, questioned as one of Africa’s biggest lenders. Now, however, there’s reason to believe that much of the region’s debt relief will come from China than other bondholders.

No Penalties

The pandemic’s concentration in Africa is described by the WHO as the lowest around the world. Nevertheless, the outbreak has already raised the specter of seemingly uncontrollable debt defaults in developing nations that had to risk their economic growth to try and slow the spread of Covid-19. As such, the demand for raw materials has gone through the roof, and one of the best ways out is to seek debt relief—at least for now.

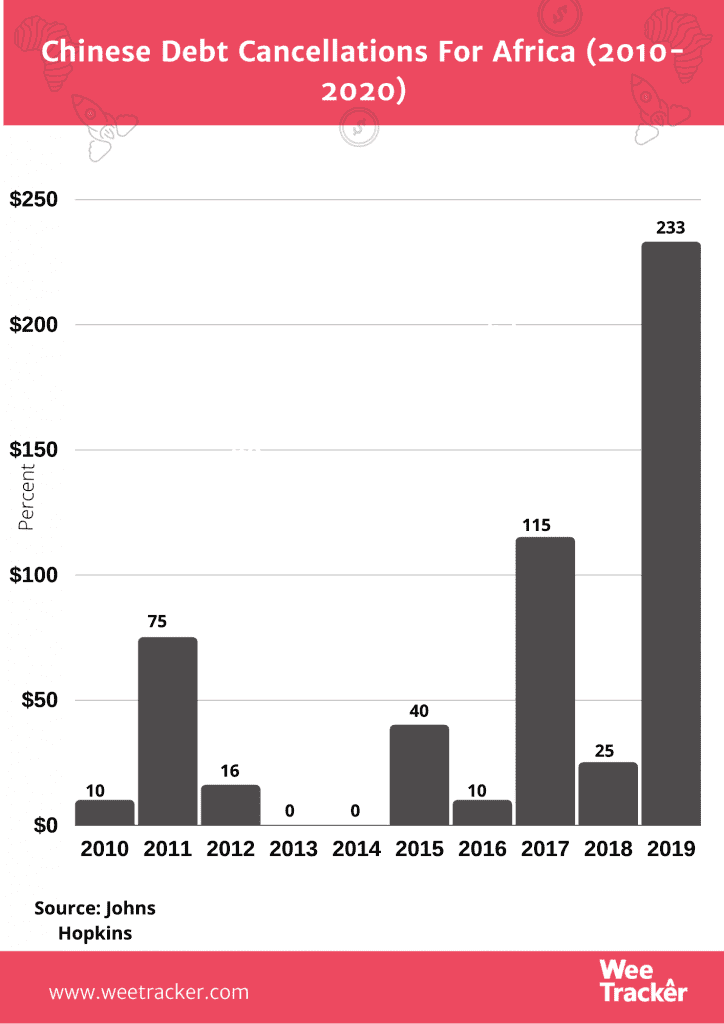

A new study from Johns Hopkins University shows the possibility that African countries will get more debt relief from China than other private creditors. According to the report, China has written off USD 3.4 Bn and restructured/refinanced about USD 15 Bn of debt in Africa in the last 10 years—measures that came with no penalties or seizure of assets from borrowers.

The study—which was published a day after Chinese President Xi Jinping promised to cancel interest-free government loans and do some rework on a number of commercial obligations of African countries—suggests that agreements have been easier to reach with Chinese lenders than with private creditors.

There is reluctance on the part of some multilateral and private lenders as to granting blanket debt relief. These creditors have expressed concerns over rating downgrades and the reduction of fiduciary obligations. However, the highlight of China’s Jinping teleconference with African leaders was the president urging the international community to forcefully act regarding debt relief/suspension for Africa.

Extreme Measures

The need to access debt relief or suspension is so much that it is driving a wedge between trade and friendly ties. For instance, Angola—one of Africa’s biggest oil-producing countries—has chopped down the volume of oil shipments to Chinese state firms to pay down debt to Beijing.

The African nation looks to negotiate repayment rates, a bid with which it hopes to be financially capable of dealing with the impact of coronavirus. With an estimated USD 20 Bn current bilateral debt, Angola has China as not just its primary creditor, but also its top oil importer, globally.

As payment for funds borrowed for energy, transportation and agricultural projects, Angola ships oil cargoes to major Chinese state-owned oil firms as debt repayment. China is not the only beneficiary, but Angola has called for a cessation of oil-for-debt exports, in part, due to the fall in crude barrel prices.

One Debt Overlord

Thanks to lockdowns, border closures, business shuttering and the global fall in price of commodity and oil prices, fragile Sub-Saharan African economies could not have been in a worse place.

Part of the problem is the continent’s exacerbated debt burden, as many of the countries spend huge chunks of their government budgets in the service of debts. This leaves little to no room for them to channel their financial resource towards public health.

China’s position as Africa’s leading creditor has been propelled by two decades of lending bonanza. According to Johns Hopkins researchers, the Asian country has lent 49 African countries over USD 120 Bn between 2000 and 2018, which makes it own between 17 to 24 percent of Africa’s external debt. Much of these funds have gone into building infrastructure projects.

As Africa’s largest single creditor, China is considered a key to the Group of 20’s economic plans to freeze some USD 11 Bn in debt payment from poor countries this year due to coronavirus. Nevertheless, the scheme has not realized as fast as expected, as now even less than a quarter of the 73 qualified countries have gotten waivers.

Photo: Martin Sanchez Via Unsplash.