A Neobank’s USD 42 Mn Series B Cements Tiger Global’s African Comeback

One of the earliest investors in the African tech ecosystem has made another remarkable return.

As another neobank contender in Nigeria announces its new raise, the supposedly long-lost VC known as Tiger Global Management has officially broken the ice on its reservations towards African investments. The VC led the USD 42 Mn round of FairMoney, a fintech startup which operates in Nigeria and India.

FairMoney operates a credit-led fintech model, one which allows it to offer loans to users and, then, offer them banking services in the process. This focus round comes two years after its Series A (which was closed at USD 11 Mn). The neobank has secured a license from the Central Bank of Nigeria to operate as a microfinance bank in the country.

Tiger Global Management has been around since 2001, and since then the New York-based firm has made nearly countless investments in both the public and private equity markets. Today, the organization claims to have USD 50 Bn assets under management (AUM), and is among best-known funders in the world.

Tiger Global is believed to be the VC firm with the most unicorns in its portfolio, with more than a hundred of them backed so far. There are no less than 180 unicorns in Tiger’s registry, and that’s arguably the highest concentration of such companies in a single portfolio.

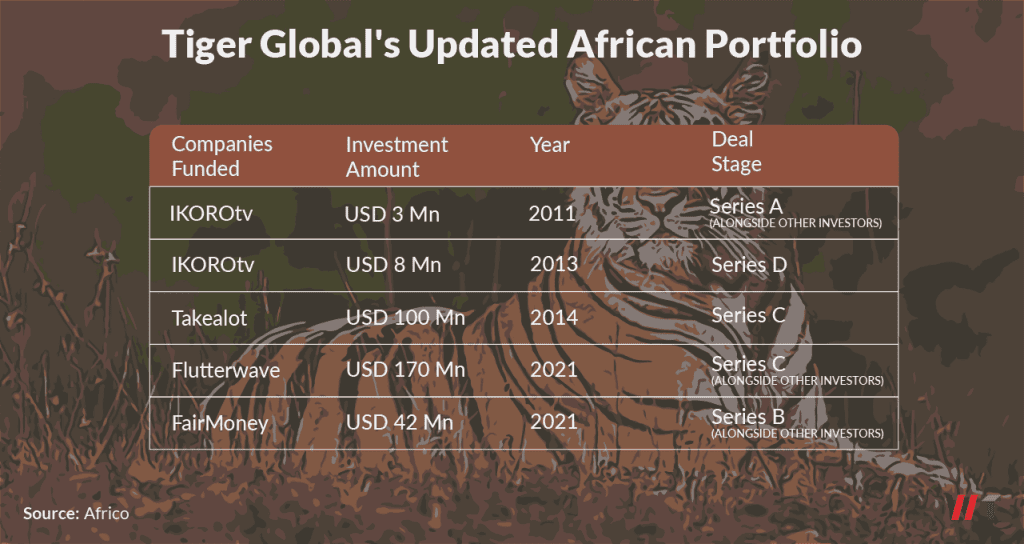

Back in 2011, Tiger Global made its first African investment by participating in the USD 3 Mn Series A of iROKOtv. The VC seemed to restrain from a second backing until 2013 when iROKOtv was raising its Series D, reported at USD 8 Mn. Then, in 2014, Tiger loosened its purse strings for Takealot—and that development amounted in USD 100 Mn for the dominant South African eCommerce player.

Since Takealot’s Series C, Tiger Global Management has been AWOL in African venture funding. It took 7 years before it finally resurfaced, participating in the USD 170 Mn Series C that turned Nigeria’s Flutterwave into a fintech unicorn. That makes FairMoney the second African startup Tiger Global is backing this year.

Back when Tiger Global was relatively active in the continent’s investment space, there wasn’t only a scarcity of VCs on the landscape but the startup ecosystem was also embryonic to begin with. As of then, investors were not too keen on putting money into Africa—at least compared to how they are now.

Perhaps also because Tiger has developed a palate for unicorns, it has stayed away from African investments for almost a decade. Nevertheless, it has been splashing the cash elsewhere.

In May when WeeTracker last contacted the VC, it had finalized 100 deals in 120 days. But none of that record-breaking blitz made an African stop. The company has since been backing startups mostly from the United States and India.

Tiger Global’s investment in FairMoney comes at a time when the African fintech promise seems to be at an all-time high. Besides Flutterwave, there are other digital financial services in Africa that have attained unicorn status: Fawry and Interswitch.

From high-profile exits to multimillion-dollar investments, it’s becoming provable that African fintech is a goldmine. With one African fintech unicorn already under its wing, the investor might be on the lookout for similar opportunities in the continent’s underserved financial markets.

“We are excited to partner with FairMoney as they build a better financial hub for customers in Nigeria and India. We were impressed by the team and the strong growth to date, and look forward to supporting FairMoney as they continue to scale,” says Scott Shleifer, a Partner at Tiger Global.

Interestingly, Tiger Global isn’t the only darling VC to Africa that has been missing in action. The same narrative webs in Naspers Foundry, the investment arm of the Naspers—the most valuable company in Africa.

The VC, which also likes to keep its potential dealflow low-profile, came out of investment stealth only last month when it backed the South African e-mobility startup known as WhereIsMyTransport.

Before WhereIsMyTransport’s Naspers-led USD 14.5 Mn investment, Nasper Foundry’s ¬USD 100 Mn warchest—which was set up to invest in SA’s tech startups—had cut out less than only about USD 10 Mn in 3 disclosed deals.

As it seems, the nostalgia effect is taking hold in Africa’s investor haven.