Why MTN Is Ditching Almost Everything Else For Africa

In a new development for the African telecoms landscape, South African-born mobile operator, MTN is burning the bridges that connect it with the Middle East.

To focus more on Africa, the billion-dollar telco will sell it businesses in countries like Syria and Yemen. In the region, the business losing money on falling regional currencies, suffering from volatile geopolitics, and facing problems with Western sanctions.

No Place Like Home?

MTN is the largest telecoms company in Africa, with operations in 17 countries in the continent. In fact, it has more than 50 percent market share in 10 African countries. In another six markets, it has more than 30 percent, while South Africa is the only country where the operator’s share is under the 30 percent mark, thanks to stiff competition.

Though it is not without competition, the company has experienced success with its African operations since the 90s when it first started. MTN’s largest market, however, is Nigeria, where it plans to invest around USD 1.6 Bn over the next 3 years.

The countries where the operator has remarkably high market shares include eSwatini (84.72 percent) South Sudan (60.64 percent); Guinea-Bissau (59.78 percent); Ghana (55.97 percent); Uganda (55.13 percent); Rwanda (54.61 percent); Benin (54.60 percent); Congo-Brazzaville (54.24 percent); and Nigeria (50.49 percent).

These figures come from its statistics published as part of its financial results for the 6 months ended June 30, 2019.

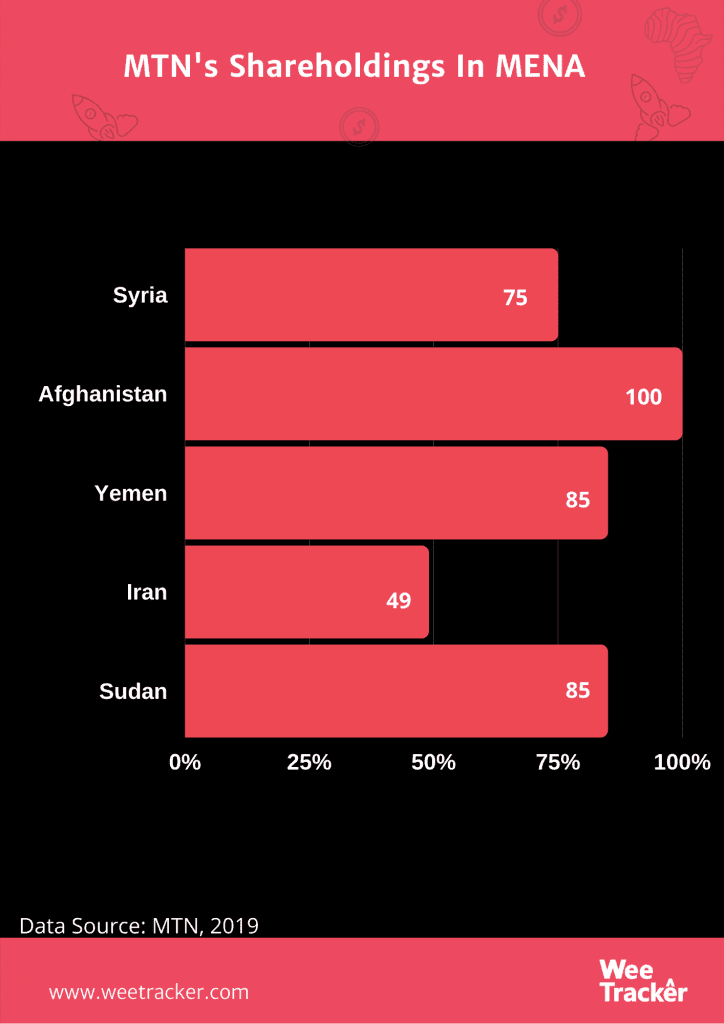

Also, its shareholdings in its African ventures are much more than that which it has anywhere else. For example, it owns 100 percent of its business in 4 African countries—South Africa, South Sudan, Congo-Brazzaville and Guinea-Bissau. But Afghanistan is the only Middle Eastern country where MTN fully owns its business.

