Neobanks, On The Heels Of Fintech, Make Headway In Africa

In the past few years, the world of banking has been rapidly evolving in response to the demand for digitized services. This has opened up the clouds pouring down consumer-focused innovations like open banking, payments tech, and digital banking. The many parallels of such a fintech revolution come together to form the domain that is neobanking.

As is evident in places like the United Kingdom, the United States, and Brazil (think Nubank), the first wave of neobanks has seen immense growth. With millions of customers served and an assortment of multi-billion dollar valuations achieved in those parts, the neobanking wave swept into emerging markets like Southeast Asia and the Middle East.

In Southeast Asia, the neobank market was expected to grow by 50 percent in 2021, according to an analysis from Singapore-based fintech services provider UnaFinancial. According to the report, in January 2020, 21 companies applied to obtain digital banking licenses in Singapore and 4 in Malaysia.

Currently, 17 traditional banks have indicated their interest in going digital in Indonesia. On the heels of enormous demand for digital-first banking services in the entire Asia-Pacific, venture funding for neobanks in 2020 was 22.8 percent more than what was recorded the previous year.

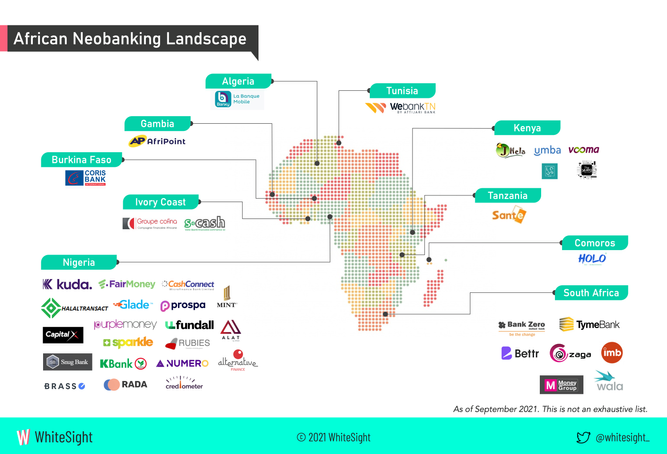

Is Africa left out? Not quite. In fact, neobanking in the region—which is not only a dovecote of equally emerging markets but also home to the world’s fastest-growing venture-backed tech ecosystem—is a fever now hotter than ever.

While digital-only has been around in other regions of the world since 2016, it found landing grounds in Africa in 2019, when Nigeria’s Kuda emerged with a pre-seed of USD 1.6 M—the largest, at the time, for any Nigerian startup.

However, roughly three years later, neobanking (not only digital banking) is substantially making inroads into the last frontier market via different routes. Just today, Finclusion, a credit-centric fintech that leverages Artificial Intelligence to offer financial services, secured USD 20 M in debt-equity pre-Series A. Last September, the pan-African firm raised USD 20 M in debt financing from Lendable, an emerging markets debt funder.

Finclusion’s raise comes on the heels of that of United Kingdom-based Fintech Farm, a newly launched fintech specializing in the creation of digital banks in emerging markets, which raised USD 7.4 M in seed to launch neobanks in Nigeria and other emerging markets.

Late December 2021, Kwara, a Kenyan fintech, raised USD 4 M in seed to build a neobank for East Africa’s credit unions. Since Kenyan fintech is more or less the prerogative of Safaricom’s M-PESA initiative, Kwara’s raise—which saw SoftBank’s participation—drew attention to an ecosystem seemingly evolving beyond the mobile money mania.

As of September 2021, African neobanks had cumulatively raised USD 220 M, with the best-funded being South Africa’s Tyme Bank (which has raised USD 123 M since inception). Kuda, now halfway to attaining a unicorn valuation, comes in second place with 92 M.

The latter and the former are pacesetters with more than 3.5 million and 1.4 million users, respectively. Meanwhile, other neobank contenders, most of which started off solving different financial problems, are in the limelight with weighty capital.

Some best-known names are Uganda’s Chipper Cash and Eversend, Tiger Global-backed Fairmoney (Nigeria), South Africa’s Bettr and Bank Zero, Kenya’s NCBA Loop, and 7aweshly. Mind you, Chipper Cash, after metamorphosing into a neobank, attained USD 2 B+ in valuation on the back of a USD 150 M Series C extension last November.

Per 2021 figures, as much as 57 percent of Africa’s population (approximately 95 million people) remain unbanked. However, thanks to increased smartphone penetration and the development of the region’s network infrastructure, previously unbanked Africans are entering the financial ecosystem via mobile money wallets, pay-tech solutions, and, of course, neobanks. With traditional banks unable to provide service up to the last mile, fintech has fast-evolved to usher in digital-only contenders.

From all indications, fintech remains the breadwinner of Africa-focused venture capital due to the huge need to offer a new breed of digitized financial services to over 1 billion people. Even as B2C fintechs and digital banks race in the same direction, only time can tell the outcomes of the neobanking wave now hitting the continent.

Featured Image: miro.medium