It Took A Pandemic For Safaricom To Finally Heed & Cut High M-Pesa Fees

Safaricom’s hold on Kenyan fintech, via its mobile money platform, M-Pesa, is one that is well known. And it looks like this dominance is about to take a new dimension in the foreseeable future, going by an announcement the telco recently made.

This new move looks set to basically make a mobile money service that already accounts for around 99 percent of such transactions in Kenya into something that is even more attractive.

The new gist is that Safaricom has, as of this week, pronounced a reduction in M-Pesa transaction fees which is to take effect in the new year, from the 1st of January.

The new charge would begin the very next day after the discontinuation of the ongoing free transaction offer on amounts below KES 1 K, as recommended by the Central Bank of Kenya (CBK), which has been on for several months since the pandemic hit Kenya.

Now, M-Pesa’s tariff is set to be reduced by up to 45 percent, and this will rub off on more than 90 percent of all customer’s transactions. (View all the revised transaction fees here).

This new Safaricom disclosure didn’t just pop out of nowhere, though, as the telecoms giant has previously murmured its consideration for this move.

Sometime in November, after the release of Safaricom’s half-year financial result, the mobile operator was rumored to be toying with the idea of lowering transaction charges in M-Pesa.

The disclosure by Safaricom also followed CBK’s earlier announcement and reiteration that the offer of free transfers transfer for transactions below KES 1 K, will not end until after December 31st.

It took a pandemic

For years, M-Pesa’s transaction fees have been thought to be quite high despite its ubiquitousness in Kenya. And for customers, this has always been a huge concern even though they have all had little choice but to stick with the service. As it is, it took a pandemic and CBK’s prior move for Safaricom to adjust the steep pricing.

As Peter Ndegwa, the CEO of Safaricom, said in the announcement: “As guided by the Central Bank of Kenya (CBK), and taking into account the principles on the pricing of mobile money services, we have taken the decision to reduce our M-Pesa tariffs by up to 45 percent for lower value transaction bands,” said Safaricom Chief Executive Peter Ndegwa in a statement yesterday.

He further said, “This is in consideration of the expiry of the period for the zero-rated M-Pesa transactions and the ongoing Covid-19 and economic circumstances.”

In essence, this price cut action proves that Safaricom is far from being blind to the cost challenge customers on its platform have been facing.

For insights, it was seen that there was a surge in transaction volume during the period of zero-fee transactions on the benchmark sum of KES 1 K.

Formerly, sending 101 KES incurs a transaction cost of KES 11.00. That represents 10 percent of the original transaction amount, and thereby points to a huge cost of transaction. No doubt, that has somewhat kept Safaricom doing great numbers regardless through its near-monopolistic grip and control on the market.

The new reduction in place would see the initial transaction cost of KES 11.00 incurred in sending between KES 101 and KES 500, down to KES 6.00. Likewise, transactions between KES 1,501 and KES 2,500 will now cost KES 32.00 down from KES 41.00.

A good move by Safaricom, or not?

While the new move would in no doubt be beneficial to M-Pesa users, can the same be said for the business itself? Would this new move make sense for Safaricom, revenue-wise? A solid question of if this new permanent reduction would hamper Safaricom’s already dwindling earnings from M-Pesa.

M-Pesa’s revenue lifeline is the fees charged to customers upon the completion of transactions and so the permanent reduction of this lifeline poses would almost certainly affect the net revenue of M-Pesa. Just like how its half-year financial result reacted to the effect of the earlier zero-fee transaction pushed by the CBK.

However, it seems to not be totally out of track for its revenue, as would have been predicted. The reason being, the free transaction mandate imposed by the CBK for instance, saw M-Pesa grow its transaction volume by 32.9 percent.

This volume increase faces the threat of being lost if the “free transactions” measure is totally reversed. Hence, this makes the new action taken a positive one for M-Pesa’s growth. This price-cut could also help it retain the newly acquired customers, who joined during the free transaction era.

The plot is to retain the more than 27 Million subscribers on M-Pesa’s platform and to cushion the operators from further losses occasioned by the fees waiver for amounts of less than KES 1 K. A good bet, no?

In any case, it can be said that the permanently reduced fees hold benefits for users and, in particular, Safaricom in the long term.

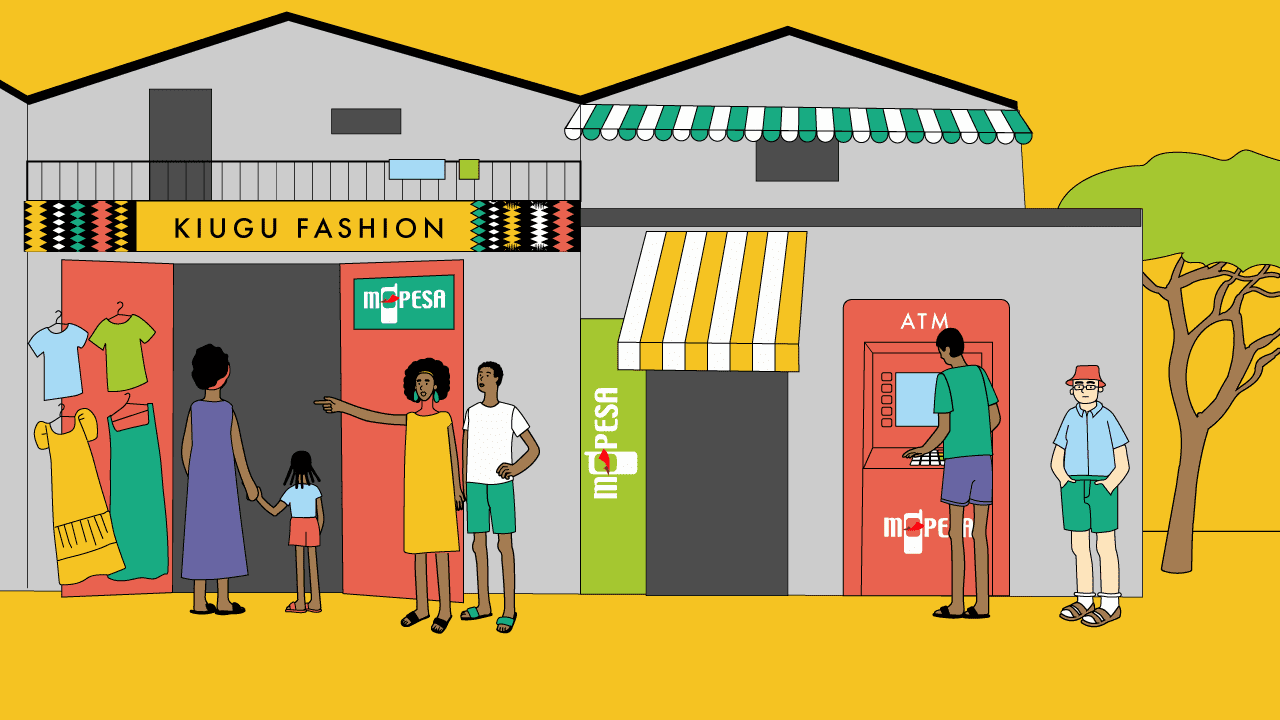

Featured Image Courtesy: OpenWay Group