Ecocash’s Refusal To Suspend Mobile Money Transactions Strengthens Its Feud With Zimbabwe

It is the belief of the Zimbabwean government that the Zimbabwe Stock Exchange, mobile money platforms and other political critics have conspired to drag down the Southern African country’s economic growth.

Last week, the Emmerson Mnangagwa-led administration suspended operations in the bourse and ordered for mobile money platforms to halt transactions. But, Ecocash has disregarded the directive, adding fuel to the fire of disagreement which has long burned between its mobile money service and the government.

Ecocash & The Ponzi Indictment

Ecocash was established by Econet—an African mobile phone company founded by Strive Masiyiwa, and it is Zimbabwe’s top mobile money platform. But being the topdog in the country’s nascent fintech sector has not been an entirely smooth journey for the business, as it has come under both political and diplomatic pressure in recent months and in the last few years.

Just last month, Zimbabwean authorities accused Ecocash of running a ponzi scheme as they looked to get permission to disable the business’s agent lines. Ironically, the service was once celebrated by the same government as the no-brainer solution to the country’s cash problems. Things turned round, the mobile money leader, reportedly, has something to do with the instability and devaluation of the Zimbabwean Dollar (ZW$)

Regulators believed that Ecocash has been supporting the dealing of illegal currency on the streets of Zimbabwe. The country’s currency, at the time, was USD 1 to ZW$45 against an official rate of USD 1:ZW$25. The adverse economic effects black market dealings, most of which are taking place in the streets of Harare, forced the government’s hand to shutter the country’s main form of payments—mobile money.

Raising The Stakes

In a dramatic turn of events, Ecocash has decided that the government does not have the right to shut down its mobile money service. While there’s no similar development from its counterparts, the Borrowdale, Harare-based firm said that only the country’s central bank can order for such a suspension of transactions. As such, the platform has urged its customers, majority of whom have no bank accounts to carry on with their “lawful” transactions.

Zimbabweans are mostly unable to obtain physical cash, so a majority of their transactions are done via mobile money. In the fourth quarter of 2018, mobile money was used for 85 percent of all transactions in Zimbabwe. Cash-in services doubled sequentially to USD 2.4 billion in Q2 2019, while active accounts grew from a record of 6.7 million in Q1 2019 to more than 7 million.

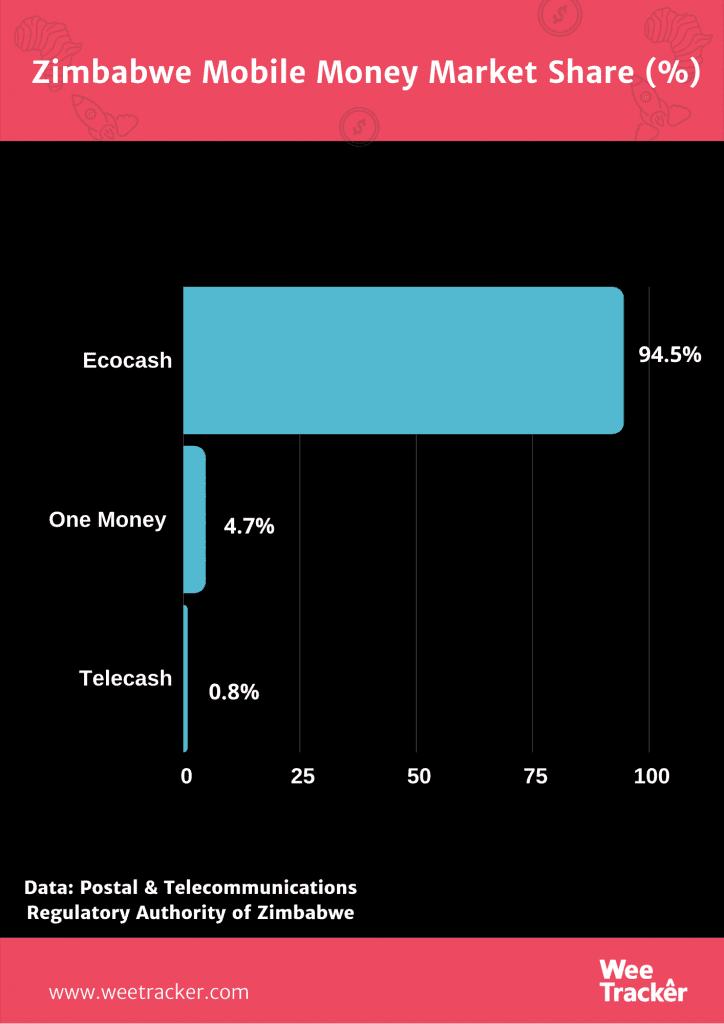

EcoCash ended Q2 2019 with 6.64 million active users, delivering a marginal 0.8 per cent rise in its market share to 95.4 per cent. “Ecocash, in particular, is acting as the centre pivot of the galloping black market exchange rate and therefore fuelling the incessant price hikes of goods and services that are bedevilling the economy and causing untold hardship to the people of Zimbabwe,” the government said.

Agent Lines

The Reserve Bank of Zimbabwe (RBZ), once, said that Ecocash’s agents have an overdraft on their accounts, something in excess of ZW$ 39 Mn. The central bank believes that these funds are then used by the platform to buy foreign currency and inflate the exchange rate. RBZ governor, John Mangudya, said that the devalued exchange rate on the mobile money platform is a threat to livelihood of Ecocash users as well as Zimbabwe’s economy.

According to Sunday Mail, two Econet employees were arrested for alleged fraudulent acts with using agent lines belonging to ETG Parrogate, a cotton firm, to conduct some shady illegal currency transactions. Nyanga-based Osmond Wachenuka, 25, and Nigel Domboka, (22) of Mutare appeared before the Chipinge Magistrate Court and were remanded in custody to May 22.

Coming under regulatory pressure and facing grievous accusations made Ecocash drag the country’s central bank to court, especially after its agent lines were frozen. It is yet to be realized whether the Econet-spinoff is guilty of the allegations, but the recent turn of events might prolong its already heated dispute with Zimbabwean authorities. Disobeying a suspension order, even on the right grounds, could send mixed signals.