In Brand Finance’s most recent annual report, MTN was awarded the most valuable telecoms brand in Africa. Alongside Dangote, the company remains one of the most admired African brands.

Retreating From Stern Lands

It was in November 2018 that MTN first hinted its intention to spring-clean its business. At the time, it considered whether it is necessary for it to remain in all 22 African and Middle Eastern markets.

Some of these markets are either a fraction compared to home, torn by conflict or unfriendly when it comes to regulations aimed at curbing the company’s dominance.

At the time, MTN said it won’t invest it classified as “conflict markets”. Local units would have to be self-funded to survive, and the firm would take an appropriation action if any of them prove troublesome in terms of cash flow.

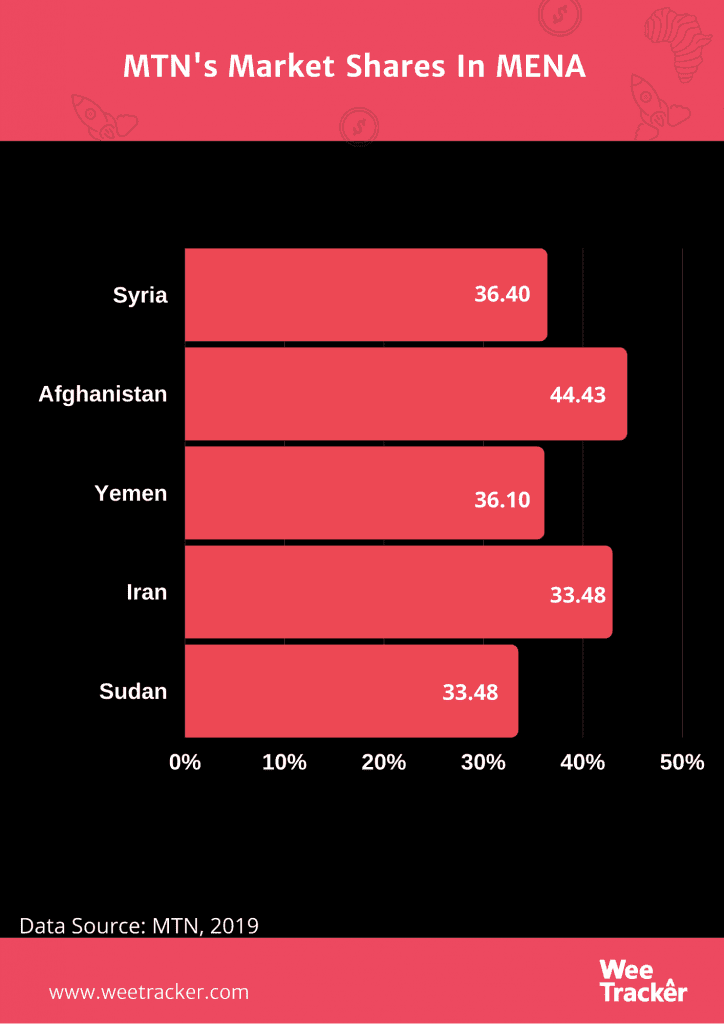

So, MTN Syria is the first to go. MTN will sell its 75 percent stake in the business to TeleInvest, which holds the other 25 percent of the business. Well, even if MTN has some significant shareholdings in its few MENA countries, its market shares in the region are low compared to that of Africa.

MTN’s foray into the MENA region has been hurdled by series of allegations. Though it has denied all of it, the firm has been accused of bribing its way into a 15-year operating license in Iran. The telco has been questioned also on the grounds of having a hand in militancy in conflicted-ridden Afghanistan.

Moreover, in the first half that ended June 30th, 2020, MTN’s assets in the Middle East contributed less than 4 percent to the group’s earnings before interest, taxes, depreciation and amortization. In Iran where it operates a joint venture, American sanctions have made it difficult for the network provider to repatriate cash from its business.

In other news, MTN is also looking to sell its USD 243 Mn stake in JUMIA, Africa’s troubled eCommerce giant. In April, Rocket Internet also dumped its 11 percent stake in the company.

Featured Image: Dampress.net